Australian Coking Coal: Prices decline further on subdued demand

China: Market Overview

In China, fresh seaborne trades of Australian premium hard low-volatile coking coal were done at lower level, as steelmakers considered restocking in order to take advantage of competitive pricing compared to domestic coals.

The spot market has therefore been active lately with Chinese end-users buying the cheaper seaborne material.

In the meantime, however, Chinese traders have been adopting a cautious approach, in light of the ongoing restrictions imposed at several major seaborne coal handling ports, including China’s main coking coal import port of Jingtang located in the northeastern Hebei Province.

Chinese officials had reportedly begun restricting customs clearance declarations to only local end users from the past two weeks — and overseas trading entities have thus effectively been debarred from unloading their imported coal cargoes at the ports of Jingtang and Caofeidian.

India: Current Market Scenario

Indian end-users are very cautious at the moment even as the seaborne price levels are certainly attractive for buying spot cargoes. Sources claim that most steel mills are well covered until the end of monsoon, and seem to wait for prices to come down further and possibly hit rock bottom in August.

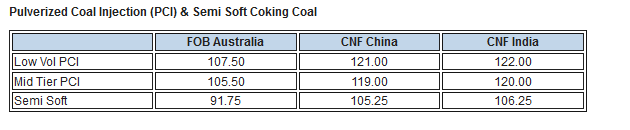

PRICE ASSESSMENTS

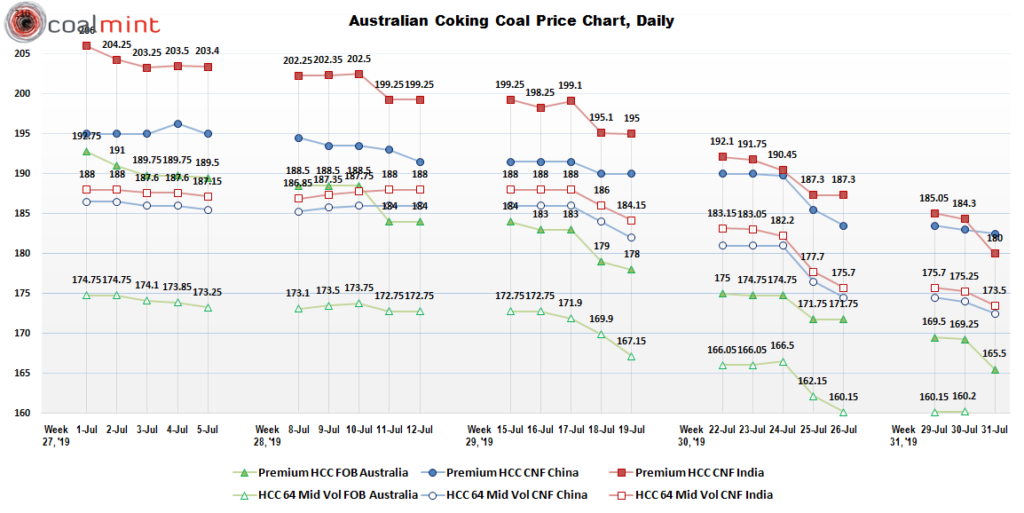

Latest offers for the Premium HCC grade are assessed at around USD 165.50/MT FOB Australia, lower by USD 8.10/MT than the average rate of USD 173.60/MT prevailing in the week gone by (22-26 Jul’19).

Offers for the 64 Mid Vol HCC grade are assessed at around USD 159.00/MT FOB Australia.

For Indian buyers, the above offers amount to USD 180.00/MT and USD 173.50/MT respectively on CNF India basis.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook