Indian Bulk HRC Export Shipments Rise 20% M-o-M

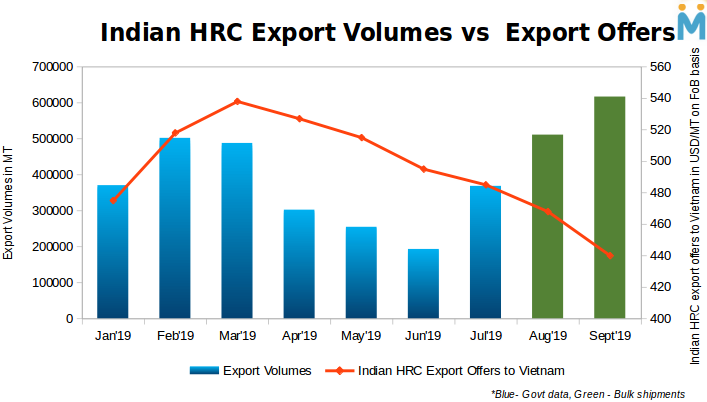

South East Asia remains the dominant export destination accounting for 45% share of the overall exports in September, with Vietnam alone receiving 30% of exports during the month.

Indian HRC export numbers were reported at around 370,000 MT in July and around 180,000 MT in June by Indian government.

Domestic flat steel demand and prices continue to suffer, impacted primarily by the slowdown in the auto and manufacturing sectors. Resultantly, steel mills have been experiencing a drop in off take and a rise in overall inventory levels.

Demand from manufacturing and automotive sector continue to remain subdued in India amidst seasonal slowdown and weak economic conditions. PMI for manufacturing in September was recorded at 51.4, unchanged from August levels and the lowest since May 2018.

Similarly in case of automotive sector, sales have reportedly fallen by 8.3% y/y from a level of 1.5M units in September 2018 to 1.38M units in September this year. To fulfill this gap in the domestic demand, mills are thus looking to export aggressively.

While the automotive industry is hopeful that the upcoming festive season and announced price discounts can help to push up some sales volume in the coming months, market is not looking for a complete turnaround in near term and sector is likely to remain under pressure.

Indian mills thus will continue to look for avenues in export market to push volumes and ease pressure of low domestic demand. With unexpectedly low imports coming into India due to ADD, India will remain a net exporter for HRC in the near term.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook