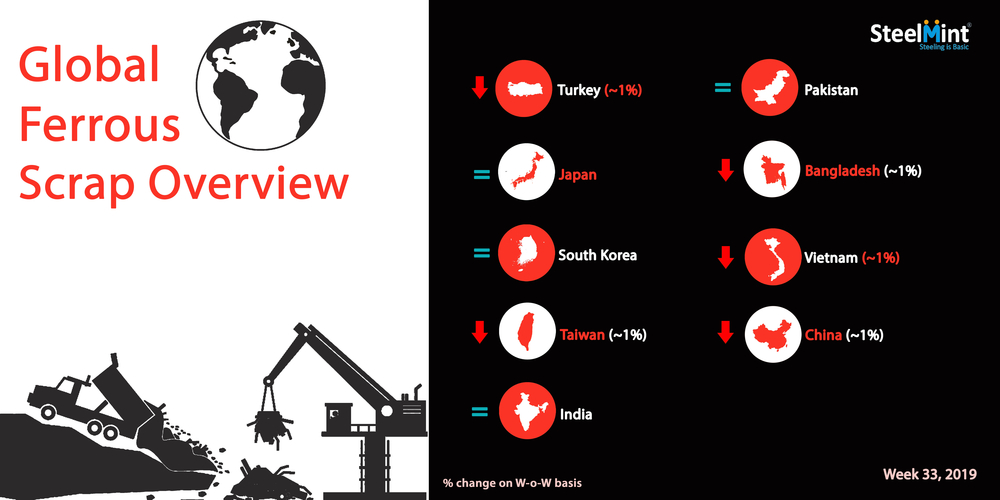

Global Ferrous Scrap Market Overview - Week 33, 2019

Turkey - Turkey steel mills remained out of deep-sea trade activities amid Eid holidays this week. No fresh deal reported as most of the Middle East region market was closed on festival mood.

An assessment of US-origin HMS 1&2 (80:20) scrap stand at USD 284-285/MT, CFR Turkey, while assessment of European origin HMS 1&2 (80:20) stands at USD 278-279/MT, CFR. In a single deal came into light from last week, an Iskenderun based steelmaker booked a European scrap cargo comprising 30,000 MT of HMS 1&2 (75:25), 5,000 MT of Shredded and 5,000 MT of Bonus at an average price of USD 279/MT, CFR Turkey.

US domestic ferrous scrap market outlook remains unclear for September with the disparity in the price expectations among sellers and buyers amid limited finish steel demand.

Japan – Japan’s mini-mill Tokyo Steel keeps domestic scrap purchase bids unchanged amid ongoing Obon festival holidays. It is paying JPY 25,000/MT (USD 235) and JPY 26,500/MT for H2 scrap delivered to Okayama Plant and Utsunomiya plant in the Kanto region.

Notably, the Japanese currency JPY remained volatile over this week and devalued to 106.3 today after appreciating to 105.2 in the mid of week. Japanese steel & iron association’s weekly scrap index remained flat for two consecutive weeks. The overall market remained sideways as suppliers turned passive this week.

South Korea - Leading steelmaker Hyundai Steel booked 20,000 MT Russian bulk A3 ferrous scrap cargo at a stable price of USD 287/MT, CFR South Korea. Its bid for Japanese H2 has remained unchanged at JPY 27,000/MT (USD 254) since 5th July’19, while the company has not observed any significant bookings from Japan in several weeks now.

With the rise in export offers from Japanese suppliers in later July’19 not meeting the buyers expectations, South Korean steelmakers instead seem to be exploring other suppliers more, including Russia and USA, as the current trade tensions between South Korea and Japan have been further intensified by the possibility of removal Japan from Korea’s trade white-list September onwards and the increasingly strict inspections of vessels with Japanese scrap at South Korean ports.

Taiwan - High inventories in hand and weak finish steel sales pulled imported scrap offers in the range USD 275-280/MT, CFR Taiwan for US-origin HMS 1&2 80:20 marginally down by USD 3-4/MT against last week. The leading steelmaker Feng Hsin steel kept its domestic scrap buying prices unchanged for 5th successive week at TWD 9,000/MT (USD 287) for HMS 80:20 delivered to Taichung plant and Rebar prices at TWD 16,200/MT (USD 517).

China - After observing 3 successive price cuts last week, Shagang Jiangsu Steel group had announced another price cut by RMB 50/MT for all grades of domestic steel scrap procurements. However, easing trade war between US-China in the second half of week kept scrap prices flat then after. Shagang is paying RMB 2,650/MT (USD 376) inclusive of 13% VAT for HMS 3 (6-10 mm thickness) delivered to headquarter works situated in Zhangjiagang.

India - Indian imported scrap market remained mostly waiting for a news of stimulus to the economy to recover finish steel demand amid availability of scrap inventories with major steelmakers and cheaper domestic scrap and sponge as an alternative. Also, trades remain inactive with holidays in addition to the ongoing heavy monsoon. Assessment for containerized Shredded from Europe, UK and USA remained at USD 300-305/MT, CFR Nhava Sheva, unchanged from last week, while no major trade was reported.

HMS offers remained mostly unchanged on a weekly basis. South African HMS 1 offered at around USD 290-295/MT, CFR Nhava Sheva, while West African HMS 1&2 (80:20) assessed at USD 270-275/MT, CFR Goa and Chennai, as per quality. Ongoing Eid holidays kept HMS trades from Dubai silent, with few offers for HMS 1 and P&S at USD 280-285/MT and USD 290/MT CFR respectively.

Domestic scrap prices remained volatile through the week, as price hike due to supportive semi-finished prices was undone later on weak demand amid holiday with local HMS 1&2 (80:20) standing at INR 20,800-21,100/MT (USD 292-297), ex Mumbai

Pakistan - Steel market in Pakistan witnessed little to no activity this week on holiday closure, with no significant deals being reported as buyers & steelmakers remained away from the market. However few thin trades of Shredded scrap from Europe/UK were concluded at USD 303-305/MT, CFR Qasim, while the assessment for Shredded scrap remains at USD 305-310/MT. Offers of Dubai HMS scrap heard at around USD 290-295/MT, CFR.

Bangladesh - Eid Holidays kept the Bangladeshi market completely silent this week, with no trades being observed as all the steel mills remained closed. Shredded scrap prices from Europe and UK had dropped in the range USD 315-320/MT, CFR Chittagong. However, a clear picture will emerge after the market opens from 19th August’19. HMS 1&2 from various origins stand at USD 300-305/MT, CFR. Domestic scrap reported a correction before closing for Eid holidays and stand at BDT 32,000-32,500/MT, ex-Chittagong (USD 385-390) amid a consistent decline in finish steel prices.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook