Pakistan: Imported Scrap Offers Inch Down Amid Limited Buying Interest

Heavy rains in most regions of the country since last week and changes in new parameters of FBR for steel retailers and distributors push the domestic market in ‘wait and watch’ mode.

SteelMint’s assessment for containerized Shredded 211 scrap from US, Europe and UK stands at USD 310-315/MT, CFR Qasim, marginally down as against last week’s report, with few deals being concluded in this range. Offers from recyclers mostly remained at around USD 315-318/MT, but lower buying interest at around USD 310-312/MT kept trades limited.

Assessment for Dubai origin HMS scrap stands at around USD 300-305/MT, CFR, depending on quality with few offers also heard slightly below than these levels. On the other hand, good quality HMS 1 reported to have sold at USD 305-310/MT, CFR Qasim.

Pakistani Rupee depreciated slightly this week and stood at around 161 levels against USD.

Domestic steel market remains slow ahead of Eid holidays – Pakistan steel market likely to remain less active for almost 1 week after 10th August on account of Eid holidays. Drive against misdeclaration and under-invoicing has been initiated on the directives of FBR and customs departments. Domestic market conditions remained almost steady but prices are expected to soften on less activity on account of Eid holidays.

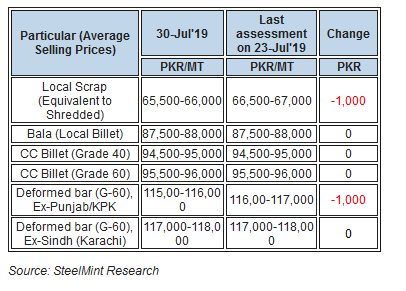

With a slight softening on weak demand, average rebar selling prices of Northern region’s steel mills assessed at around PKR 115,000-116,000/MT, ex-works (USD 715-721) while Southern (Karachi region) steel mills have kept rebar offers at around PKR 117,000-118,000/MT, ex-works. Assessment of CC billet G-60 stood at PKR 96,000-96,500/MT (USD 597-600).

Domestic scrap prices fall still buyers prefer imported scrap - Local scrap prices decreased by PKR 1,000/MT to PKR 65,500/MT ex-works however, stricter restriction of invoicing and less clarity on documentation keep buyers to prefer imported scrap.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook