The future of Steel Industry

1. INTRODUCTION

There's no doubt, make predictions about the future of steel industry it's always close to impossible. Many key factors have to be considered while foreseeing something about this big elephant industry, remembering the macroeconomics aspects can easily move things in one or the other directions.

2. SHARES OF WORLD STEEL PRODUCTION BY MAIN COUNTRIES

Let's see what's happened to the shares of steel production by the major countries in the last century:

CHINA Since the 1980s, China has emerged as a major producer in a number of heavy industries, including steel and aluminium. Chinese steel production growth from 10% to 50% of the global total between 1990 and 2018;

EUROPEAN UNION The global share production of European Union has consistently declined over most of the past 150 years, counting nowadays about 9% of the total worldwide production;

USA Share of steel production in the USA peaked in the early 1920s and fell sharply thereafter. The USA currently accounts for less than 5% of global steel production;

JAPAN The share of Japanese steel production continues to fall after reaching over 15% of the global total in the 1970s counting nowadays about 5% of the total worldwide production;

INDIA Along with Chinese, Indian production has increased in the last ten years and today contributes about 6% of the worldwide production;

The result is that global steel production has shifted dramatically against the United States, Europe and Japan and toward China and India over the last century and particularly the last four decades.

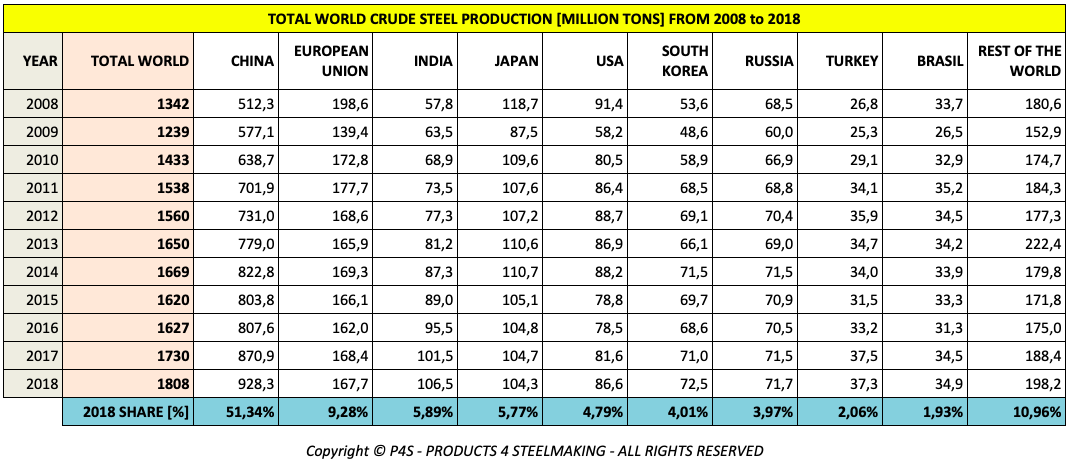

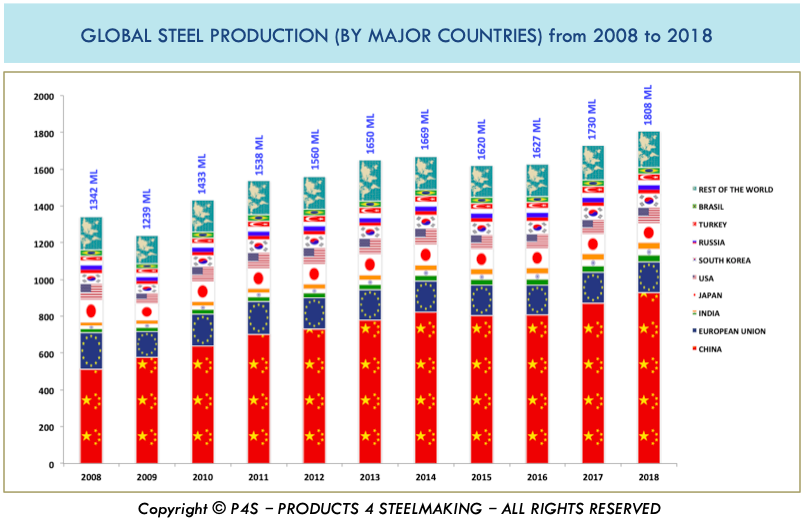

3. STEEL PRODUCTION IN THE LAST DECADE

In the last decade total crude steel production jumped from about 1.342 ML TONS (2008) to a 1.808 ML TONS (2018) with an increase of about 35%. Here below the table and graphs with the total production (by year) divided by regions:

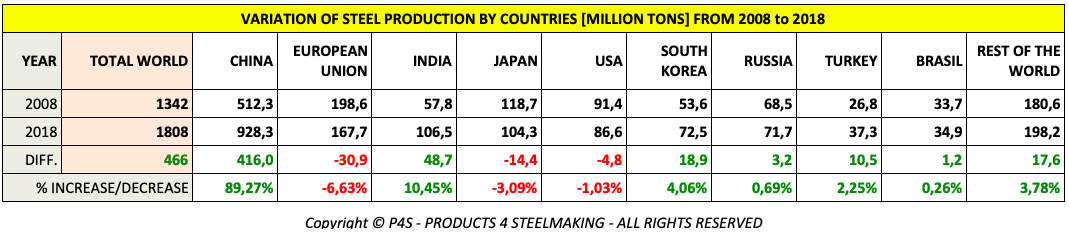

It's easy to come to the following conclusion:

In the last decade, world steel output increased of about 466 ML TONS, where 416 ML TONS is the total increase due to the Chinese steelmakers. That's means that China totally driven the growth in production counting about 90% of the total one. The remaining 10% is mainly due to the Indian steelmakers, while the other countries had a decrease or just slow increase in the production (as indicated in the table here below):

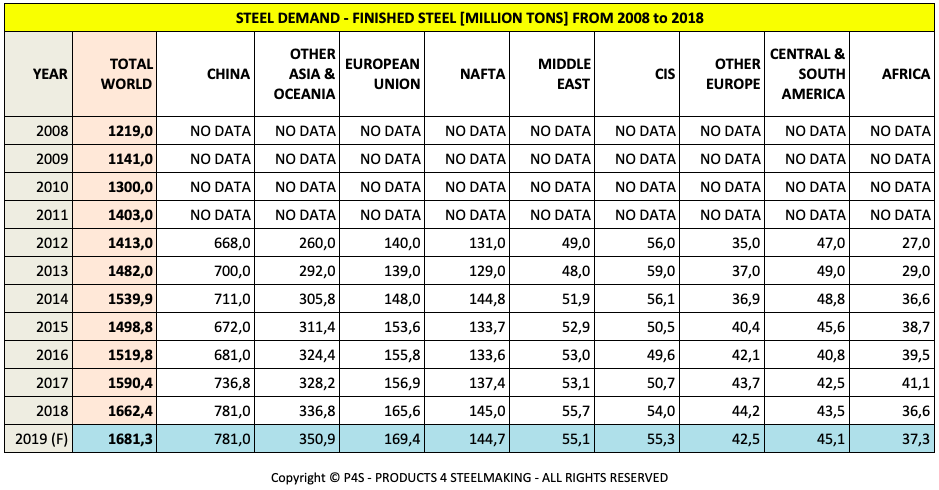

4. STEEL DEMAND IN THE LAST DECADE

The worldwide steel demand in the last decade jumped from 1.219 ML TONS (2008) to about 1.662 ML TONS (2018) with a total increase of about 36%. Steel demand has increased in different regions of the world, especially in China, Europe, Middle East and Africa. Here below a table with the steel demand divided by regions:

5. THE CHINESE STEEL BALANCE

As Chinese production account for about 50% of the total world steel production, the first parameter that has to be considered to predict the future of steel industry is the balance between the export and import of steel in and from China. As indicated in the table here below it's simple to note that the high unbalance created in 2015 and 2016 (about 100 ML TONS/YEAR) have brought a relevant crisis in the steel sector especially in Europe, Middle East and South America.

6. MAIN STEEL GROUPS PRODUCERS

Here below you can see the top ten steel producers (nowadays) and the first steel producers by each country.

It's easy to note that the output of the first ten steel producers counts about 25% of the total steel produced worldwide.

7. WHAT TO EXPECT IN THE FUTURE

To understand the future of steel industry several points have to be taken in account. Some of them are summarized here below:

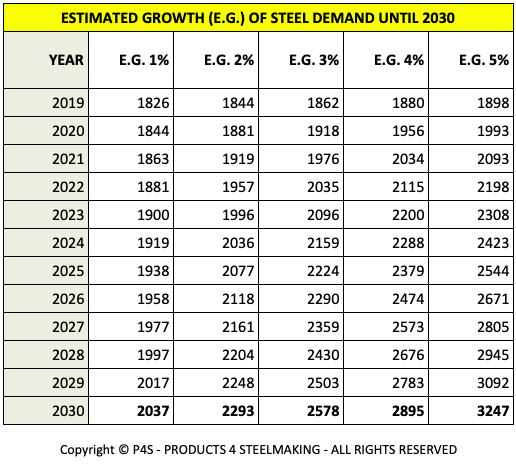

1) FUTURE GLOBAL STEEL DEMAND As indicated in the table above the increase of global steel demand in the last decade was about 35%, which means about an average of 3 to 4% increase every single year. If we go ahead in this way we can foresee a total demand to be about 2.500-2.800 ML TONS of steel by 2030. The other estimations are summarized in the table here below. Of course we've to consider that China’s rapid ascent—which drove previous global demand—was a unique phenomenon that is not going to be repeated in other countries. Based on this statement someone expects a slow growth of steel demand of 1 to 2% per year;

2) FUTURE OF STEEL AS "PRODUCT" The long-term decline in overall steel intensity is accelerating due to material substitution, shifts in design parameters and steelmakers’ own success in producing lighter, stronger steels;

3) POTENTIAL REDUCTION OF CHINESE STEEL CAPACITY AND DEMAND Reductions in China’s excess internal capacity could easily change the cards on the table. But this hypothetical reduction has to be linked to the potential declining of domestic Chinese steel demand. Someone predicts that an oversupply will remain over the next decade. This will be mainly attributed to the resistance of China to cut production levels as well as the declining demand across the world;

4) SHIFTING TO ELECTRICAL STEELMAKING Scale is important in the industry—and even as electric-arc furnace (EAF) mini-mills have made inroads, the pursuit of operating scale has continued. But so too has the development of advanced, smaller scale configurations. The restricted incoming rules of the circular economy and climate change will encourage the proliferation of reduced-scale plants that are sized to match new low-carbon production processes and take advantage of renewable energy sources;

5) EMERGING ECONOMIES Global steel demand over the next decade will mainly depend on the emerging economies. However, economic conditions for the global steel industry remain uncertain and challenging;

Matteo Sporchia

Sales Export Manager on Steel products | Refractory, Graphite Electrodes Technical Expert

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook