India: Ferro Chrome Industry under Constant Stress; Production Levels Reduced

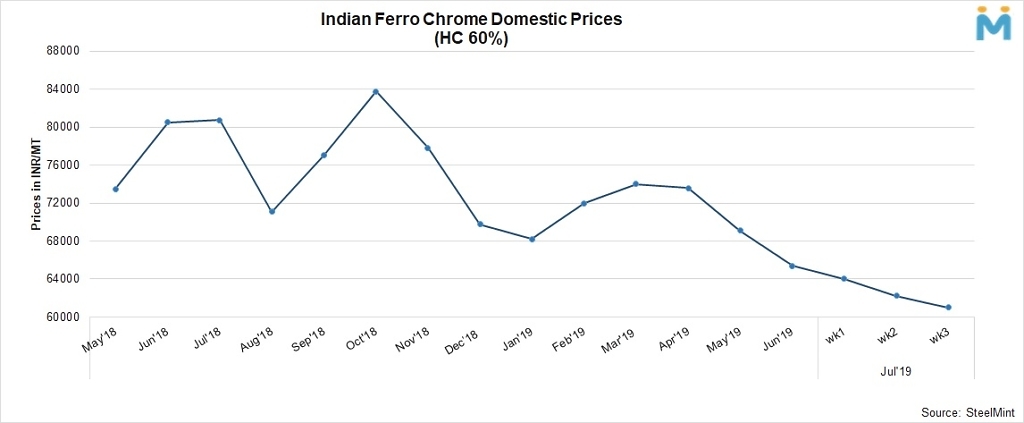

Many market participants believe that after the recent Chrome Ore Auctions, the Cost Price would still hit as high as INR 64,000-65,000/MT but as per the present scenario, the selling price is at around INR 61,000/MT, which would force many producers to reduce their production of Ferro Chrome to limit losses. Effects of such situation were seen in the OMC Chrome Ore Auctions where about 6,969 MT of Chrome Ore remained unsold, out of the total offered quantity of 37,455 MT.

A senior official from Tata Steel revealed to SteelMint, "We have decided to limit our domestic Ferro Chrome allocation to 7,000-8,000 MT for the month of August and focus more on exports." He further highlighted that few sellers are getting increasingly aggressive to conclude deals and stated the only way to control the free fall of Ferro Chrome prices is by a significant reduction in the supply of the commodity.

Mismatch of demand and supply is the major cause for fall in prices. Many Ferro Chrome producers have reduced production levels by around 30%, to save themselves from major losses. Domestic Prices for Ferro Chrome in India is assessed at INR 61,000/MT Ex-Jajpur. However, a few deals were heard to be concluded at even much lower levels, indicative of the fact that the mainstream Ferro Chrome prices could yet come down further. Export offers however remains unchanged due to lack of inquiries. Offers for CNF South Korea (10-50mm, HC 60%) is at around 72 cents/lb, CNF Japan (10-50mm, HC 60%) is at 73 cents/lb and for CNF China the prices are at around 69 cents/lb.

On the future Outlook, the Ferro Chrome prices are likely to continue at such levels due to lack of demand. Such a scenario is attributed to Supply-Demand dynamics. Market participants believe that the prices may go down further in August if there is not a significant resurgence in demand from China.

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

UBS lifts 2026 gold forecasts on US macro risks

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Afghanistan says China seeks its participation in Belt and Road Initiative

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery