Will Indian Steel Mills Lower HRC Prices in August?

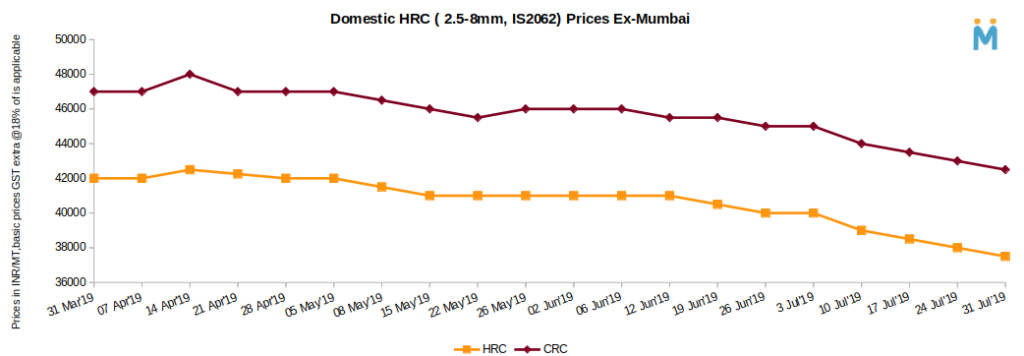

As per SteelMint price assessment trade reference prices for HRC (IS2062,2.5-8mm) is currently at INR 37,500-38,000/MT (Ex-Mumbai), INR 37,000-37,500MT (ex-Delhi) and INR 39,000-40,000/MT(ex-Chennai).Prices mentioned above are basic and extra GST@ 18% will be applicable.

Meanwhile trade reference prices of CRC (0.9mm, IS 513) prices on weekly basis are currently hovering around INR 42,500-43,000/MT (ex-Mumbai), INR 40,500-42,500/MT (ex-Delhi) and INR 43,500-44,500/MT(ex-Chennai). Prices mentioned above are basic and extra GST@ 18% will be applicable.

Market participants are expecting price cut by INR 1,000-1,5000/MT for August. However company officials mentioned that announcement is yet to be made, however reduction will be in terms of offers or discounts which is yet to be announced.

A trader based in Ludhiana commented that,” Slow demand continue to pressurize HRC prices further in domestic market. Also trade segment is expecting discounts and rebates to support current scenario”.

Few other trade sources shared that,”Demand is likely to pick up towards the end of monsoon season in Sep month which may support the prices in near term”.

Auto sales continue to decline in Q1- As per market reports, auto sales reported decline in first quarter of this fiscal against the backdrop of consumer sentiment continuing to remain subdued because of the overall slowdown in the economy and tightening of credit norms by banks.

The situation further worsened as demand in the rural market nosedived because of falling farm income and lack of financing options from NBFCs.

In Q1 FY20, sales of automobiles from showrooms declined by 6% to 5.12 Million units. Retail sales of passenger vehicles declined by just 1%, but commercial vehicle sales fell sharply by 14%.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook