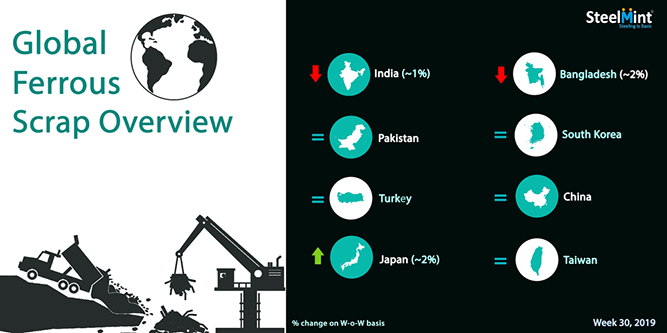

Global Ferrous Scrap Market Overview - Week 30, 2019

Turkey - Imported scrap prices for Turkey remained largely stable amid 2 major deals reported, among other negotiations underway. Turkey’s finished steel demand remained largely subdued as market puzzled with effect of recent interest rates cut announced by the Central Bank.

Assessment of US-origin HMS 1&2 (80:20) scrap stand at USD 294/MT, CFR Turkey, while assessment of European origin HMS 1&2 (80:20) stands at USD 287-288/MT, CFR Turkey.

The recent deal included a Marmara based steel mill booking US bulk cargo of total 30,000 MT 11,000-15,000 MT HMS 1&2 (80:20) scrap at USD 294/MT, 5,000-7,000 MT of Shredded at USD 299/MT and 10,000-12,000 MT of P&S scrap at USD 304/MT while another Baltic cargo of HMS 1&2 (80:20) at USD 291/MT and bonus scrap at USD 301/MT, CFR Turkey.

Japan - After remaining silent for 3 weeks, Japan’s Tokyo Steel raised domestic scrap purchase price this week after a gap of around 5 months, while the domestic scrap market had stabilized since this week. With a JPY 500/MT hike for scrap for Utsunomiya plant, the company will pay JPY 26,500/MT (USD 245) for H2 scrap delivered to this plant, while the price for delivery to the other 4 works remains unchanged. Other Japanese EAF steelmakers and overseas exporters are also likely to follow the trend and hike their scrap prices.

Japan’s Kansai Iron and Steel Federation’s monthly tender concluded on 26th July’19, as the winning bid was awarded a total 5,000 MT of Japanese H2 at an average of JPY 28,120/MT (USD 259), FAS, which was JPY 910/MT higher than last winning bid reported early July.

South Korea - Hyundai Steel did not bid for Japanese scrap, while the bids have been held unchanged for the 3rd week now. No other cargo booking was also reported. The company had last revised its bid on 5th July which stood at JPY 27,000/MT (USD 248) FoB Japan. With the Japanese exporters raising their export offers, the standoff over the prices is likely to continue. Major EAF makers observed maintenance activity, thus dampening the demand further

Taiwan - Taiwanese domestic scrap & rebar prices remained flat for yet another week, low buying interest put sellers under pressure. Imported scrap prices stand in the range USD 280-283/MT, CFR Taiwan for US-origin HMS 1&2 80:20.

The leading steelmaker Feng Hsin steel kept its domestic scrap buying prices unchanged at TWD 9,000/MT (USD 290) for HMS 80:20 delivered to Taichung plant and Rebar prices at TWD 16,200/MT (USD 522).

Vietnam – Weak finish steel demand keep Vietnamese scrap importers away from buying actively. US west coast origin bulk HMS 1&2 mix scrap offers heard stable at USD 310-315/MT, CFR Vietnam. While Japanese H2 bulk scrap offers inched up to USD 300/MT, CFR Vietnam, Hong Kong origin HMS 1&2 (50:50) remained in the range USD 295-300/MT, CFR.

India - Indian imported scrap market remained very sluggish amid lack of interest on sinking steel prices and heavy rains keeping imported scrap less viable for over a month now. Additionally, significantly cheaper domestic alternatives have lowered the buying interest further. However, with lowering in offers some inquiries have witnessed against that of earlier week.

An assessment for containerized Shredded from UK, Europe and USA stands at USD 310-315/MT, CFR Nhava Sheva, down USD 5/MT against the last week. Offers of HMS 1 from Dubai have dropped to around USD 290-295/MT, CFR Nhava Sheva. South African HMS 1 was being offered at around USD 300-305/MT, CFR. Few deals of West African HMS scrap reported at around USD 280-290/MT, CFR with buying interest reported lower among secondary steelmakers, as end users kept bidding low for West African HMS at the levels of USD 270-275/MT, CFR India.

Average offers in bulk vessels stand at USD 325-330/MT, CFR Kandla but it seems not feasible to conclude at the moment.

Pakistan - Imported scrap offers recovered slightly after last week’s record low prices, as global market remained strong, while trades somewhat slowed down in comparison to last 2-3 weeks. Buyers continued to import moderately in good volumes, however prices inched up by the end of the week on tightening of supply.

SteelMint’s assessment for containerized Shredded 211 scrap from US, Europe and UK stands at USD 312-315/MT, CFR Qasim, almost in line with last week's report, with moderate deals being reported at these levels. However many offers remained slightly higher in the range of USD 315-318/MT. Dubai origin HMS 1 offers inched down and stand at USD 300-315/MT, CFR, while UK origin HMS 1&2 remained at around USD 295/MT, CFR Qasim amid limited interest.

Domestic steel market remained slow while slight hike in prices observed for finished steel and billet in the market while local scrap rose to PKR 67,000/MT (USD 416) , ex works.

Bangladesh - Trade activities remained slow this week with few deals for imported scrap being observed, even as prices softened further as South Asian market’s overall interest dwindled. The market is keeping a positive outlook, expecting full-fledged sales from later August and September onwards.

Assessment for containerized Shredded scrap from UK, Europe and USA stands at USD 325/MT CFR Chittagong, down by USD 5-7/MT against last week. Containerized HMS prices saw a sharp drop with South American HMS 1 at USD 315-320/MT while HMS 1 and HMS 1&2 (80:20) from UK at USD 310/MT and USD 300-305/MT CFR respectively. Few offers for P&S were reported at USD 330-335/MT. A leading steel maker heard to have booked a bulk cargo comprising 25,000 MT of HMS 1&2.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift