China: Chrome Market sees Improvement on a Confluence of Factors

It is learned that the transaction price of Turkey lumpy 40-42% upswings to USD 200/MT CIF China while Turkey concentrates 46-48% transaction price increased to USD 220/MT CIF China. The spot price of lumpy ore is also slightly increased by RMB1/dmtu (USD 0.15/dmtu) compared with the previous period, and this upward trend seemed sustained.

From the current market situation, even if the Ferro Chrome plant demand for mainstream chrome ore does not increase, the price of mainstream lumpy ores is firm under the backdrop of dwindling supply. The main reasons are:

1. The port spot inventory is at a low level. According to the incomplete statistics on the current spot market at ports, there are few offers of Pakistan and Iran origin ores in response to inquiries and this is particularly apparent low-grade mainstream lumpy ores. Therefore, even if the Ferro Chrome plants continuously reduce the usage amount of the mainstream lumpy ores, the fact of not increased supply and the continuous consumption of inventory have strengthened the lumpy ore price.

2. The supply of futures cargo is on the decline, and the mined volume of went down, fueling up the futures price steadily. Therefore, under the support of the cost, spot traders would rather choose to keep the goods than sell them at low costs, showing a clear mind state to prop up the prices.

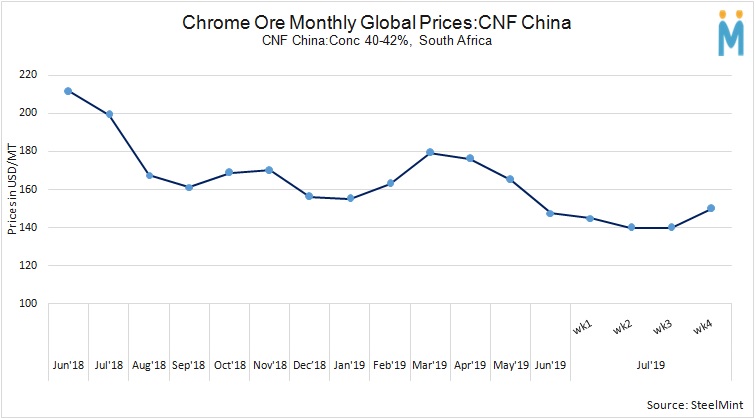

3. RSA chrome took the lead in this round of price upswing. Most of the current inventories held by traders are of high costs, and they can't miss the chance to raise their price in a buoyant market.

Although alloy factories constantly adjust the production formula to reduce the use of lumpy ore, there is still demand in order to conduct normal production. This fact has pushed factories to accept rising lumpy ore prices. On the other hand, the tender prices of HC Ferrochrome by stainless steel mills are yet to be clear, the alloy factories’ passion for purchase have not shown an apparent increase.

On Friday, Tsingshan group took the lead to release its HC chrome tender price, which is at RMB 6, 296 (USD 915) /50 basis per ton, on par with last month level. Following the release of tender prices and considerable purchasing of RSA chrome, it is expected that next week a continuous price uptick is not likely to occur and the high-price transaction may stand slim chance to sustain, calling for a quiet period on the market. However, the RSA suppliers are temporarily under little pressure for shipment, and downward price adjustment is not something under consideration. Based on this, future offers by other producing countries are also expected to remain stable.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

UBS lifts 2026 gold forecasts on US macro risks

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Afghanistan says China seeks its participation in Belt and Road Initiative

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery