Base metals performance to slow in short term, Moody’s predicts

According to the report, Moody’s Investor Service says performance will weaken due to continued trade tensions between the US and China, NAFTA uncertainty between the US, Mexico and Canada and general global economic slowdown.

Over the next year, Moody’s predicts prices will remain below 2018 levels while rising costs will put price margins under pressure.

Lead considerations for the industry’s future performance are replenishing resources and keeping capital spending down.

“Exploration and development expenditures have increased following several years of decline, as companies focus on restoring their finances,” the financial services company states.

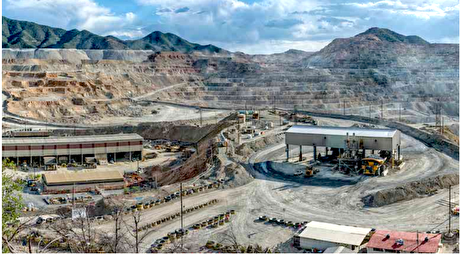

“Given the depleting nature of the industry and years necessary for a new greenfield mine to reach production, the development of new mine supply for copper, nickel and zinc remains necessary. The announced rollout of battery electric vehicles creates significant new demand over time,” Moody’s adds.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Chile’s 2025 vote puts mining sector’s future on the line

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming