Pakistan: Imported Scrap Prices Marginally Down amid Limited Trades

SteelMint’s assessment for containerized Shredded 211 scrap from US, Europe and UK stands at USD 308-312/MT, CFR Qasim, slightly lowering by around USD 3-5/MT against last week’s report, with minor deals being concluded in this range. As per data maintained by SteelMint, the current assessment for shredded scrap is lowest level in last 2 years, as prior to this, levels below USD 308/MT were seen in June 2017.

Trades for HMS scrap further decreased, as stricter custom clearance norms for HMS have increased the clearance cost with each container is being individuality checked by govt officials on concerns of auto parts being imported in the name of ferrous scrap. The continued 3% duty on HMS having narrowed gap between the landed costs of HMS & Shredded, has further affected imported HMS sales.

Dubai origin HMS is observing low interest from buyers, in spite of offers decreasing sharply. HMS 1&2 (80:20) is currently being offered at around USD 290/MT, while higher quality HMS 1 is assessed at around USD 295-300/MT, CFR. UK origin HMS 1&2 was assessed at around USD 285-290/MT, CFR Qasim, however very limited trades were reported. Few deals for LMS bundles from South Africa were reported at around USD 265/MT, CFR Qasim.

Pakistani Rupee remained comparatively stable this week, standing at around 159-160 levels against USD.

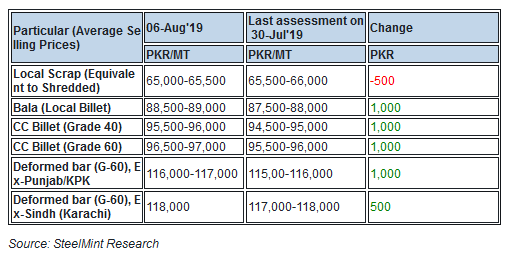

Domestic steel market likely to strengthen post Eid; steel prices increase - It was reported that banks in Pakistan have tightened the credit for steel industry and increased interest rates by 100bps, which has in turn led to increase in finished steel prices, however with upcoming Eid holidays from 9th to 15th August along with labour shortages, demand from end users is likely to remain low. Strict tax enforcements from FBR have hit the sales hard, with the general sentiment remaining against the new tax policies, as stakeholders ask for roll back of the same.

In Northern region rebar average selling prices assessed at around PKR 116,000-117,000/MT, ex-works (USD 723-729) meanwhile Southern (Karachi region) steel mills are offering rebar at around PKR 118,000/MT.

High input cost also contributed to finished steel’s price hike, as both Bala Billet and CC Billet increased by close to PKR 1000/MT, standing at PKR 89,000/MT (USD 555) and PKR 97,000/MT respectively.

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

Emirates Global Aluminium unit to exit Guinea after mine seized

South Africa mining lobby gives draft law feedback with concerns

EverMetal launches US-based critical metals recycling platform

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study