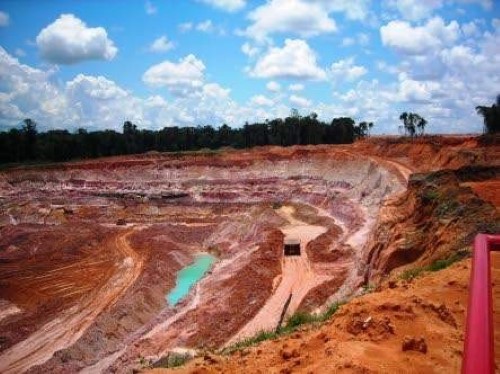

A Queensland University study shows bauxite, copper and iron ores face significant ESG challenges

Iron, copper and bauxite represent 95% of all industrial metals produced annually and demand for it is expected to double by 2050. They analysed each ore body against eight risks: waste, water, biodiversity, land uses, indigenous peoples, social vulnerability, political fragility, and approval and permitting.

“The majority of the 296 copper orebodies, 324 iron orebodies and 50 bauxite orebodies we examined are in complex ESG contexts which could either prevent, delay or disrupt mining operations,” Eléonore Lèbre, one of the researchers involved in the project, said in a media statement.

The study categorized those ore bodies with more than one risk as complex. Each of the three metals varies in their risks as they are mined in different parts of the world with different characteristics.

Bauxite is the worst-performing of the three commodities in context of ESG as almost all bauxite ore bodies are located in high-risk areas. Lèbre said that major innovation in project design and development is required to handle ESG risks.

“Even now numerous mining projects stall or are abandoned due to materialised ESG risk,” she said.

The research team has suggested government, investors and mining companies to change their methodology in order to de-risk their projects.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook