Indian Steel Market Weekly Snapshot

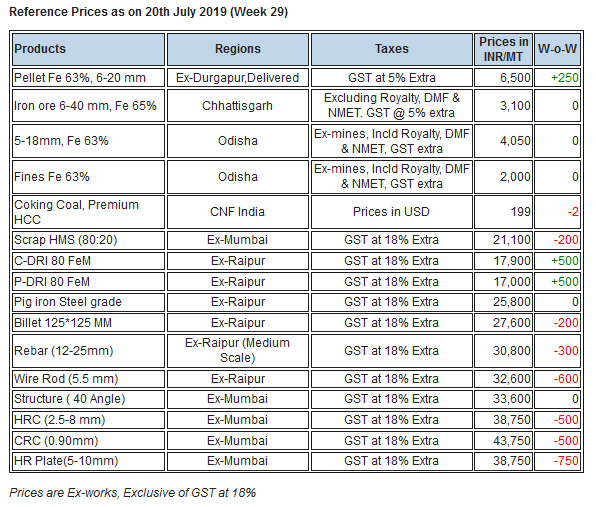

As per SteelMint's assessment, in these days the prices of Semis products - Sponge iron fluctuated by INR 200-500/MT, while Billet prices slump in same proportion.

In line Finished long steel prices dropped by INR 200-500/MT (USD 3-7) through the mid size mills & upto INR 1,000/MT (USD 14) by large scale mills, as per participants.

Also, the Flat steel prices moved down by INR 500-1,000/MT (USD 7-14) through the traders end owing to poor lifting & limited demand.

IRON ORE & PELLETS

Odisha merchant miners kept the prices unchanged for this week. Limited bookings for lump (5-18 mm) were reported at INR 4,000/MT (ex-mines) and bulk bookings for fines were reported. SteelMint's assessment for Odisha stands at INR 4,000/MT (ex-mines) for 5-18 mm and INR 1,900-2,100/MT for fines (Fe 63%).

-- India’s domestic pellet market remained slow witnessing limited trades. SteelMint’s assessment for Durgapur pellets stands at INR 6,500/MT (delivered). Raipur (Central India) based pellet manufacturers offering at INR 6,800-7,000/MT and about 10,000 MT pellets deal was reported at INR 6,800/MT ex-plant.

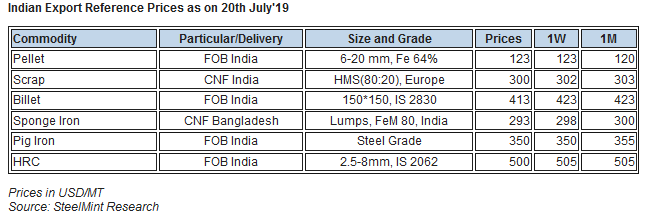

-- Indian pellet export prices remain unchanged for this week for 63.5 Fe (+/-0.5%), 3% Al at USD 121-122/dmt FoB India east coast for August loading. Three pellet export deals reported this week.

-- Goan Govt to auction around 5 MnT Iron ore dumps soon, as per update received by SteelMint. The Honorable Chief Minister Pramod Sawant on Monday (15th July) said e-auction of material lying at jetties and plots will begin in about next 15-20 days.

-- South India (Karnataka) based - NMDC Donimalai Pellet Plant has reduced pellet offers by INR 330/MT to INR 6,500/MT as against last offer at INR 6,830/MT (FoT basis).

COAL

Australian coking coal prices continued plunging this week as fresh bookings were concluded in China but at lower traded price levels. Although Chinese end-users’ demand has reemerged, buying interests in the seaborne metallurgical coal markets elsewhere around the globe has turned increasingly bearish, driven by concerns over a global economic slowdown and its potential impact on steel demand.

-- Indian demand for coking coal from steel mills has also been hurt by falling profit margins on higher prices for iron ore. Latest offers for the Premium HCC grade are assessed at around USD 179.00/MT FOB Australia and USD 195.10/MT CNF India.

SCRAP

Indian imported scrap market remained standstill in terms of prices amid very limited trade activities happening while scrap imports remained less viable for steelmakers for almost around months’ time.

Ongoing monsoon season production cuts in the secondary sector, along with considerably cheaper domestic scrap and competitive sponge iron prices keep steelmakers away from buying imported scrap.

-- Assessment for containerised Shredded from UK, Europe and USA remained unchanged w-o-w at USD 315-320/MT, CFR Nhava Sheva, few offers heard in the range of USD 310-315/MT, CFR.

-- Offers of HMS 1 scrap from Dubai and South Africa reported at around USD 305-310/MT, CFR Nhava Sheva, while HMS 1&2 (80:20) from other origins and West Africa assessed at around USD 300/MT and USD 290/MT, CFR Nhava Sheva, respectively. However, buying interest remained on lower price range at around USD 280-290/MT, CFR.

SEMI FINISHED

Indian Semi finished market observed volatility in prices on subdued demand. Sponge offers fluctuated in the range of INR 200-500/MT (USD 3-7), in which Raipur & Raigarh- Central India registered surge in price range by INR 500/MT, while in remaining markets it inched down, as per assessment.

In context to Billet, offers down by INR 100-500/MT over lessened inquiries from the re-rollers amid seasonal dry construction activities.

-- Indian Sponge iron export offers fell by USD 5/MT this week & assessed at around USD 290-295/MT CFR Chittagong, Bangladesh.

-- Eastern India's mid-sized mills export offers to Nepal down by USD 5-10/MT and stood at around USD 380-385/MT for Billet (100*100 mm, induction grade) & USD 440-445/MT for Wire rod (5.5 mm, commercial grade), ex-mill at Durgapur.

-- On 15th July, power supply resumed by Jindal for Punjipathra, Raigarh based furnaces, which were cut down by 50% since 2nd July, as reported by manufacturers.

-- TATA Metaliks Limited, the largest foundry grade pig iron manufacturer in eastern India has reduced foundry pig iron prices by INR 700/MT (USD 10) to INR 31,000/MT (USD 452) which was earlier trading at INR 31,700/MT (USD 462); ex-plant, Kharagpur, eastern India.

-- SAIL may cancel 16,200 MT billet export tender due to limited participation. The tender was put up for Prime Mild Steel Non-Alloy Concast billets, size 125*125 mm from Durgapur Steel plant. According to market sources, the tender’s material chemistry was distinct from the regular billet tender, which in turn lead to limited participation and hence the company had to cancel the tender.

-- SAIL’s Rourkela Steel Plant (RSP) tender held on 17th July'19 to sell about 6,550 MT steel grade pig iron; had received limited participation & only 17% material have been sold out at the base price of INR 25,360/MT ex-plant.

-- Jindal Steel has maintained offers firm and reported steel grade pig iron at INR 25,500/MT ex-Raigarh & panther shots (granulated pig iron) at INR 24,500/MT ex-Angul, Odisha.

-- According to market sources report to SteelMint, an Indian mill has concluded one bulk export deal of granulated Pig iron to Bangladesh at around USD 340/MT FoB India.

-- Rail Wheel Factory (Formerly Wheel and Axle Plant) is situated in Bangalore, India has invited tender for the purchase of 57,300 MT Bloom. Due date for submitting the offer is 9 Aug’19 till 14:15 hrs.

-- RINL has invited a tender for export of 30,000 MT Billets, 10,000 MT Wire Rod and 30,000 MT Bloom. Interested bidders can submit their bids till 26 July ‘19 at 14:00 hrs.

FINISH LONG

Indian Finish Long Steel producers reported slow trade volumes, hence price range reduced by INR 200-500/MT (USD 3-7) in most of the regions except eastern India where it has drop sharply by INR 700/MT following poor off take.

However prices seems improved in last couple of days on account of rising sponge iron & billet prices, but finish steel yet to improve, as reported by industry sources.

Meanwhile the trade participants assuming that price range won’t get any major change in near term due to strengthening raw materials through the medium/small scale producers.

Further with recent slash offers by large scale mills, the price gap in rebars between the primary & secondary producers moved down by INR 1,000/MT this week and stood at INR 5,800/MT in Hyderabad & INR 7,000/MT in Mumbai.

-- The current trade reference rebars (12 mm) price range of large scale mills stands at INR 38,000-38,500/MT ex-Mumbai (stock yard – retail segment).

-- Central region, Raipur based heavy structure manufacturers have inched up trade discount by INR 100-200/MT to INR 700-800/MT against last week and current trade reference prices at INR 35,900-36,300/MT (200 Angle) ex-work and the price range fall by INR 300-500/MT in most of the regions.

-- Trade discounts in Raipur Wire rod slightly moved up by INR 200/MT this week to INR 1,400-1,600/MT and fresh offers stood at INR 30,800-31,600/MT ex-Durgapur & INR 31,800-32,600/MT ex-Raipur, size 5.5 mm.

FLAT STEEL

SteelMint in conversation with trade participants learned that domestic HRC prices continued to slump further over gloomy demand and limited trades happening in domestic market. Domestic HRC prices are hovering at around 1.5 years low.

On weekly basis domestic HRC prices fell further by INR 500-1,000/MT w-o-w in traders market. As per SteelMint price assessment for HRC (IS2062, 2.5-8 mm) is currently at INR 38,500-39,000/MT ex-Mumbai, INR 38,500-38,800/MT ex-Delhi and INR 39,500-40,500/MT ex-Chennai.

Meanwhile CRC (0.9 mm, IS 513) prices also fell by INR 500-700/MT and are at around INR 43,500-44,000/MT ex-Mumbai,INR 42,000-44,000/MT ex-Delhi and INR 44,000-45,000/MT ex-Chennai.Prices mentioned above are basic and extra GST@ 18% will be applicable.

Also poor sales from auto sector and slowdown in construction and infrastructure activities amid ongoing rainy season will continue to keep domestic HRC prices under pressure.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI