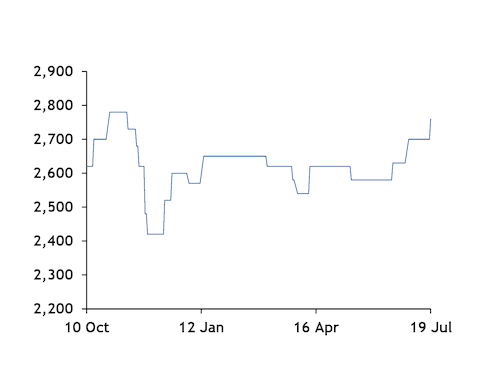

China’s ferrous scrap prices rise to 2019 highs

Regional scrap prices have been on the increase in the first half of July on higher demand and tight supplies, market participants said. Steel producer Jiangsu Shagang in east China raised its heavy melt scrap price by 60 yuan/t ($9/t) to Yn2,760/t ($403/t) on 19 July. This is for heavy melt No.3 grade scrap delivered to its mill in Zhangjiagang, north of Shanghai. The price is up by 7pc since early June and the highest level since November 2018.

Rising costs for competing feedstocks iron ore and metallurgical coke have encouraged use of scrap.

Around 80pc of China's roughly 100 EAF mills were operating last week, with the average mill utilisation rate at around 70pc, both at 2019 highs, participants said citing third-party estimates.

EAF mills are producing steel with gross margins of around Yn100/t so utilisation rates will be maintained at higher levels in the short term, supporting scrap demand, participants said.

The higher demand and drop in supplies has sent scrap inventories at processing plants to low levels, participants said. The main reasons for reduced supplies have been high temperatures and rainy weather reducing scrap collection and transportation, along with increased environmental protection policies deterring demolition of buildings and vessels that generate scrap.

China is not a significant importer of scrap steel, but the shift away from imports has been a contributor. The country's ferrous scrap imports fell by 84pc to 120,000t during January-May this year. The trend is expected to continue as China reclassified certain categories of scrap steel as restricted raw materials from 1 July.

Higher scrap prices also raise costs for blast furnace-based mills that use 10-20pc scrap in basic oxygen furnaces (BOFs). Iron ore has been the main cost increase for BOFs. The Argus ICX 62pc iron ore fines price has risen by 62pc to $121.40/dry metric tonne cfr Qingdao this year. The Argus ferrous feed unit cost for a Chinese BOF with 15pc scrap charge has risen by 21.5pc to $323.24 per tonne of steel from 1 January to 19 July.

Shagang posted heavy melt No.3 grade scrap price $/t

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

SQM boosts lithium supply plans as prices flick higher

Nevada army depot to serve as base for first US strategic minerals stockpile

Pan American locks in $2.1B takeover of MAG Silver

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook