South Korean Steel Mills Book Russian Scrap

Another leading Steelmaker, Hyundai Steel was heard to be under negotiation with Russian suppliers for 16,000 MT of A3 grade scrap at around USD 285/MT CFR, however the confirmation on the same is yet to be received from company officials.

Japanese scrap prices likely to rise on tight supply - With Japanese scrap market looking to have reached the bottom after observing sharp downtrend for the past 3 months, inquiries for Russian and US scrap are picking up by South Korean steelmakers, who are to diversify their scrap import sources and trying to hold Japanese scrap prices from recovering sharply in the short term.

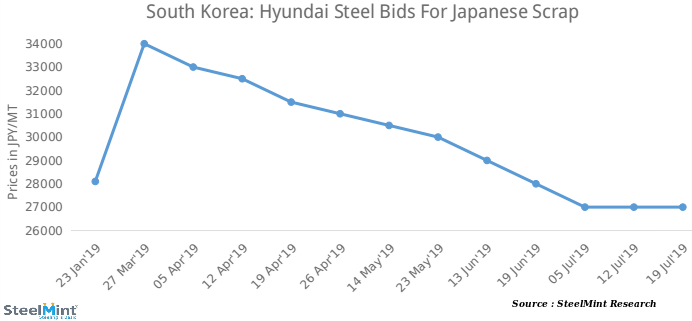

Notably, Hyundai Steel has not revised its bid for Japanese scrap since 5th July, when it had lowered its bid for H2 scrap to JYP 27,000/MT (USD 251), FoB Japan, while suppliers from Japan have raised their offers for H2 to above JPY 28,000/MT, FoB level, finding resistance from the South Korean buyers as buying interest remains low.

It is reported that with Japan’s bulk export price of H2 scrap to Vietnam currently standing in the range JPY 29,000-30,000/MT (USD 270-279) FoB, the Japanese suppliers expect that offers to South Korea and Vietnam should be higher, which will in turn help the domestic market, however with South Korean buyers holding their bids for now, the likelihood of a buyer-seller standoff is high in the coming days.

Meanwhile, Japanese domestic price indexes have stopped falling for the first time since early April’19 as Japan lron & Steel Association’s index remained unchanged on a weekly basis, indicating stability in domestic scrap prices.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook