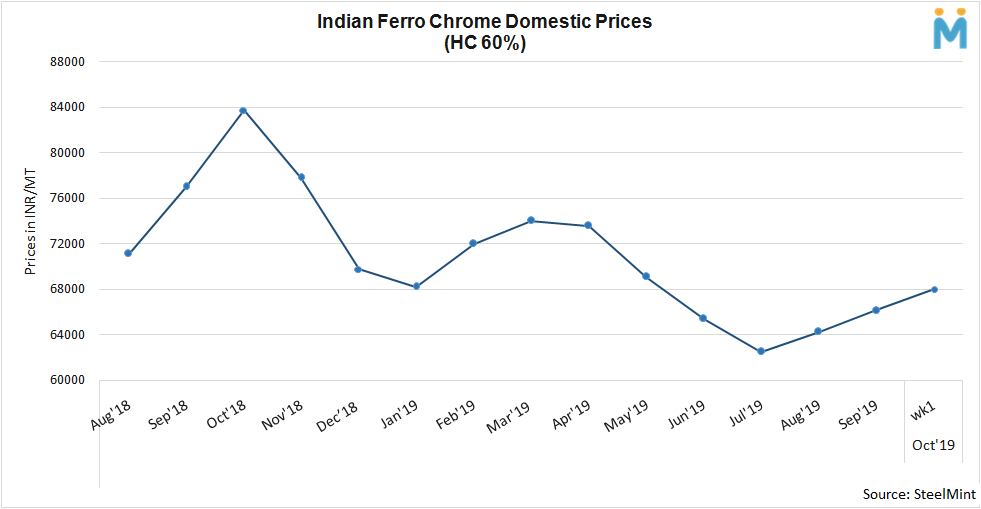

India: Ferro Chrome Prices Up by INR 2000/MT W-o-W

Market participants believe that the prices are bound to go higher as they are out of ore inventory and the cost for raw material increased sharply, which will affect the production cost.

Steelmint assessed the Ferro Chrome Prices at INR 68,000/MT, moreover, market expectations are that higher prices will find acceptance by next week in line with higher Chrome Ore prices and low inventory with producers. Prices in the export market remained unchanged due to the Chinese national day holidays. It is expected that as soon as the market resumes in China, the demand might regenerate and the prices may go higher. Tsingshan and Bao Steel both declared their prices for October deliveries. Tsingshan increased its tender Prices by RMB100/MT to RMB 6396/MT and Bao Steel increased its prices by RMB 200/MT to RMB 6500/MT. Offers for CNF South Korea (10-50 mm, HC 60%) is at around 75 cents/lb, CNF Japan (10-50 mm, HC 60%) is at 76 cents/lb and for CNF China the prices are at around 72 cents/lb.

On the future outlook, the prices are expected to go higher in line with the multitude of factors affecting the domestic and global markets as well.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook