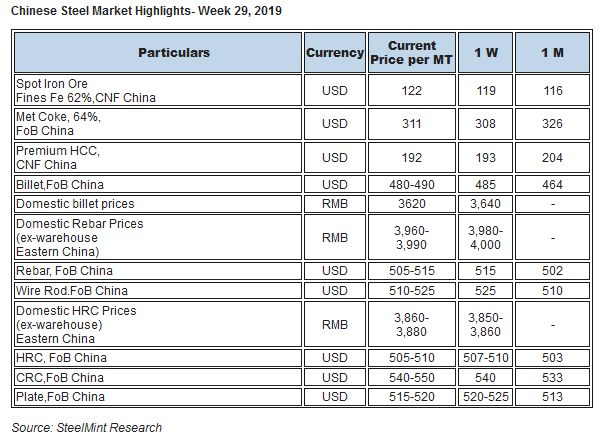

Chinese Steel Market Highlights- Week 29, 2019

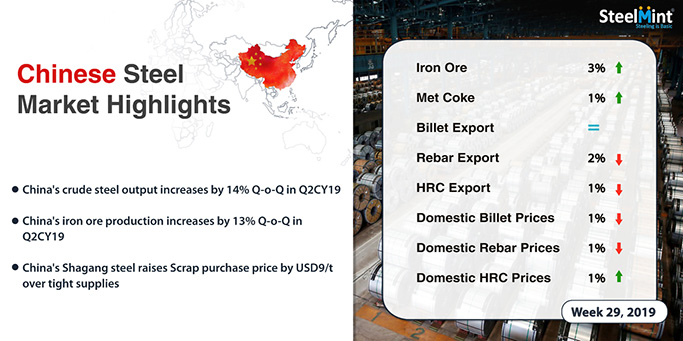

Nation’s HRC and Rebar export offers inch down this week. Coking coal offers witnessed further decline over weak buying interest from steel mills in China. Meanwhile billet export offers remained largely stable on weekly basis. However iron ore prices continued to remain on upside over restricted supply.

According to the data reported by NBS (National Bureau of Statistics), China’s crude Iron Ore production surged by 13% in Q2CY19 at 212.4 MnT, as against 188.32 MnT in Q1CY'19. Hike in iron ore prices in both global and overseas market, led the miners to ramp-up their production during the quarter.

Also, Chinese crude steel output reported surge by 14% on quarterly basis to 261.65 MnT in Q2CY19 which was 229.91 MnT in previous quarter of similar year.

Meanwhile, China's Shagang steel raises scrap purchase price by USD 9/t over tight supplies. The new rounds of inspection by the Chinese government at major steel works to ensure environmental protection and the hot summer weather has kept Chinese domestic scrap availability very limited which in turn may increase local scarp prices in nation’s domestic market.

Chinese spot iron ore prices continued to remain upside- Chinese spot iron ore prices opened up this week at USD 121.4/MT, picked up to USD 121.85/MT towards weekend. As per data compiled by SteelHome consultancy, Iron ore inventory at major Chinese ports increased to 118.35 MnT as compared to 115.35 MnT a week ago.

Spot pellet premium moves down further W-o-W- Spot pellet premium for Fe 65% grade pellets assessed at USD 21.95/MT, CFR China during the week as compared to USD 22.90/MT, CFR China a week before.

Pellet inventory at major Chinese ports witnessed at 5 MnT compared with 4.9 MnT last week. The production curb in Tangshan extended till Oct’19 shall continue to support preference for pellets along with anticipation of price hike.

Further, pellet demand in southern China was stronger during the week due to limited domestic availability.

Spot lump premium fell W-o-W basis- Spot lump premium dropped to USD 0.2402/DMTU as against USD 0.3650/DMTU assessed last week.

The preference for lump continues to be on lower side amid unreasonably high prices. Also, rainfall in central China towards last week, rendered lumps nonviable to be used directly in blast furnace.

Coking coal offers decline further- Seaborne premium low-volatile hard coking coal prices continued to show downtrend amid slowdown in buying activities from China.

Meanwhile demand from Indian buyers also remained sluggish over weakening steel prices. Thus Indian steelmakers are struggling with higher raw material cost and lower profit margins which in turn resulted to lower buying of coking coal from Australia.

On weekly basis seaborne coking coal prices fell by USD 5/MT. Latest offers for the Premium HCC grade are assessed at around USD 179/MT FoB Australia which was 184.00/MT FoB Australia in preceding week.

China domestic billet prices witness a drop W-o-W- This week Chinese domestic billet prices settled at RMB 3,620/MT, down RMB 20 against last week. This week, billet trade sentiments in China were reported weak.

Chinese HRC export offers move down further- Chinese HRC export offers continue to show downturn this week owing to thin trades happening in export market. Overseas buyers are unwilling to purchase material at higher prices and are bidding on lower side with the anticipation of further decline in prices.

Currently nation’s HRC export offers on W-o-W basis stands at USD 505-510/MT FoB basis against USD 507-510/MTMT FoB basis in preceding week.

On weekly basis domestic HRC prices in China stood at RMB 3,860-3,880/MT in eastern China (Shanghai) this week up by RMB 10-20/MT which was RMB 3,850-3,860/MT in eastern China (Shanghai) in previous week.

Increased inventory levels of HRC among steel mills in China resulted to bearish sentiments and weak buying both in domestic and overseas market.

Meanwhile few steel mills in China believed that steel prices will rebound shortly amid stringent production cuts in Tangshan region coupled with iron ore prices which continued to remain on higher side.

Chinese rebar export offers edges down further- This week nation’s rebar export offers fell further over increased inventory levels among Chinese steelmakers. Since, overseas buyers are reluctant to purchase in the expectation of further decline in prices over volatile futures.

Currently nation’s rebar export offers registered at USD 505-515/MT FoB China inched down by USD 5-10/MT against previous week. Last week the offers were at USD 515-520/MT FoB basis.

Meanwhile domestic rebar prices stood at RMB 3,960-3,990/MT (Eastern China) which was RMB 3,980-4,000/MT (Eastern China) in last week.

However recent production cuts announcement in Tangshan region may keep prices firm since Chinese steelmakers refrain themselves for reducing prices further as it will hurt their profit margins.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook