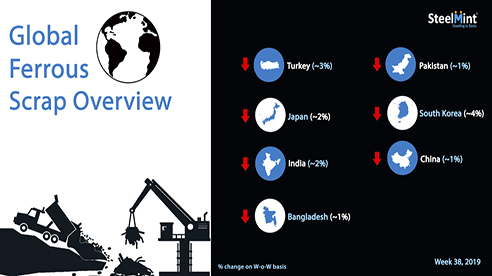

Global Ferrous Scrap Market Overview - Week 38, 2019

Turkey - Further fall was witnessed in imported scrap prices to Turkey after fresh deep-sea cargo bookings were reported in the latter half of the week at prices USD 6-7/MT lower than the previous booking, as Turkish Rebar export prices had moved down sharply.

In the only deals confirmed this week, 2 prominent steelmakers from the Mediterranean region booked a bulk vessel each comprising of 20,000 MT and 17,000 MT of HMS 1&2 (80:20) respectively, at USD 228/MT CFR Turkey. The cargoes were booked from a UK based global supplier and the deal was confirmed yesterday, for October'19 shipment.

Assessment of US-origin HMS 1&2 (80:20) scrap has moved down to USD 234/MT, CFR Turkey, down USD 6/MT against last week’s report. While assessment of European origin HMS 1&2 (80:20) currently stands at USD 228/MT, CFR Turkey.

Japan - Japan’s EAF mini-mill Tokyo Steel, observed its 6th price cut in its scrap purchase price for Sep’19 this week, lowering the price at 4 of its 5 plants (except Utsunomiya Plant) by JPY 500/MT (USD 5).

After the said price lowering, the company will pay JPY 23,500/MT (USD 218) for H2 scrap delivered at its Tahara plant in Central Japan and Kyushu works (western region), while the new price for Okayama plant and Takamatsu steel centre stand at JPY 21500/MT (USD 199) and JPY 20,500/MT (USD 190) respectively.

Japan’s Kansai Iron and Steel Federation, concluded its 2nd tender for Sep’19, this week (17th Sept’19) in which the winning bid was awarded a total 5,000 MT of Japanese H2 at an average of JPY 23,270/MT (USD 215), FAS. The current bid is JPY 1840/MT (USD 17) lower than the previous tender result on 4th Sep’19 earlier this month, while it is lower by JPY 4850/MT (USD 44) as compared to the winning bid of July’19.

China - Following a price hike by RMB 80/MT (USD 11) last week, China’s Shagang Steel slashed its price for procurement all grades of domestic steel scrap by RMB 40/MT (USD 6) effective from 20th September’19. Softening in domestic Billet and Rebar prices recently could have led to drop in domestic scrap prices.

Post the said price cut, Shagang Steel is now paying RMB 2,690/MT (USD 380) inclusive of 13% VAT for HMS 2 (6-10 mm thickness) delivered to headquarter works situated in Zhangjiagang north of Shanghai in China, down RMB 40/MT against the last report of RMB 2,730/MT on 10 Sept'19. While HMS 1 (thickness not less than 20 mm) and HMS 2 (6-10 mm thickness) stand at RMB 2,770/MT (USD 391) and RMB 2,730/MT (USD 385) respectively.

South Korea -Leading EAF steelmaker, Hyundai Steel again lowered its purchase bids for Japanese scrap by a further JPY 1,000/MT (USD 9) this week, on the account of drastic fall in Japanese domestic scrap market in the last couple of weeks.

In bids presented today for Japanese scrap, the company has its reduced H2 scrap bids to JPY 25,000/MT (USD 232), FoB Japan as against JPY 26,000/MT (USD 241), FoB presented 2 weeks ago.

Earlier in the week, Hyundai Steel has booked 45,000 HMS 1 scrap from US recently for Oct loading and arrival in Nov. The deal was learned to have concluded at USD 275/MT, CFR basis.

India - Imported scrap to India dropped again this week amid further global decline following the new Turkish bookings earlier. After a slight uptick in buying activity last week, continued fall in prices turned buyers cautious again.

Assessment for containerized Shredded from the UK/Europe and USA stands at USD 260/MT, CFR Nhava Sheva, down by over USD 5/MT against lest week, with only few deals being reported. Amid low buying interest, some traders also offered at USD 2-3/MT lower.

HMS 1 offers from Dubai also incjed down to around USD 260/MT, CFR on slow demand, while UK origin HMS 1 was being offered at around USD 250/MT CFR. Few deals of West African origin HMS were reported at USD 245/MT CFR Goa, while HMS 1 of higher quality from South Africa was offered at USD 265/MT CFR Nhava Sheva.

Pakistan - Earlier in the week, offers to Pakistan had stood stable w-o-w and buying activity had picked up, however by the end of the week, a slight fall in prices were reported on global weakening.

Assessment for containerized Shredded 211 scrap from UK/Europe stands at USD 256-260/MT, CFR Qasim, down by USD 4-5/MT against the closing of the last week. Few bookings at USD 260-261/MT levels were reported earlier in the week.

Dubai origin HMS scrap prices inched down slightly amid a continued slowdown, with HMS 1 (Super) being offered at USD 260/MT, but buyers showed little interest.European origin HMS scrap was assessed at around USD 250/MT, CFR Pakistan. Domestic steel prices moved down due to slow sales amid limited demand even as quite a few mills have cut their production to secure their margins.

Bangladesh - Even as offers for imported scrap to Bangladesh remained stable for most of the week, trades have remained average. With the global moving downwards again, buyers expect further correction and are in wait-and-watch mode before any major container bookings.

Assessment of Shredded scrap from North America & Europe remain at around USD 280/MT CFR Chittagong, mostly unchanged from last week. With mostly offers in the market, very limited deals were heard. A booking for Australian origin shredded scrap was heard from a trade source, at USD 272 CFR.

HMS 1 offers from Australia and South Africa and Chile stood at around USD 270-272/MT CFR, while HMS 1&2 (80:20) from Brazil is still bring offered in the range of USD 265-266/MT CFR Chittagong. Few P&S scrap offers from Brazil were reported at around USD 290-295/MT CFR, amid little demand among buyers off late.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook