India: TATA Steel Sukinda Chromite Ore Block goes to ‘State PSU’

The decision was taken at a high-level meeting on auction of major minerals chaired by the Development Commissioner-cum-Additional Chief Secretary on September 21, 2019.

“The Sukinda chromite mining block is already processed for reservation in favour of a State PSU and hence, not to be put to auction as of now,” the minutes of the meeting read.

Speculation is rife as to whether that “State PSU” will be the Industrial Development Corporation of Odisha Ltd. (IDCOL) or Odisha Mining Corporation (OMC). No final word has yet emerged.

Earlier, the Odisha government had decided to auction Misrilall Mines’ Saruabil mine and B C Mohanty’s Kamarda mine – two chrome ore deposits in the state the leases of which are lapsing in seven months.

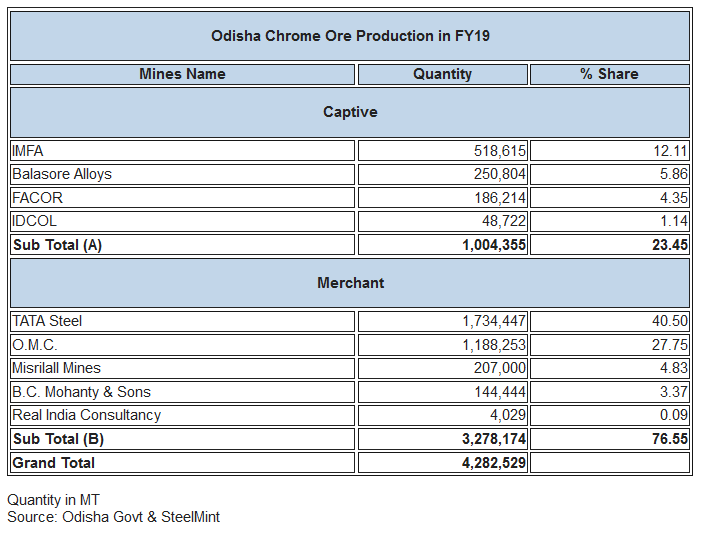

India has approximately 1% of the world’s chrome ore reserves, 97% of which lies in Odisha’s Sukinda valley. Along with the state-owned OMC, the three mines catered to 0.7 MnT capacity of ferrochrome, or almost half the country’s 1.4 MnT annual capacity.

Balasore Alloys, Indian Metals and Ferro Alloys (IMFA) and FACOR have captive mines with rights till 2030.

Miners, manufacturers and Odisha’s steel fraternity in general had earlier raised objections regarding TATA Steel holding on to the Sukinda mine. The argument ran that there are too few mines to allow equitable distribution and auctioning them would lead to hoarding of chrome ore by a few.

At the current available rate of chrome, ferrochrome players are struggling to make profits. A further increase in raw material prices will shut down those without a captive mine. The Indian ferrochrome industry is already under tremendous pressure with China in the recent past increasing its production to around 6MnT. It was, therefore, argued that the mine be allocated to a state entity which would carry out mining operations and auction ore, as OMC does for chrome and bauxite.

However, of the 5300 ha of chrome ore leased out in the state, OMC holds 3899 ha or 74% of the area. With environmental clearances of 41 lakh tonnes, it produces only 9.8 lakh tonnes or 29% of the total chrome ore produced in the state. While Tata Steel, holding 9% of the total area, accounts for 35%. This fly in the face of the government’s avowed claim that the 2020 mineral auctions are intended to maximize productivity not revenue.

Spread over 406 ha in Odisha’s Sukinda valley, the chromite mining block has a jaw-dropping 95,821 MnT chrome ore resources.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook