Steel Industry Officials Draw Up ISMC 2017 Agenda

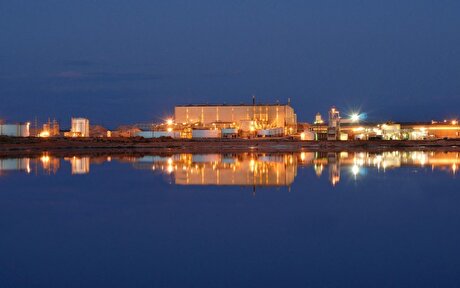

In the run-up to the annual steel event, top government officials and industry experts convened at Financial Tribune’s headquarters in Tehran on Sunday to discuss the Iranian steel sector and the ISMC conference agenda. (Photo: Amir Havasi)

In the run-up to the annual steel event, top government officials and industry experts convened at Financial Tribune’s headquarters in Tehran on Sunday to discuss the Iranian steel sector and the ISMC conference agenda. (Photo: Amir Havasi)

Iran’s steel industry is moving towards becoming a major global player. Unshackled from years of economic sanctions, Iran is looking to expand its steelmaking capacity over the next decade. The way forward, however, is riddled with pitfalls. A global oversupply and price slump in the iron ore sector has dogged the industry ever since 2015; China has yet to fulfill its pledge to cut its steelmaking capacity to revive prices; as protectionist measures are being taken all over the world to counter the steel behemoth’s dumping strategies.

Meanwhile, Iranian steelmakers are grappling with weak domestic demand due to the slump in the construction sector. Nonetheless the industry aims to boost its crude steelmaking capacity to 55 million tons by the end of 2025, as stipulated by the 20-Year National Vision Plan.

With the aim to devise a strategy for realizing the industry’s potential and securing a path towards growth, the 7th Iranian Steel Market Conference (ISMC 2017) is scheduled to be held in Tehran February 16-17, 2017. Top Iranian officials, domestic steel industry players as well as global steel companies will attend the annual conference that is hosted by Donyaye Eghtesad Taban Co., the owner of the Financial Tribune daily.

Prominent participants who attended last year’s conference include Peter F. Marcus, managing partner and founder of World Steel Dynamics steel information and analytics service; Gianpietro Benedetti, chairman and CEO of the Italian Danieli Group; Yang Zunqing, deputy chairman of China Iron and Steel Association; Burkhard Dahmen, CEO of German SMS Group; Roland Kristl, managing director of Austria’s INTECO; and Elias Gonzalez Gil, chief executive director of Spanish GRUPO SARRALLE.

In the run-up to the upcoming event, top government officials and industry experts convened at Financial Tribune's headquarters in Tehran on Sunday to discuss the current state of Iran's steel sector and the conference agenda.

The three preliminary suggested themes of ISMC 2017 as discussed in the Sunday meeting include:

- Forecasting the state of global and domestic iron ore and steel sectors;

- Devising strategies to compete in the global market and increase the share of Iranian steelmakers;

- Discussing the shutdown of inefficient and low-output steel plants.

According to statistics presented by Donya-e-Eqtesad Market Studies Unit, Middle East countries, excluding Iran, are set to add 36.9 million tons to their crude steelmaking capacity by the end of 2016. In the meantime, the global crude steel production capacity is expected to rise by 3.9 billion tons.

No Change on the Horizon

Addressing the meeting, deputy minister of industries, mining and trade, Mehdi Karbasian said he believes the statistics indicate that not much will change for iron ore and steel in the current year. Prices will neither go up nor down till 2017 as not much has changed in terms of market dynamics.

He said as the end of President Hassan Rouhani's 4-year tenure is drawing close, industrialists can rest assured that no big projects will take off this year and things will remain relatively stable.

“In this climate, we need to focus on our priorities. The most important point on the agenda must be cutting down on production costs and finished prices in order to be able to compete in global markets,” said Karbasian, who is also the head of state-owned IMIDRO (Iranian Mines and Mining Industries Development and Renovation Organization), Iran's biggest holding in the mining sector.

Shifting Toward Exports

He underscored the importance of shifting towards exports amid diminished demand for iron ore and steel owing to the recession-hit construction sector, noting that until domestic demand for structural steel picks up again, exports appear to be the best way to make profits for the industry and subsequently fuel growth.

Echoing the IMIDRO chief's remarks, the CEO of Mobarakeh Steel Company Bahram Sobhani who was also present at the meeting, pointed to Iran’s limited crude steel consumption per capita. According to him, the figure stood at 225 kg last Iranian year (March 2015-16) and is expected to reach 280 kg next year.

“Considering Iran's population, domestic demand for crude steel is expected to reach 22 million tons per year. By subtracting 2 million from the figure for special products not produced domestically, we reach an effective demand for 20 million tons,” said the industry official.

Industry officials are making every effort to reach the 55-million ton production capacity by 2025. Current capacity already exceeds 25 million tons. The industry has to export at least 20 million tons of crude steel per year in order to sustain, according to experts. According to head of Iran Iron Ore Producers and Exporters Association Ghadir Ghiafeh, another speaker at the meeting, Iran’s infrastructural limitations must first be overcome before the export target can be met. This requires giving up on uneconomical expansion programs and focusing on merging major steelmakers so that they can share their expenses and build up their needed infrastructure.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming