Poor Steel Demand, Rising Raw Material Costs Pinch Indian GE Producers Hard

As per information that various sources have shared with SteelMint, prices of UHP grade GEs have registered a plunge of INR 100,000 – 150,000 (USD 1,500- 2,100/MT) against last month and the price of electrodes of size 600-650mm are in the range of INR 550,000-500,000/MT (USD 7,900 – 7,100/MT), whereas that of 450mm are heard to be in the range of INR 225,000-250,000/MT (USD 3,200 – 3,500/MT).

Domestic GE manufacturers who used to have only 10-12 days’ inventory are currently sitting on a stock of about 1-2 months as steel mills are delaying procurements in the hope of a further fall in prices. On the other hand, GE manufacturers are already dealing with the pressure of rising raw materials, aka needle coke (NC) costs. The contracts for petroleum-based needle coke for the second half of 2019 have been settled at USD 4,000-4,500/MT. Now, if GE prices fall further it is likely that electrode producers’ margins may see a sharp fall in the coming months.

Key Reasons for Price Plunge

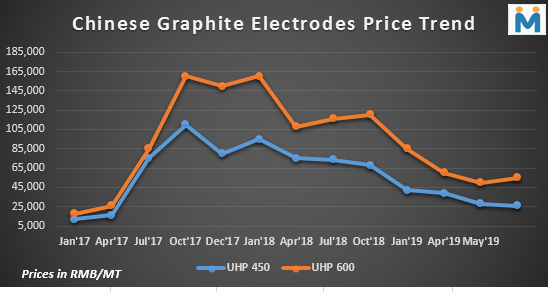

The positive sentiments in India’s electrodes market turned negative when GE prices in China started plunging towards the end of 2018 amid sluggish domestic downstream demand and increase in electrode supplies. When GE prices had surged two years back due to supply-side structural changes in the Chinese market, which led to the closure of polluting GE units and subsequent supply shortag e, many Chinese GE companies invested either in capacity expansion or building new manufacturing facilities. Over a span of two years, sufficient electrode supply eased concerns in the domestic market, subsequently impacting both domestic and global GE prices.

With India lifting anti-dumping duties on electrode imports from China in August last year, Chinese GE started entering India unrestricted. As per customs data, India’s electrode imports in the first three months of 2019 have registered an increase of 53% on a Y-o-Y basis. Although the majority of imports in India are that of non-UHP grade electrodes, still there is a fear in the market that if Indian manufacturers do not lower their UHP grade prices, they may face tough competition from their Chinese counterparts in this segment too.

This apart, GE prices are also plunging due to the fact that steel demand across the globe has turned sluggish over the past few months as a result of the unrelenting trade war between the U.S. and China and rising protectionist measures adopted by the key EAF-dominated countries such as U.S., Turkey and Iran. In fact, in case of Iran which was one of the key export destinations, Indian electrode manufacturers are not supplying to the country due to U.S. sanctions imposed on Iran last year. This, combined with tepid steel demand in various other countries, has compelled Indian GE producers to lower electrode prices and maintain high inventories.

Will Global GE Prices Bounce Back?

So, will global GE prices bounce back and can Indian exporters hope for better days ahead? To keep track of the subtle changes in the global GE market make sure you attend the 2nd Global Graphite Electrode Conference to be organized by SteelMint Events from 27-29 August, 2019 in Thailand.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook