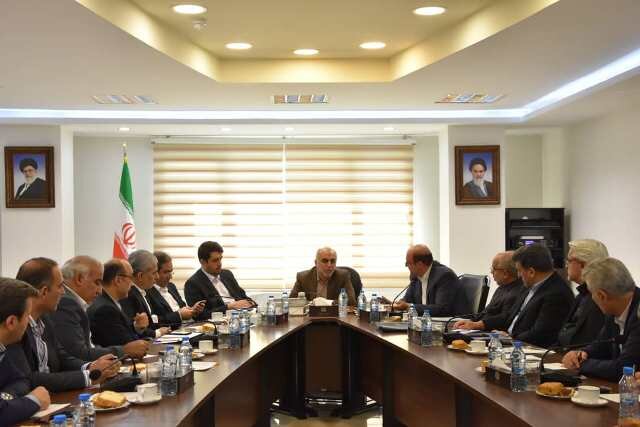

Economy ministry offers banking reform plan to govt.

Speaking in a meeting with the CEOs of government-owned banks, Dejpasand noted that the ministry will follow up on the provided solutions in the program through relevant authorities until it reaches a conclusion, Shada reported.

The official noted that government-owned banks (including the biggest lenders) are seriously following a program to relinquish their excess assets and subsidiaries and also reduce the number of branches in order to increase their cash reserves.

Back in February, the government announced launching a program for selling excess properties of state banks, as part of its plans to reform the limping banking sector.

He further stressed that transparency, efficiency and sound management of banks' costs are all bound to the establishment of digital banking as well as the full and effective implementation of corporate governance.

“The Economy Ministry’s Deputy for Banking, Insurance and Government Corporate Affairs is going to rank banks in terms of corporate governance and digital banking deployment,” Dejpasand added.

Dejpasand also urged state banks to continue providing the necessary support to various economic sectors, especially the production sector, as before.

Iran’s banking industry is suffering, among other things, from issues such as poor balance sheets, capital inadequacy, inability to recover non-performing loans to the tune of billions of dollars, arcane rules, and dubious operations of illegal credit institutions that have been punishing the economy for years.

In late August, Governor of Central Bank of Iran (CBI) Abdolnasser Hemmati said the bank has been working hard to reform the banking system long grappling with mismanagement and financial indiscipline.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook