Indian Steel Market Weekly Snapshot

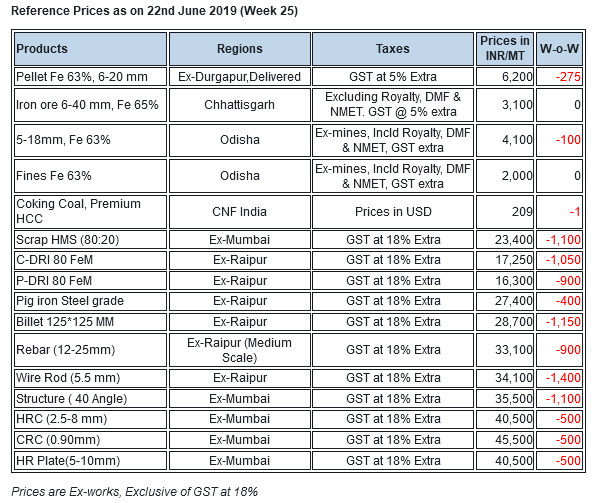

This week the prices fall by INR 500-1,800/MT ( USD 7-26), in which Semis prices tumbled by INR 800-1,200/MT, Finished long steel by INR 1,000-1500/MT & Flat steel by INR 500-1,000/MT(USD 7-14).

IRON ORE & PELLETS

Odisha based merchant miners have kept iron ore prices unchanged for this week, however they continue offer discounts. SteelMint's current Odisha iron ore prices assessment for 5-18 mm lump (Fe 63%) is around at INR 4,000-4,300/MT and fines (Fe 63%) at INR 1,900-2,100/MT (ex-mines, including Royalty, DMF & NMET) for bulk bookings. The prices quoted are for 100,000 MT booking.

-- India’s domestic pellet price plunge over low demand amid weak sponge prices. SteelMint's Raipur pellet assessment stands INR 6,500-6,700/MT ex-plant. One deal reported for 5,000-10,000 MT pellets at INR 6,500/MT (ex-plant) few days back. In Durgapur (eastern India) SteelMint’s reference pellet price assessment stands at INR 6,200-6,300/MT (delivered) down sharply by INR 400-500/MT against INR 6,600-6,700/MT in the beginning of last week.

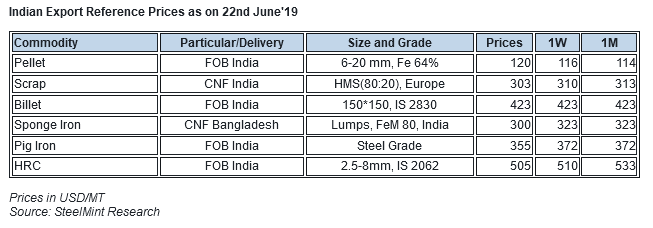

-- Godawari Power & Ispat recently this week concluded pellet export deal to China for 50,000 MT iron ore pellets (Fe 64%, less than 2% Al) at around USD 133-134/MT, CFR China (equivalent to USD 123-124/MT, FoB India). Jindal Steel & Power also concluded for regular grade pellets (Fe 64%, containing 3% alumina) at USD 130-131/MT, CFR China.

COAL

Australian premium low-volatile hard coking coal prices continued their divergence in different directions this week, as Chinese delivered prices witnessed a USD 3/MT day-on-day fall, with new deals concluded at lower levels.

Chinese upstream demand for coking coal is likely to be particularly sluggish in the upcoming summer season, with steel companies’ profitability set to deteriorate going forward owing to reduced construction activity. Elsewhere, falling global steel prices are weakening seaborne coking coal demand from major steel-producing nations like Japan, South-Korea and the European Union.

-- Indian spot demand for July-August-loading cargoes of imported coking coal has now moderated, due to the approaching monsoon season. Latest offers for the Premium HCC grade are assessed at around USD 197/MT FOB Australia and USD 209.15/MT CNF India.

SCRAP

-- Indian imported scrap prices continued weakening for fourth consecutive week on minor trades amid market uncertainty. Weak domestic fundamentals continue to put pressure on scrap buying prices for both imported and domestic scrap. Notably, imported scrap offers reach the lowest levels so far this year. However, global prices unlikely to drop further.

-- SteelMint’s assessment for containerised Shredded from Europe, UK and US stand in the range USD 310-315/MT, CFR Nhava Sheva with limited trades being reported in this range. Few leading Shredded suppliers were offering in the range USD 315-320/MT, CFR.

-- Buying interest for HMS 1&2 scrap lowered to significantly low level amid which no major deals reported this week. HMS 1&2 from Europe and UK assessed in the range USD 295-300/MT, CFR. Not much offers were available for West African containerised HMS while South African HMS 1&2 assessed at around USD 315/MT, CFR.

SEMI FINISHED

Indian billet trades slow-down this week as prices slump by INR 500-1,800/MT amid poor off take of finished goods. In these period major fall of INR 1,400-1,800/MT in billet seen in Rourkela & Raipur.

Similarly, Sponge iron offers dropped by INR 800-1,200/MT W-o-W following significant fall in Billet prices & strong supply. Amid sharp fall in price range, selling pressure being mounts with the sponge producers along with low margins.

-- Indian induction grade Billet (100*100 mm size) export offers to Nepal are reported at USD 410/MT & Wire rod at USD 480-485/MT, ex-mill at Durgapur. These offers drop by USD 15-20/MT, W-o-W.

-- Indian sponge iron export offers are currently trending 2 years low as it drop further by USD 10-15/MT (W-o-W) to USD 285-290/MT CPT Benapole (dry port of India & Bangladesh), equivalent to USD 300-305/MT CNF Chittagong, Bangladesh.

-- SAIL has floated export tender for prime mild steel non-alloy concast blooms of 10,800-13,500 MT. The last date for bid submission is 19 Jun’19 and bid validity is till 24th Jun'19.

-- RINL has concluded the billet export tender for 20,000 MT (150*150 mm) at around USD 435/MT, FoB India, whose last date for bid submission was 11th Jun’19- Sources.

-- State-run Vizag Steel also known as Rashtriya Ispat Nigam Ltd (RINL) has concluded a single lot of 2,709 MT (1 rake) Billet export tender to Nepal at around USD 435/MT ex-mill. The company has also concluded Wire rod (5.5 mm) export tender at around USD 515/MT for 5,418 MT (equivalent to 2 rakes) on ex-mill basis.

-- RINL has issued an export tender of 21,000 MT basic grade steel making Pig iron for any country other than Nepal. The due date for submission of bids is 27th Jun’19 and bids validity is till 4th Jul'19.

-- SAIL has schedule a auction to sale of about 3,800 MT basic grade Pig iron on 24th Jun'19 from its Rourkela Steel Plant (RSP).

-- MMTC has floated export tender of 30,000 MT non-alloy Pig Iron on behalf of NINL. The due date for submission of bids is 2nd Jul’19.

-- Jindal Steel is offering steel grade pig iron at INR 27,300-27,500/MT & panther shots (granulated pig iron) at INR 26,000-26,200/MT ex-Angul, Odisha.

FINISH LONG STEEL

Indian Finish long steel market notified with measured demand and trade volumes remain less than average across regions which led to slump in price range by around INR 1,000-1,500/MT (TMT/Structure).

Meanwhile trade participants are assuming that rebar price range might get sustain at current levels or minor fall may observed in coming days due to liquidity issue which delayed payment cycle among trade associates along with slow down construction activities.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 33,000-33,200/MT Ex-Raipur & INR 34,500-34,700/MT Ex-Jalna; basic & excluding 18% GST.

In addition, the State owned large mills have being poised with low demand and reduced the finish long prices by around INR 1,000-2,000/MT in past week and current rebar (12 mm) trade reference price registered at around INR 39,600-40,000/MT Ex-Chennai (Stock Yard) & price range for Structure (Channel 125) assessed at INR 40,400/MT Ex-Mumbai (Stock Yard).

-- Central region, Raipur based heavy structure manufacturers have raised trade discount by INR 100-200/MT to INR 800-1,000/MT against last week and current trade reference prices at INR 37,100-37,400/MT (200 Angle) ex-work.

-- Trade discounts in Raipur Wire rod firm this week at INR 1,300-1,500/MT. However, basic prices reduced by INR 1,200-1,400/MT and fresh offers stood at INR 34,800/MT ex-Durgapur & INR 33,300-34,100/MT ex-Raipur, size 5.5 mm.

FLAT STEEL

Domestic HRC prices in traders market have come down by INR 500-1,000/MT against last week and are hovering at almost 4-months low. This week Indian HRC prices witness significant downturn amid bearish market sentiments along with competitive cost of imports and sluggish demand prevailing in domestic market.

On weekly basis domestic HRC prices declined by INR 500-1000/MT in traders market. Currently HRC (2.5-8 mm, IS2062) prices in traders market is around INR 40,000-40,500/MT ex-Mumbai, INR 40,500/MT ex-Delhi and INR 43,000/MT ex-Chennai. The CRC (0.9 mm, IS 513) prices in traders market is around INR 45,000-45,500/MT ex-Mumbai, INR 45,000-46,000/MT ex-Delhi and INR 47,000-48,000/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Thus global downtrend in prices from major exporting nations like China, Japan and South Korea result to surge in HRC import volumes to India.

However increased prices by major steel mills in the beginning of the month by INR 750-1,000/MT doesn’t seems to be absorbed in market. Also lacklustre demand from construction and auto sector and arrival of monsoon season will keep domestic HRC prices under pressure in upcoming month.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI