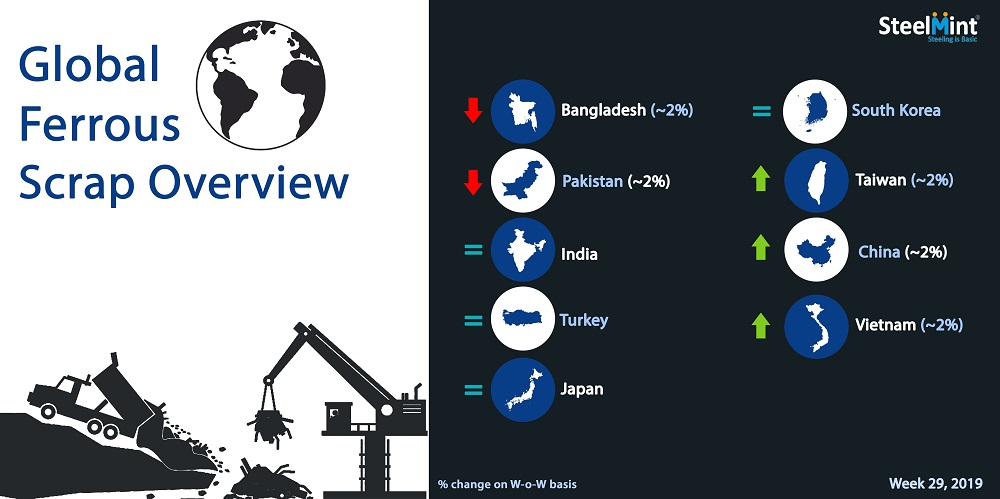

Global Ferrous Scrap Market Overview - Week 29, 2019

Turkey - Turkish steel makers resumed their August shipments at almost stable prices with two Baltic origin deals followed a couple of UK bulk cargoes reported towards the closing of the week. It is expected that more trades can be witnessed next week provided finish steel prices remain supported.

-- SteelMint’s assessment of US and Baltic origin HMS 1&2 (80:20) stands at USD 294-295/MT, CFR Turkey, flat against the last week while European HMS 1&2 assessed at around USD 288-290/MT, CFR Turkey.

-- In a recent deal reported, Marmara based steelmaker booked UK origin cargo comprising 18,000-22,000 MT of HMS 1&2 (80:20) at USD 290/MT, while another Baltic deal concluded comprising 14,000 MT of HMS 1&2 (80:20) at USD 295/MT, CFR, 12,000 MT of Shredded at USD 300/MT and 6,000 MT of Bonus scrap at USD 305/MT, CFR.

Japan - Japanese scrap market seems to have reached the bottom after observing sharp downtrend for the past 3 months, while Tokyo Steel is yet to revise its bid for scrap purchase since last revision on 5th July’19, when its bid for H2 scrap had reached 2 year low, at JPY 26,000/MT delivered to Tahara and Utsunomiya plant. However Japanese scrap suppliers have now raised their offers of H2 above JPY 28,000/MT, FoB.

-- Japanese Iron & Steel Association’s price index has stopped falling for the first time since early April’19 and remained unchanged on a weekly basis, indicating stability in domestic scrap prices.

South Korea - South Korean EAF steelmaker, Dongkuk Steel recently booked 10,000 MT of A3 grade Russian scrap at USD 287/MT, CFR South Korea, down USD 7-8/MT than the previous booking which was signed for USD 294-295/MT, CFR in June’19.

-- Another leading steelmaker, Hyundai Steel was under negotiation with Russian suppliers for 16,000 MT of A3 scrap at around USD 285/MT CFR while it held Japanese H2 purchase bids since 2 weeks at JYP 27,000/MT, FoB Japan. South Korea seems currently diversifying its import sources for short term, watching the Japanese scrap market situation to unfold.

China - Chinese EAF steelmaker Shagang Jiangsu Steel announced a price hike for purchase of domestic steel scrap (all grades) by RMB 60/MT (USD 9) after three weeks, as supply tightened further amid seasonal issues and increased environmental checks by the Government at steel plants.

-- With the said price hike, Shagang Steel is paying RMB 2,760/MT (USD 401) inclusive of 13% VAT for HMS (6-10 mm thickness) delivered to headquarter works in Zhangjiagang north of Shanghai in China, against the last report’s price of RMB 2,700/MT.

Vietnam - Vietnamese scrap importers observed pick up in prices following an increase in end-user demand and prices this week.

-- US west coast origin bulk HMS 1&2 mix scrap offers heard in the range USD 310-315/MT, CFR Vietnam. While Japanese H2 bulk scrap offers were hovering equivalent to USD 295-300/MT, CFR Vietnam. Hong Kong origin HMS 1&2 (50:50) heard negotiated in the range USD 295-297/MT, CFR.

Taiwan - Taiwanese domestic scrap & rebar prices remained flat this week while imported scrap prices marginally increase on improved demand. Imported scrap prices stand in the range USD 280-285/MT, CFR Taiwan for US-origin HMS 1&2 80:20.

-- The leading steelmaker Feng Hsin steel has rolled over its domestic scrap buying prices at TWD 9,000/MT (USD 290) for HMS 80:20 delivered to Taichung plant and Rebar prices at TWD 16,200/MT (USD 522).

India - Indian imported scrap market remained standstill in terms of prices amid very limited trade activities happening while scrap imports remained less viable for steelmakers for almost around months’ time. Ongoing monsoon season production cuts in the secondary sector, along with considerably cheaper domestic scrap and competitive sponge iron prices keep steelmakers away from buying imported scrap.

-- Assessment for containerized Shredded from UK, Europe and USA remained unchanged W-o-W at USD 315-320/MT, CFR Nhava Sheva, few offers heard in the range of USD 310-315/MT, CFR.

-- Offers of HMS 1 scrap from Dubai and South Africa reported at around USD 305-310/MT, CFR Nhava Sheva, while HMS 1&2 (80:20) from other origins and West Africa assessed at around USD 300/MT and USD 290/MT, CFR Nhava Sheva respectively. However, buying interest remained lower at around USD 280-290/MT, CFR.

Pakistan - Imported scrap offers witnessed a sharp decline in the opening of the week on global softening, while buyers continued to actively import in good volumes, however prices inched up by the end of the week on tightening of supply.

-- SteelMint’s assessment for containerized Shredded 211 scrap from US, Europe and UK currently stands at USD 310-315/MT, CFR Qasim, lowering by around USD 8-10/MT against last week, however after several trades concluded at USD 310-312/MT while offers from traders remained mostly at around USD 315/MT, CFR.

-- Dubai origin HMS 1 stands at around USD 305-310/MT, CFR, dropping by USD 5-10/MT w-o-w and UK origin HMS 1&2 assessed at around USD 295/MT, CFR Qasim, while 3% duty on HMS discouraged large quantity buying of imported HMS.

Bangladesh - Decent trades for imported scrap were witnessed as offers moved down on a weekly basis. Few bulk cargo deals for Shredded scrap from USA and Japan were reported earlier in the week for immediate requirement.

-- Assessment for containerized Shredded scrap from UK, Europe and USA stands at USD 328-333/MT CFR Chittagong, marginally down against last week. Containerized HMS was actively traded with HMS 1 of Brazilian and Chile purchased at around 320-325/MT, CFR Chittagong. HMS 1&2 from other origins was offered at around USD 310-315/MT, CFR, and limited deals of P&S scrap concluded at USD 330-335/MT CFR.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook