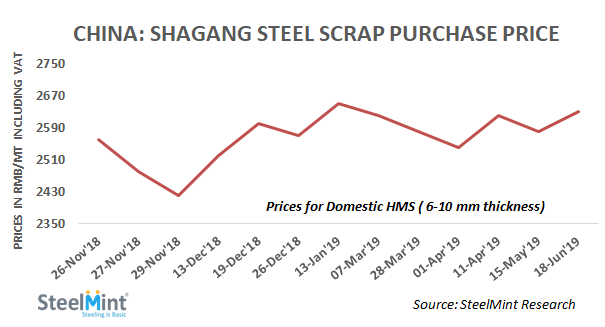

China: Shagang Steel to Raise Scrap Purchase Price Amid Tight Availability

Notably, this price revision for domestic scrap purchase comes after almost a gap of one month against the previous price cut made on 15th May’19. The specific prices shall be based on the price of 2019-F9.

Chinese steel scrap prices remain supported amid tight availability. The continuing high prices of imported iron ore are leading some blast furnace (BF) steel mills to prefer to increase their use of ferrous scrap in the steelmaking process. The rising demand for scrap from the steelmakers’ side could have resulted in a price rebound in the domestic steel market.

With recent price hike, Shagang Steel will pay RMB 2,630/MT (USD 380) inclusive of 13% VAT for HMS (6-10 mm thickness) delivered to headquarter works situated in Zhangjiagang north of Shanghai in China, up RMB 50/MT against the last report of RMB 2,580/MT on 15th May’19.

Following the largest privately owned steel mill's lead, many leading scrap consumers in eastern regions like Maanshan, Handan, Shanghai and Taizhou likely to lift scrap purchase prices by RMB 40-60/MT in China.

Shagang Steel lowered finish long prices for mid-June shipments - Steelmaker had lowered finished steel prices on lower list prices and bearish sentiments in the local steel market. Shagang is selling HRB400 16-25 mm dia rebar at RMB 4,070/MT (USD 588) over the mid-June (11th-20th) period, down RMB 180/MT against the last set of prices for early-Jun'19 shipments. While prices for HPB300 6.5 mm dia wire rod lowered to RMB 4,150/MT (USD 599), down RMB 130/MT as against the last set. All prices are on an ex-works basis, including VAT.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook