Indian Steel Market Weekly Snapshot

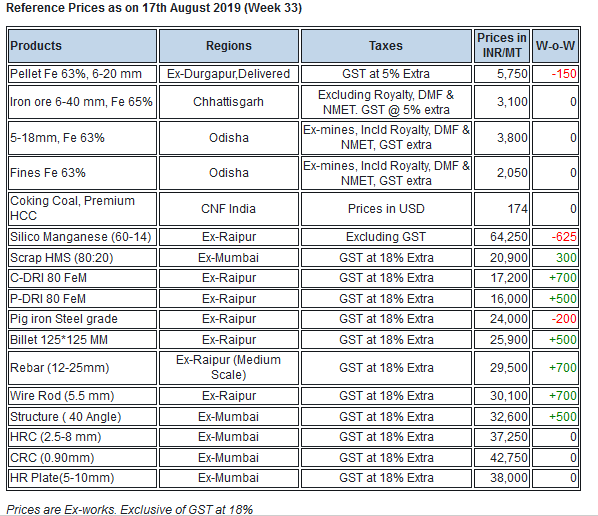

During the week-33 (10-17th Aug'19) prices of Semis & Finished long steel products surged approximately by INR 200-1,300/MT (USD 3-18) through the mid size mills. However the Flat steels price range dropped by INR 500/MT (USD 7) in traders market amid weak demand globally.

IRON ORE & PELLETS

National Mineral Development Corporation (NMDC) has kept the iron ore prices unchanged for both C.G and Karnataka. Odisha miners also kept the same price level for this week.

-- Raipur (Central India) based pellet manufacturers have increased offers for Fe 63% grade pellet by INR 200/MT to INR 6,400/MT (ex-Raipur, GST extra). In Durgapur SteelMint’s reference, pellet price assessment stands at INR 5,700-5,800/MT in line with last week assessment. In Raipur, over 30,000 MT pellets were booked earlier this week at INR 6,200/MT (Ex-plant).

-- Southern India based pellet maker - KIOCL had concluded domestic pellet deal recently via tender floated for 50,000 MT pellet consisted of Fe 64% content with less than 2% Al at around INR 8,300/MT (on FoB basis to Mangalore port).

-- As per the SteelMint pellet export realization for standard grade pellet has come down to USD 100-101/DMT FoB (Al 3%) amid declining iron ore prices in China and falling bids from China. Chinese steel mills prefer iron ore lumps over pellets.

COAL

Australian coking coal prices resumed their southward journey this week amid competitive offers in the Asia-Pacific markets, and lower traded prices in China. The Chinese markets saw thin buying interest as buyers have already restocked in the past weeks, and are currently liaising with relevant port authorities to ensure receipt of their cargoes.

The Indian market saw the emergence of several bids and offers as sellers competed by reducing offer levels, but overall buying interest remained thin due to the ongoing monsoon season. Trade sources anticipate that Indian buyers may possibly return to the spot market next week, seeking October laycan cargoes.

-- Latest offers for the Premium HCC grade are assessed at around USD 155.50/MT FOB Australia and USD 170.90/MT CNF India.

SCRAP

Indian imported scrap market remained mostly waiting for news of stimulus to the economy to recover finish steel demand amid availability of scrap inventories with major steelmakers and cheaper domestic scrap and sponge as an alternative. Also, trades remain inactive with holidays in addition to the ongoing heavy monsoon this week.

-- Assessment for containerized Shredded from Europe, UK and USA remained at USD 300-305/MT, CFR Nhava Sheva, unchanged from last week, while no major trade was reported. Few suppliers heard offering at around USD 295-300/MT, CFR to check buying interest.

-- HMS offers remained mostly unchanged on a weekly basis. South African HMS 1 offered at around USD 290-295/MT, CFR Nhava Sheva, while West African HMS 1&2 (80:20) assessed at USD 270-275/MT, CFR Goa and Chennai. Ongoing Eid holidays kept HMS trades from Dubai silent, with few offers for HMS 1 and P&S at USD 280-285/MT and USD 290/MT CFR respectively.

FERRO ALLOYS

-- Silico Manganese prices inched down in Raipur and Durgapur as producers tried to attract buyers. However, in the present scenario, the export market looks better than the domestic market.

-- Ferro Manganese demand remains low and the market is still affected by the imports from Malaysia and South Africa. Prices are however stable for the week owing to the raised Manganese Ore index prices.

-- Indian Ferro Chrome prices have gone up marginally from last week as most producers reduced their production levels. Limited quantity is available in the domestic market as producers have reduced their allocation in the domestic market to curb the free fall of prices.

-- Producers in India and Bhutan have maintained the prices of Ferro Silicon despite low demand and thin trading activities. An Indian producer reported that they are expecting prices to go marginally up by next week.

SEMI FINISHED

As per SteelMint assessment, domestic Sponge iron prices have increased by INR 400-800/MT (USD 5-11) & Billet by INR 200-1,200/MT (USD 3-17). In this period major rise in Billet prices reported in North India (Mandi Gobindgarh) by INR 1,200/MT.

-- India's mid sized mills export offers to Nepal is hovering at USD 365-370/MT for Billet & USD 415-420/MT for Wire rod, ex-mill, Durgapur.

-- In East India, private pig iron producers have increased prices by INR 300-900/MT, W-o-W. Latest offers for steel grade is hovering at INR 23,500-23,800/MT in Jajpur, INR 24,300-24,700/MT ex-Durgapur & INR 23,800-24,300/MT ex-Bokaro (Jharkhand).

-- Jindal Steel has further lowered pig iron offers and reported steel grade at around INR 23,800-24,000/MT ex-Raigarh.

-- MMTC- India’s largest and state-owned trading house, has floated an auction of 10,000 MT non-alloy Pig Iron. The due date for submission of bids is 22 Aug’19.

-- SAIL has scheduled an auction to sale of about 2,400 MT basic grade Pig iron on 22nd Aug'19 from its Rourkela Steel Plant (RSP) in eastern India.

-- Punjipatra, Raigarh based steel manufacturers are still facing problems of power cut by JPL. The plant's are getting power supply of about 12 hrs (50%) per day.

-- RINL has invited tender for export of 10,836 MT Billets, 5,418 MT Blooms, 2,709 High Carbon Wire rod Coils and 8,127 MT Wire Rod to Nepal. Interested bidders can submit their bids till 22 Aug’19 at 14:00 hrs.

FINISH LONG

Indian Finish long steel prices surged by INR 500-1,300/MT (USD 5-18) this week amid average supply movement.

As per participants, the rebar price range has been improved amid strengthening raw materials but trade volume couldn’t exist adequate form and further it’s been expected that price range should not get any major change amid tight raw materials supply as domestic scrap availability is limited and imported scrap is not viable due to depreciating currency.

In addition, furnaces in Gujarat - western India, notified non-operational with sufficient numbers amid lack of appropriate conversion spread (margins) which is currently hovering at INR 5,300-5,400/MT from melting scrap to Ingot/billet.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 29,300-29,500/MT Ex-Raipur & INR 31,000-31,200/MT Ex-Jalna. All prices mentioned above are basic & excluding GST.

-- Central region, Raipur based heavy structure manufacturers have maintained trade discount at INR 1,200-1,400/MT against last week and current trade reference prices at INR 34,700-34,900/MT (200 Angle) ex-work and the prices surged by INR 400-500/MT in most of the regions.

-- Trade discounts in Raipur Wire rod is hovering at INR 1,500-1,700/MT and fresh offers stood at INR 30,300-30,500/MT ex-Durgapur & INR 29,600-30,100/MT ex-Raipur, size 5.5 mm.

FLAT STEEL

This week Indian HRC prices witness further slump by upto INR 500/MT owing to limited buying in domestic market. Weak purchases along with gloomy market outlook continue to pressurise HRC prices in domestic market.

As per SteelMint price assessment trade reference prices for HRC (IS2062, 2.5-8 mm) is currently at INR 37,000-37,500/MT ex-Mumbai, INR 36,500-37,000/MT ex-Delhi and INR 38,500-39,500/MT ex-Chennai. The CRC (0.9 mm, IS 513) prices on weekly basis are currently at around INR 42,500-43,000/MT ex-Mumbai, INR 40,000-42,000/MT ex-Delhi and INR 43,000-44,000/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Indian steel mills are trying to liquidate inventory by offering discounts and rebates to escalate buying in domestic market. Also major steelmakers are actively exporting in order to offload surplus output to overseas nations.

As per an update received, major Indian steelmaker booked around 60,000 MT of HRC (position cargoes) with Vietnam end users at around USD 475/MT CFR Vietnam for Sep shipments.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI