Dubai Confab to Examine Iranian Steel Market

The conference has been hosted by the Ukraine-based steel market analysis firm, Metal Expert, in collaboration with Iranian Mines and Mining Industries Development and Renovation Organization and Iron Ore Producers, and Exporters Association of Iran.

In addition to representatives of IMIDRO and IROPEX, a host of Iranian steelmaking companies are expected to attend the conference, including Khuzestan Steel Co., Esfahan Steel Co., Kish South Kaveh Steel Co., Arfa Iron and Steel Co. and Sepahan Industrial Steel Co., in addition to Iran’s giant mining holding, Middle East Mines and Mineral Industries Development Holding Company.

International companies scheduled to attend the event include Turkey’s Diler Holding, Asil Celik, and Acemar; Oman’s Al-Jazeera Steel, Jindal Shadeed Iron and Steel, and Dhofar Steel; UAE’s Al Ghurair Iron and Steel, MN Gulf Group, CGT Middle East, Jadeed Al-Hadeed International, and MetalOne.

Keynote speakers at the conference include Mohammad Taheri, international affairs advisor of IMIDRO; Nematollah Mohseni, senior advisor on marketing and sales of Esfahan Steel Company; Keyvan Jafari Tehran, the head of international affairs of IROPEX; Asadollah Farshad, managing director of IGISCO; Iraj Salehi, chairman of the board of directors at Barsoo Company; Abu Bucker Husain, CEO of UAE’s Al Ghurair Iron & Steel LLC; Xinchuang Li, president of China Metallurgical Industry Planning and Research Institute; and Alagramam Nagarajan Venkataraghavan, CEO of Oman’s Al Jazeera Steel.

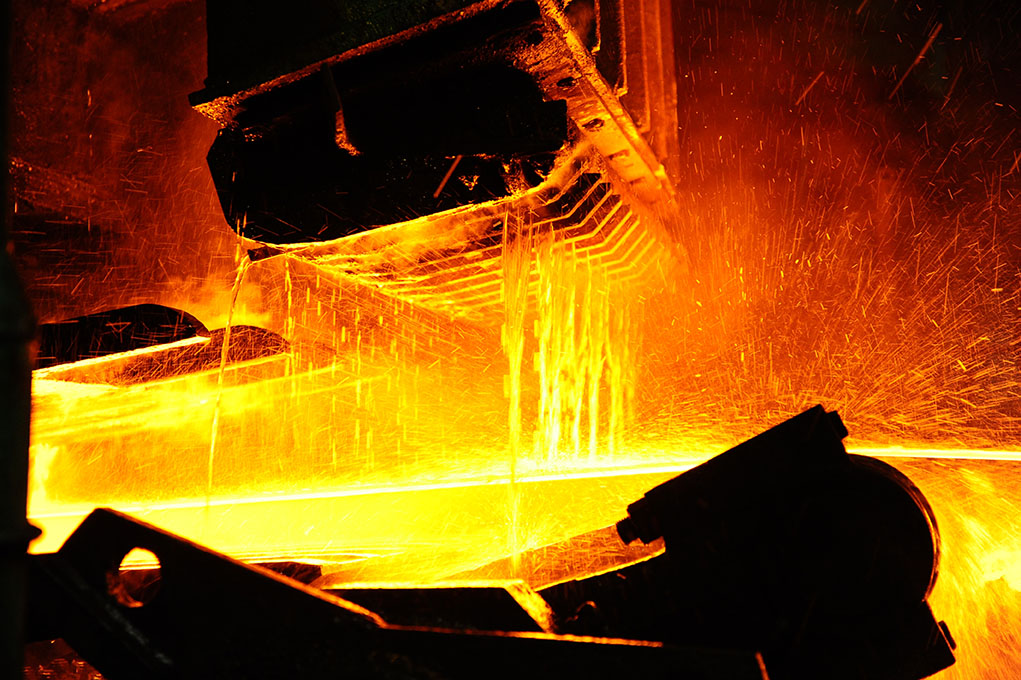

According to the brochure published by Metal Expert on the conference, Iran’s steel industry tops the global steel market’s agenda following the lifting of nuclear sanctions and the country’s energy and production cost advantages.

Iran’s steel exports are expected to rise by more than 30% this year, mainly in billets. Moreover, the country’s role as a reliable supplier of billet is expected to increase further after China cancelled a number of contracts in the first quarter of the year.

According to Business Monitor International, a boom in Iran’s infrastructure sector will invigorate domestic demand for steel and iron ore over BMI’s forecast period to 2024. The group forecast the country’s construction industry value to rise from $20.7 billion in 2015 to $41.8 billion in 2024. This represents a solid annual growth average of 2.9% up to 2024.

The Metal Expert booklet also notes that Iran and the Commonwealth of Independent States enjoy the lowest cost in the Middle East and North Africa region.

However, the outlook for development of Iranian state-controlled iron and steel sector will depend on how fast it will be able to meet its objectives in attracting foreign investment and acquiring modern production technologies.

Iran aims to become the world’s sixth largest steel producer as per its 20-Year National Vision Plan (2005-25), which stipulates the production of 55 million tons of crude steel per year.

Experts believe that for the ambitious target to materialize, the domestic industry is required to export close to 20 million tons of the production figure every year.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook