India: KIOCL Concludes 50,000 MT Pellet Export Deal to China

Last week, JSPL - east India based pellet maker also concluded a pellet export deal to China for Fe 64%, and 3% Al at around USD 108/MT, CFR China for prompt shipment. Another east India based steel maker is learned to have negotiating export deal for non-Chinese markets as well.

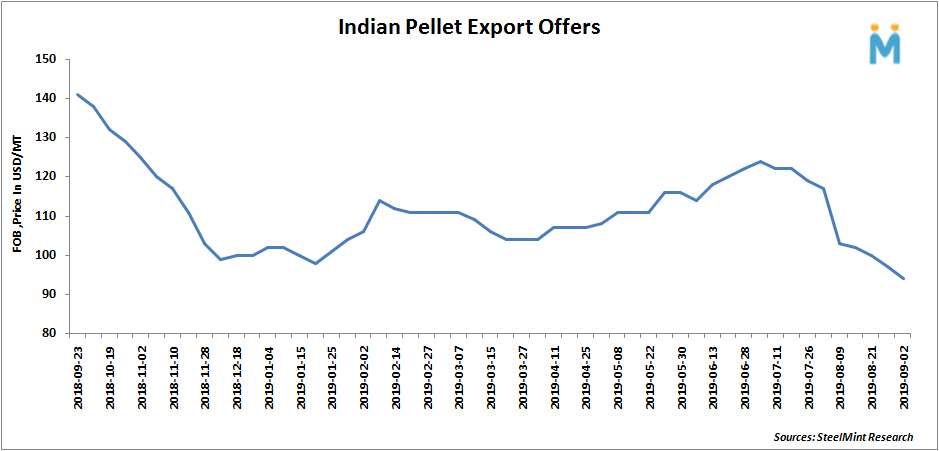

As per the SteelMint assessment for the regular grade pellets (Al 3%) export realization stands at USD 92-94/DMT FoB India.

Few Indian pellet trades at Chinese ports were reported at RMB 960/MT.Indian pellet makers are hopeful of demand recovery from China later this week.

Spot iron ore fines Index increased on weekly basis: The global iron ore fines prices (Fe 62%) has increased to USD 89.35/MT, CFR China yesterday (03rd Sept) as against USD 84/MT, CFR China a week back.

sluggish and the prices prevails to be weak.

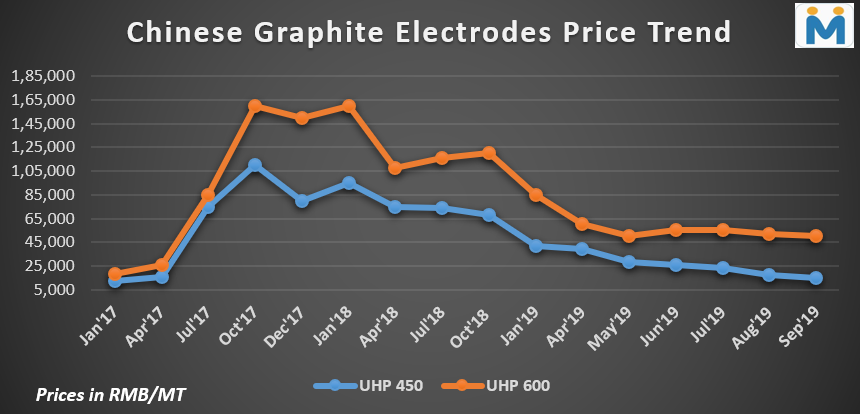

At present, although the Chinese electrodes manufacturers have restricted their production due to tepid domestic demand and upcoming National Day holiday (in order to ensure clearer skies), the inventory build up continues in the market especially that of ordinary power and high power small-specifications electrodes.

The Chinese downstream steel demand is not picking up and the off-season for the procurement continues, the procurement enthusiasm is not high, the GE manufacturers are fiercely bidding resulting which the electrodes prices in China have touched new low. On the other hand, the price of ultra-high power large-sized electrodes is less affected and there is small downward adjustment in prices.

According to the market participants based in China, the GE prices in the country are likely to remain subdued for the upcoming months amid production cuts (prior to National Day holidays) and enough inventories with the manufacturers.

The current GE prices of size 450mm UHP grade electrodes are trending at RMB 13,000 – 15,000/MT (USD 1,810 – 2,100/MT) and that of 600mm are at RMB 42,000 – 53,000/MT (USD 5,870 – 7,400/MT) whereas that of 450mm HP grade electrodes are at RMB 13,000 – 14,000/MT (USD 1,800 – 1,960/MT) and of 600mm are at RMB 15,000 – 17,000/MT (USD 2,100 – 2,400/MT).

Needle Coke:

In case of raw material, the negative sentiments in GE market are weighing down the needle coke prices also. Its current prices are trending at RMB 19,000 – 22,000/MT (USD 2,655 – 3,075/MT). The needle coke demand from China’s anode material industry is relatively stable and is showing a gradual upward trend which is why the fall in needle coke prices are not as dramatic as that of plunge in GE prices.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook