Bangladesh Steel Mills Book Three Bulk Scrap Cargoes - Sources

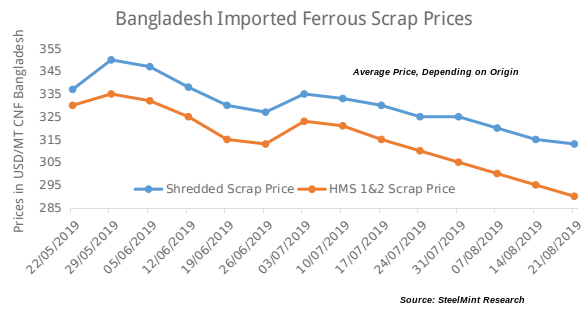

It was reported that recently, 3 bulk cargo vessels of ferrous scrap were booked by a leading Chittagong based manufacturer, with around 30,000 -32,000 MT of cargo each. If sources are to be believed the composite cargos, comprising of Shredded scrap and HMS 1&2 (80:20) were reportedly booked for USD 320-322/MT and USD 305-308/MT respectively.

SteelMint’s assessment for containerized Shredded scrap from UK, Europe and USA stands in the range of USD 310-315/MT, CFR Chittagong dropping by USD 5-10/MT in comparison to the pre Eid levels, with limited trades of shredded scrap being concluded. One prominent global supplier was reported to offer Shredded scrap at USD 310/MT, CFR as buyers remained cautious.

Notably, a Dhaka based steelmaker had booked 10,000 MT of shredded scrap in containers, earlier in the week from a major UK based supplier, however, the deal was heard to have concluded at a premium of 5-6 USD/MT than current market price.

HMS scrap witnessed decent trades this week, including a Chittagong based mill booking 2000 MT of Venezuela origin mixed grade (HMS 1 and P&S; 40:60) containerized shipment at USD 315/MT, CFR. Other deals included HMS 1&2 (80:20) from Panama and high quality HMS 1 from South Africa of nearly 1000 MT each being booked at USD 299/MT and USD 308/MT, CFR respectively.

HMS 1 offers from Brazil and Australia were reported at around USD 305/MT, CFR, while European HMS was being offered at around USD 300/MT, CFR. Few offers for P&S scrap from South America stood at USD 320-325/MT, CFR respectively.

Domestic market observes oversupply situation, prices fall - With the leading steelmakers witnessing overproduction of finished steel even as demand has not fully picked up, the prices for the same dropped by around 7-8% in comparison to levels seen before holiday’s closure. It is expected that improved demand from September onward will somewhat boost the market. Also, many of the laborers are yet to return back from their villages.

Offers for shipyard scrap dropped further and currently stands in the range of BDT 32,500-33,000/MT (USD 380-386), ex Chittagong, falling by BDT 500/MT from 2 weeks ago, and with the recent cuts in finished steel prices in addition to the continued oversupply of in local scrap market, the prices for local scrap are less likely to recover till at least October'19.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook