Indian Imported Scrap Prices Fall, Buyers Turn Cautious

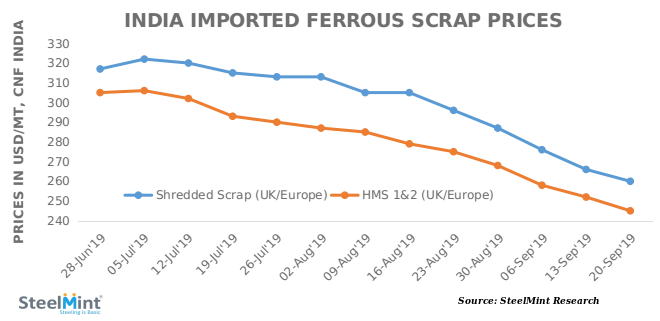

SteelMint’s assessment for containerized Shredded from the UK, Europe and USA to India stands at USD 260/MT, CFR Nhava Sheva, down sharply by over USD 5/MT against last week’s report, however only few deals of low quantity were reported. Few traders also offered USD 256-257/MT due to lower buying interest. Many foreign yards were reported to be mostly sold out for next month and did not actively offer to India during this week.

As per reports by a trade source, a bulk cargo vessel was booked by a Gujarat based steelmaker from a UK based yard comprising, of 40,000 MT of mixed grade scrap at an average price of around USD 240/MT CFR Kandla, however, the booking could not be confirmed by the time of publishing.

HMS prices also declined by the similar margin due to demand turning slow, after slight upturn in activity last week. HMS 1 offers from Dubai were reported to around USD 260/MT, CFR continuing to be at the same level as shredded. UK origin HMS 1&2 has dropped to around USD 245/MT CFR, while higher quality HMS 1 from South Africa was offered at around USD 265/MT amid limited trades.

Few deals of West African HMS to Goa were reported at around USD 245/MT CFR Goa, which translates to USD 240/MT CFR Nhava Sheva.

Pakistan Follows The Downtrend - In line with the global downturn this week, imported scrap offers to Pakistan also declined slightly after remaining stable for more than a week. In last couple of days, few bookings of Shredded scrap from Europe were reported at USD 255-256/MT CFR Qasim, down USD 5-6/MT from earlier in the week. Buyers have shied away from any large quantity bookings under the current market and mostly making smaller 500 MT bookings as per requirements.

Indian Domestic Scrap Prices Fall - After some stability over the last couple of weeks, local scrap prices dropped this week by around INR 500-600/MT W-o-W. The current assessment of local HMS 1&2 (80:20) stands at INR 21,100/MT (USD 297) ex Mumbai, down INR 500/MT against last week, while Chennai based HMS 1&2 (80:20) assessed at INR 20,400/MT ex-works.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook