Global HRC, CRC Market Overview - Week 37, 2019

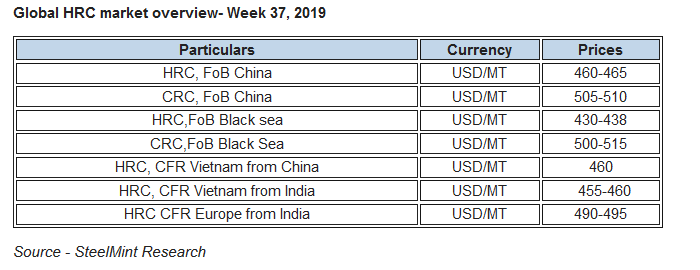

Also industry participants reported that two major Indian steelmakers based in western region booked one vessel each for export to Europe comprising of mixed cargoes of HRC, galvanized etc. Although the price could not be confirmed at the time of reporting, HRC export price is expected to be around USD 490-495/MT CFR Europe basis which is equivalent to USD 450-455/MT FoB basis.

Thus Indian steel mills continue to lower HRC export offers to stimulate buying from overseas buyers amid increased inventories and sluggish sales witnessed in domestic market.

Low priced Indian cargoes weighs down Chinese HRC export offers- Chinese HRC export offers slide down further amid low priced exports from India.

Thus increased supply of Indian cargoes to Vietnam at competitive prices can be considered as the key reason for continual decline in nation’s HRC export offers in global market.

Currently nation’s HRC export price assessment is at USD 460-465/MT FoB declined by USD 5/MT against USD 465-475/MT FoB basis in previous week.

Also slight improvement in domestic HRC prices fail to support nation’s export offers in overseas market.

Thus, Chinese steelmakers have increased domestic prices by RMB 40/MT on D-o-D basis and stood at RMB 3,690-3,710/MT. Meanwhile prices in northern region also moved up by RMB 20/MT on D-o-D basis at RMB 3,620-3,630/MT. Prices mentioned above are inclusive of 13% VAT.

In addition to this, today China’s major steelmaker Baosteel announced a cut in domestic HRC and plate prices by RMB 100/MT for October deliveries.Although company increased prices of plain carbon CR Coil and HDG prices by RMB 100/MT.

Vietnam importers continue eyeing lower HRC offers from major exporting nations- Imported HRC offers to Vietnam continued to move downwards following decline in HRC offers from major exporting nations.Meanwhile end users in Vietnam are preferring Indian origin cargoes over China amid competitive pricing.

Current imported HRC offer to Vietnam

1.HRC (SAE 1006) 2-3mm/ Chinese offer- Laiwu Steel is at USD 460/MT CFR Vietnam. Last week offer was at USD 460-462/MT CFR basis.

2.HRC (SAE 1006) 2-3mm/ Indian offer - Indian steel mills is at USD 455-460/MT CFR Vietnam.Few deals booked at these offers for Oct shipments. Last week offer was at USD 460-462/MT CFR basis.

3.HRC (SAE 1006) 2mm/ Korean offer– Hyundai is offering at USD 470-475/MT which was USD 480/MT CFR Vietnam last week.

4.HRC (SAE 1006) 2mm/ Japanese offer- Nippon steel is offering at USD 475/MT CFR Vietnam. Last week offers stood at USD 485/MT CFR basis.

5.Formosa will revise its monthly HRC offers for Oct-Nov deliveries in next week.

CIS- origin HRC export offers drop significantly on weekly basis- This week CIS nation’s HRC export offers witness decline by around USD 20/MT and is hovering around USD 430-438/MT FoB basis which was USD 450-460/MT FoB Black sea last week.

The major reason for decline in nation’s HRC export offers is lower demand in key importing markets.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge