How does China’s Needle Coke Market perform so far in 2019?

Since the latter half of 2017, when the GE demand spurted in China with the push to EAF sector, the demand for needle coke also increased substantially. In the ongoing year so far, China’s needle coke demand has been estimated to be 780,000 tonnes, registering an increase of about 36%. In 2019, the total output of graphite electrodes in China is expected to reach 1.34 MnT, a y-o-y increase of 39%, with the highest surge in large-sized electrodes of 600mm or more.

The output and export volume of electrodes have also increased greatly in 2019 (especially small-sized) and the development of large-scale electric furnaces in China has reached more than 13 requiring UHP 700mm electrodes.

The next year 2020 is going to be the year of centralized production capacity replacement of Chinese steel mills and the newly added electric furnace steel production capacity is expected to increase by 10 MnT compared to an increase in the ongoing year of 2019. China’s total EAF capacity is expected to reach 194 MnT which will require GE for production and the demand for high-quality needle coke will also increase.

In terms of anode materials, in 2018 the output of lithium battery anode materials in China was 257,500 tonnes and its needle coke requirement was 220,000 tonnes. In 2019, China's anode materials continued to maintain rapid growth. According to IC Carbon statistics, the output of anode material in the first six months was 137,000 tonnes, a year-on-year increase of 45%. Also, the demand for anode material in China’s domestic market is not only strong but the export is also remarkable. It is estimated that the annual export growth of Chinese anode material will exceed 60%. Stimulated by the growth in the global new energy vehicle market, China's anode material production is expected to reach 650,000 tonnes by 2021.

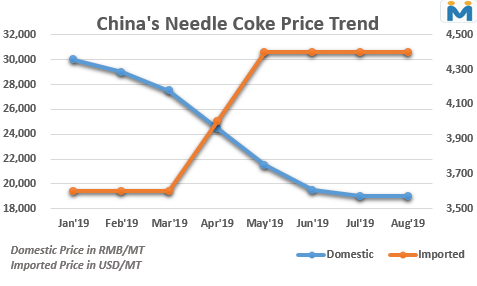

With the increased demand, China’s domestic needle coke capacity also surged and reached as high as 2.01 MnT out of which the proportion of coal-based needle coke capacity is relatively large. Subsequently, although the prospects for higher size GE demand looks good in China, it requires good quality petroleum-based needle coke for production. As the prices of small-sized electrodes in China have been falling over the past few months due to its excess supply, China’s domestic needle coke prices are also plunging. Thus, the increased capacity of coal-tar needle coke capacity is unlikely to support China’s needle coke prices in the upcoming months. The planned capacity of 1.84 MnT for needle coke will be put into production or not remains to be seen.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook