China: Chrome Market Affected Due To Oversupply And Increased Imports

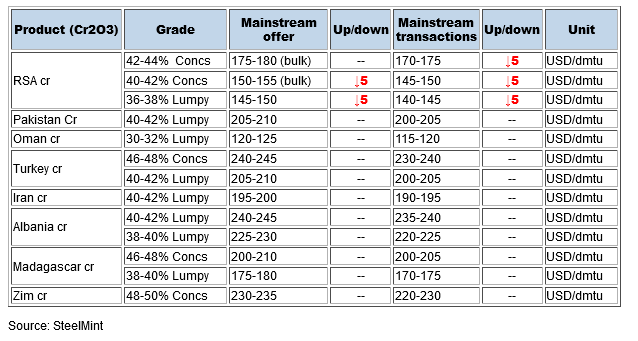

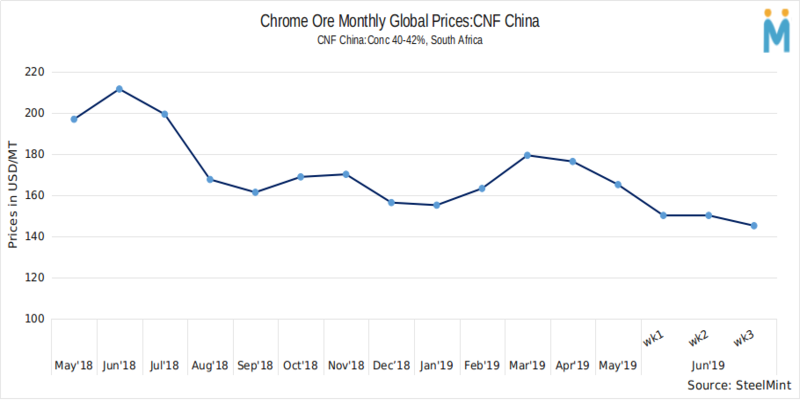

At present, in the chrome ore spot market, traders showed reluctance to sell and showed little interest in booking future cargoes. The major reason for such reluctant sales is the low prices of chrome ore as the downstream demand continues to be weak. For example, 42% of South African concentrates has downturned by RMB5.5/MT in the second quarter, reflecting the enthusiasm for spot purchase from the alloy factories. Therefore, some traders, to a certain extent, have given up the idea of negotiation to seek deals.

The root cause for hesitancy among traders is that the domestic market has not shown signs of rebound for later development, making a judgment on the market difficult and the market may be in the low tide for some time to come. On the other hand, overseas suppliers have chosen to pressure offers downwards, leaving no room for importers to wiggle around, which is manifested by the inverse price structure of overseas offers and domestic prices, plunging traders into a helpless state.

The downstream HC Ferro Chrome market is governed by many bearish factors like the alloy manufacturers receiving fewer inquiries; the market transactions are dull owing to tepid demand. In order to facilitate the transaction, offering discounts is unavoidable. HC Ferro Chrome imports have increased substantially, and therefore, the domestic Ferro Chrome plants are facing “double attack”, by weak domestic market and competition of imported low-cost resources from India and similar exporting countries. Major producing areas have changed their operation mode, as the large-scale factories are mainly focusing on futures purchases whereas; small and medium-sized alloy factories are focusing on spot purchases. Small and medium-sized industries mostly make procurement based on the actual demand and therefore, will not build up inventory when market sentiments are bearish. Thus, multiple factors at play have led to reduced transactions and weak price of spot chrome ore and Ferro Chrome.

At the same time, stainless steel entered the low season of consumption, where transactions enthusiasm is low. Sino-US trade war poses a bearish outlook towards export, and domestic stainless steel mills gradually resorted to plant maintenance under the sluggish macro economics. The problem of oversupply of Ferro Chrome is still severe, resulting in subdued sales in the end market. The dynamics between supply and demand is forever an important factor affecting alloy prices.

On the future outlook, the market performance of Chrome Ore is mainly negative, and there is no other apparent stimulating news, except for the high operating rate of alloy plants. However, the higher operating rate is also a “double-edged sword”. The obvious oversupply made it difficult to improve the supply and demand pattern in a short period of time. Therefore, most market participants are pessimistic about the mill tender prices of next month. Affected by an insufficient prop from downstream, the chrome ore price in the short term is believed to keep in low profile. However, given that the prices have already tumbled to a relatively lower point, scope for the further decline is limited.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook