13 Things SteelMint Learned from POSCO Q2CY’19 Results

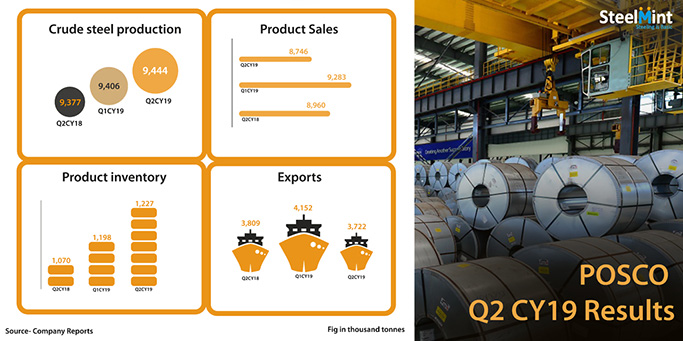

1.Company’s crude steel production inch up slightly on Q-o-Q basis- POSCO’s crude steel production inched up slightly on Q-o-Q basis at 9,444 thousand tons in Q2CY’19 in comparison to 9,406 thousand tons in Q1CY’19. However on yearly basis it registered slight increase in Q2 from 9,377 thousand tons in similar quarter of previous year.

2.Company’s product sales volumes down on planned maintenance- Company’s sales volumes witnessed marginal decline by 6% on quarterly basis to 8,746 thousand tons in Q2CY’19 against 9,283 thousand tons in previous quarter. The decline in sales volumes can be attributed to heavy maintenance carried out during the quarter.

However the same fell marginally by 2% in Q2CY19 as compared to 8,960 thousand tons in Q2CY18.

3. Company’s export sales declined by 10% Q-o-Q in Q2CY'19- Export sales stood at 3,722 thousand tons in Q2 declined by 10% against 4,152 thousand tons in Q1. Meanwhile on yearly basis the same inched down by 2% against 3,809 thousand tons in Q2CY'18.

4. Domestic sales move down slightly by 2% Q-o-Q in Q2CY19- Company’s domestic sales move down marginally by 2% Q-o-Q basis in Q2 at 5,024 thousand tons against 5,131 thousand tons in Q1CY'19.

5. Product inventory up by 2% in Q2CY'19- Company’s product inventory witnessed an uptick by 2% in Q2 to 1,227 thousand tonnes against 1,198 thousand tonnes in previous quarter. On yearly basis the same increased by 15% in Q2CY19 against 1,070 thousand tonnes in Q2CY'18.

6.Carbon steel prices moved up by 2% Q-o-Q in Q2CY19- Company’s carbon steel prices moved up by 3% in Q2 CY'19 to 735/MT thousand KRW from Won 722/MT thousand KRW in Q1 CY'19. However Y-o-Y basis it inched up by 1% against 730K tons in Q1 CY'18.

7. Global steel demand likely to remain weak in CY'19 amid economic uncertainties- China-US trade dispute and slower economic growth will likely to keep moderate demand in global market. While demand forecasts for India, Southeast Asia and other emerging markets may improve by 5-7%. And the demand forecast for MENA region shall remain bleak amid geopolitical risks.

8. Higher raw material cost may keep Chinese steel prices steady in H2- Constant hike in iron ore prices over supply disruptions from Vale will sustain steel prices from China. Also in H2 demand shall improve on increased infrastructure spending and reduction in tax rebate along with boost in economic policies.

9.Automobile production likely to remain weak in Q3CY’19- As per Korean automobile manufactures association in Q3CY19 auto production of cars will move down by 16% to 898 thousand cars which was 1071 thousand cars in Q2. Thus delayed recovery in production and weak buying from consumer sector resulting to lower demand in upcoming quarter.

10. Construction sector will improve in H2CY19- Demand from construction sector will improve in H2CY19 on increasing SOC orders However construction from private housing sector remain sluggish.

11.Shipbuilding volumes to increase in Q3- The demand in shipbuilding sector likely to touch 5.0 million GT in Q3CY’19 which was 4.9 million GT in Q2CY’19.

12. Global iron ore prices to rise in Q3 over tight supply- Global iron ore prices are expected to touch at USD 100-110/MT in Q3 amid prolonged re-stocking at Chinese ports.However, improvement in supply conditions with increased production at Vale after recovering from disasters in Q1 will keep iron ore prices sustained in global market.However strong demand along with supply disruption in Brazil and cyclone in West Australia kept iron ore prices on higher side in Q2.

13.Coking coal prices to witness fall in Q3- Coking prices is expected to decline at USD 170-180/MT in Q3 amid stricter Chinese govt regulations on coal imports at major ports like Jintang and Caofeidian. Meanwhile easing of railways and port infrastructure in East Australia may pull down coking coal prices in upcoming quarter.Also decline in buying interest from India owing to monsoon season shall further exert pressure on coal prices.However in Q2 restocking demand from steel mills in India and China kept coking coal prices on higher side.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse