Europe’s central banks ditch 20-year-old gold sales agreement

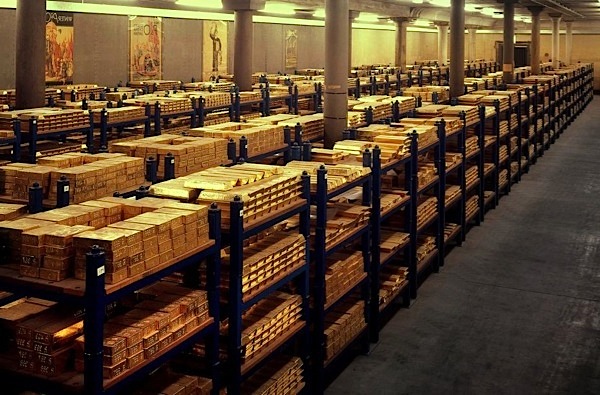

The Central Bank Gold Agreement (CBGA) was originally signed in 1999 to limit gold sales and help stabilise the market for the precious metal.

Through the 1990s, sporadic sales often conducted behind closed doors by European central banks, which hold some of the world’s largest gold hoards, drove down prices and undermined the metal’s status as a stable reserve asset.

The Central Bank Gold Agreement (CBGA) was originally signed in 1999 to limit gold sales and help stabilise the market for the precious metal

“The signatories confirm that gold remains an important element of global monetary reserves, as it continues to provide asset diversification benefits, and none of them currently has plans to sell significant amounts of gold,” the ECB said in its statement.

The deal, originally between 15 central banks, capped the amount signatories could sell each year, stabilising the market.

Over the next two decades prices surged, from less than $300 an ounce to a high of almost $2,000 in 2011, while central banks switched from being net sellers of gold to net buyers.

In a sign of the change in the market, the price of gold, currently around $1,400 an ounce, barely budged after the announcement.

The agreement was updated three times and eventually expanded to include 22 central banks, though in 2014 – three years after the last significant gold selling by those covered by the pact – the cap on sales was lifted.

The latest version of the deal was due to expire on Sept 26.

“It’s absolutely the right decision,” said Natalie Dempster, managing director of central banks and public policy at the World Gold Council.

She said the market had transformed since 1999 and was now more liquid and more stable.

“The biggest change is in central bank behaviour,” she said. “While back in 1999 they were net sellers to the tune of 500 tonnes, last year central banks bought record amounts of gold.”

Central banks bought 651 tonnes of gold worth nearly $30 billion last year, according to World Gold Council figures – the most in half a century.

Larger European central banks have not started buying gold, but purchases by Poland and Hungary turned the continent into a net buyer.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook