Major Australian producers raise iron ore shipments

Total exports from Australia-based producers Rio Tinto, BHP, Roy Hill, Atlas and Fortescue were 18.34mn t in the week that ended 3 August, up by 17.5pc from 15.61mn t a week earlier. Iron ore shipments from Australia typically arrive at major Chinese ports in 10-15 days.

Portside stocks of imported iron ore were unchanged from a month earlier at 116mn t on 31 July, according to the China iron and steel association (Cisa).

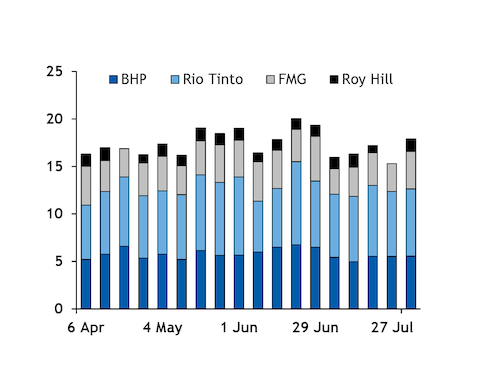

Iron ore shipments from major Australian supplies have hovered in the 16mn-20mn t/week range since 6 April, after dipping to a low for this year of 5.48mn t in the week ended 30 March.

Rio Tinto, Australia's largest iron ore producer, has forecast a decline in exports in 2019, while BHP and Fortescue have projected that shipments will rise in the 2019-20 fiscal year that started 1 July.

Rio Tinto shipped 7.07mn t in the week that ended 3 August, compared with 6.84mn t in the previous week. BHP's shipments edged up to 5.56mn t from 5.53mn t and Fortescue's exports increased to 3.94mn t from 2.91mn t over the same period. Roy Hill shipped 1.33mn t in the latest week, after not exporting any ore in the week ended 27 July. Atlas' exports rose to 429,076t from 329,217t.

Iron ore prices are likely to remain under pressure in the near term amid a slide in the value of the yuan and US-China trade friction. Steel mill profitability has not recovered from lows reached in November and December last year. This has curbed mills' interest in building stocks, something that could continue if portside stocks increase this month and shipments from Australia and Brazil remain at current rates.

Brazilian mining firm Vale expects to bring 20mn t/yr of iron ore capacity on stream by the end of this year on a dry processing basis, further easing supply tightness.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook