Indian Iron Ore Export Volumes More Than Double in Q1 FY20

On monthly basis, iron ore export stood at 1.80 MnT in the month of June’19 as compared to 2 MnT in May’19.

Why Indian iron ore export volumes increase in Q1 FY20?

1. Increased Chinese demand amid global supply crisis:

Chinese procurement of raw material from India picked up amid rising global supply constraints caused due to Vale mishap and Australian cyclone. Also, Australian major miner, Rio Tinto in June’19 announced drop in its iron ore Pilbara shipments guidance due to mine operational challenges at the company’s Greater Brockman hub. Rio Tinto 2019 Pilbara iron ore shipment guidance is reduced to 320-330 MnT as against 333-343 MnT previously.

2. High global prices:

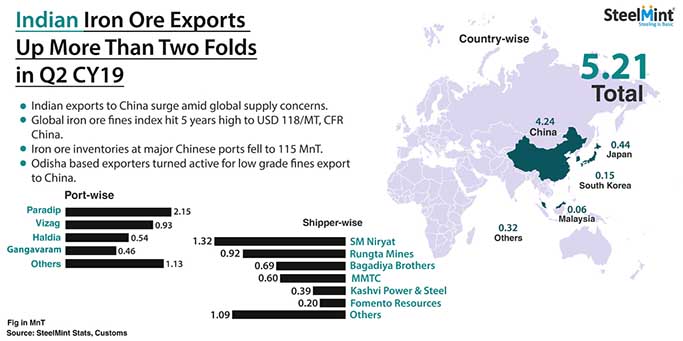

The spot iron ore fines (Fe 62%) index price increased for the quarter and recorded at USD 118/MT, CFR China towards June’19 end, hovering five years high amid material shortage . The monthly average spot iron ore prices for Q1 FY20 witnessed at USD 100/MT as against USD 82/MT in previous quarter. This led to high realization in exports market during the quarter.

3. Fall in iron ore inventory at Chinese Ports:

As per data compiled by SteelHome consultancy, Iron ore inventory at major Chinese ports dropped to 115.25 MnT towards June’19 end as against 147.6 MnT towards end of 1st quarter CY19. The inventory has fallen to lowest levels since around 2017. Amid low stock in China, mills continue buying expensive material to continue full-load operation.

4. Narrowing discounts of low-grade ore

Fortescue Metals Group - world's 4th largest iron ore producer has reduced iron ore discount for SSF (super special fines) fines for the month of Jul’19 to 7% from 11% in Jun’19. Discount from the miner has dropped sharply from as high as 42% in Oct-Nov'18 to 33% in Feb'19, 16% in Mar'19,13% in Apr'19 and 11% in May'19. Also, SteelMint's assessment for low grade (Fe 57/58%) iron ore fines prices during the quarter recorded as high as USD 87/MT, CFR China.

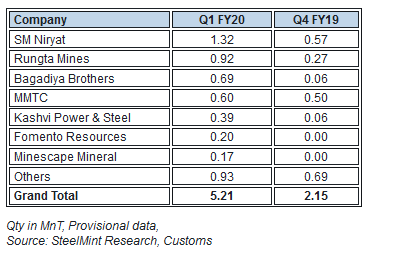

SM Niryat turned out to be India's largest iron ore exporter

SM Niryat stood largest iron ore exporter in Q1 FY20 at 1.32 MnT, up significantly as against 0.57 MnT in Q4 FY19. Rungta mines stood second largest and its exports increased more than three folds on quarterly basis to 0.92 MnT. MMTC exports picked up 19% to 0.60 MnT.

India iron ore exports to China increased amid rising demand

China continued to be the largest importer of Indian iron ore for the quarter at 4.24 MnT, up sharply against 1.54 MnT in previous quarter. Japan stood second largest importer at 0.44 MnT followed by South Korea at 0.15 MnT.

Exports from Paradip port up sharply in Q1 FY20

In Q1 FY20, Paradip port stood the largest exporter of Indian iron ore at 2.15 MnT, up as compared to 0.95 MnT in previous. Vizag port stood second largest at 0.93 MnT, followed by Haldia at 0.54 MnT and Gangavaram at 0.46 MnT.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI