Indian Steel Market Weekly Snapshot

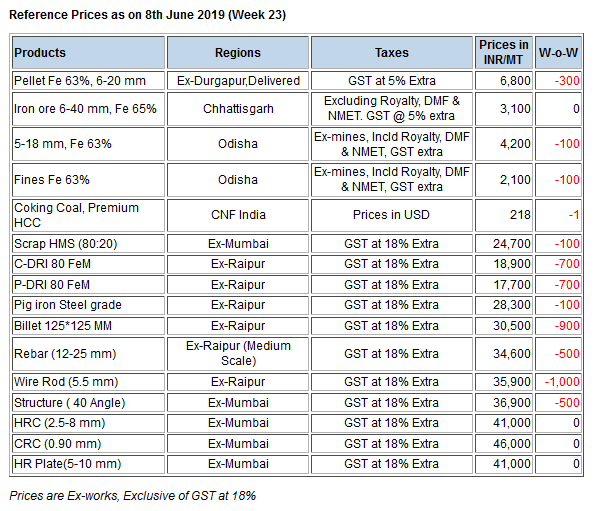

During these days, the prices of Semi-finished products fell in the range of INR 300-900/MT (USD 4-13) & Finished long by INR 400-1,200/MT (USD 5-17) in across major Indian markets. However in the duration, Flat steel offers were steady despite limited trades.

IRON ORE and PELLETS

Odisha based major merchant miners have got a decent response after revision of offers. Current assessment for Odisha iron ore 5-18 mm lump (Fe 63%) for bulk bookings at around INR 4,100-4,300/MT and fines (Fe 63%) at INR 2,000-2,200/MT (ex-mines, including Royalty, DMF & NMET).

-- OMC (Odisha Mining Corporation) got 75% material booked in the recently concluded iron ore Lump e-auction on 03rd Jun’19 at flat bids or slightly higher by INR 50/MT.

-- This week limited trades put domestic pellet offers under pressure. Central India based pellet manufacturers have decreased their offers by INR 200/MT couple of times to INR 6,800/MT (ex-Raipur, GST extra) for Fe 63% grade. In Durgapur (Eastern India) reference pellet offers stands at INR 6,800/MT (delivered) down by INR 250-300/MT against last week.

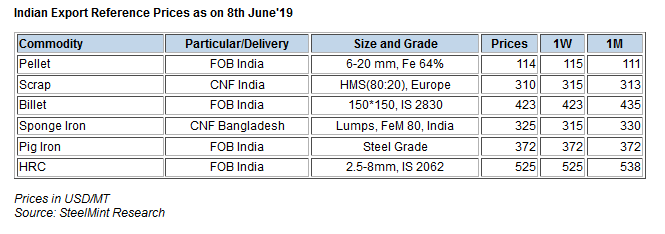

-- Central India based pellet maker - Godawari Power & Ispat had concluded an export of 50,000 MT iron ore pellets (Fe 64%, less than 2% Al) at around USD 117.25/MT, FoB India. In another pellet export deal, an eastern India pellet maker was concluded around 50,000 MT (Fe 64%, containing 3% alumina) at around USD 123-124/MT, CFR China.

-- Jindal SAW (West India) has concluded pellet export deal to China for 50,000 MT consisting of Fe 63% (around 1.5% Al) at around USD 116/MT, FoB India for June shipment.

-- KIOCL has invited a tender for purchase of 50,000 DMT (dry metric tonne) iron ore concentrate-Haematite. Interested bidders can submit their bids till 14 Jun’19 at 14:00 hrs.

-- Alok Kumar Mehta assumed charge as Director (Commercial) of state owned NMDC Limited, on Saturday, 1st Jun'19.

COAL

Seaborne premium low-volatile hard coking coal prices have been on a consistent downward trajectory since the latter part of last month, as offers declined in the absence of international demand for seaborne materials with June-July laycan from India and Europe.

Prices in the mid-volatile hard coking coal segment have also come under pressure lately – after having held steady in the past couple of weeks – as buyers retreated from the market.

Traders are expecting prices to soften in the near term on sufficient supply of coking coals, according to various market sources. Hence, some traders are showing willingness to negotiate with interested buyers and are trying to offload their cargoes before prices fall further.

In India, import demand for July-August loading cargoes has now moderated but until recently, buyers were actively seeking Australian coking coal for stocking up ahead of the monsoon season. Latest offers for the Premium HCC grade are assessed at around USD 215.75/MT & for 64 Mid Vol HCC grade at around USD 195.95/MT, CNF India.

SCRAP

Indian imported scrap prices dropped USD 8-10/MT on weekly basis in recent deals concluded on poor demand. Almost subdued finished steel demand and ongoing silence on Eid holidays in other subcontinental markets kept overall trading activities dull and participants to wait for more clarity on the global market.

-- SteelMint’s assessment for containerised Shredded from Europe, UK and US stand in the range USD 320-325/MT, CFR Nhava Sheva with limited trades for Shredded being reported in this range.

-- Deals for HMS scrap from UK reported at around USD 305-307/MT, while assessment of Dubai origin HMS 1 stands at USD 320-325/MT and South African HMS 1&2 at USD 325/MT; CFR Nhava Sheva. West African containerised HMS is hovering at USD 307-312/MT CFR.

SEMI FINISHED

On weekly basis, Indian sponge iron prices fell by INR 300-700/MT owing to limited fresh bookings by local EA & Induction furnaces as Billet offers continued down trend and registered slump of INR 300-900/MT W-o-W due to poor off take in finished products.

-- Indian mid sized mills export offers to Nepal down by USD 10-15/MT (W-o-W) & currently stood at USD 435-440/MT for Billet & USD 510-520/MT for Wire rod, ex-mill at Durgapur.

-- Rashtriya Ispat Nigam Limited (RINL) has invited a tender for export of 30,000 MT Billets and 20,000 MT Bloom. Interested bidders can submit their bids till 11 June ‘19 at 15:00 hrs.

-- TATA Metaliks Limited (TML) - known as the largest foundry grade pig iron manufacturer in Eastern India has rolled over its prices for Jun'19 deliveries and reported foundry pig iron at INR 32,500/MT (USD 470) & Low Silicon (1-1.5%) pig iron at INR 29,900/MT (USD 432); are ex-plant, Kharagpur.

-- Jindal Steel has offered Pig iron at around INR 28,200/MT ex-Raigarh & Panther shots (granulated pig iron) at INR 27,000/MT ex-Angul, Odisha. As per officials no major deals due to falling steel prices.

-- RINL has invited tender for export of 5,418 MT Wire rods,13,545 MT Billets and 5,418 MT Blooms to Nepal. The Interested bidders can submit their bids till 11 June’19 at 15:00 hrs.

-- SteelMint's Pig iron export price assessment stood at USD 370-375/MT FoB India, USD 324-326/MT FoB Brazil & USD 329-331/MT FoB Black sea.

FINISH LONG STEEL

Indian Finish long steel market remained dull amid slow trade activities across regions since from the beginning of week. Hence price range down up to INR 1,200/MT particularly in Eastern region whereas in other locations it fell by around INR 500-800/MT.

Market participants assuming that prices should find stability due to measured conversion spread from billet to rebar and limited demand since from last couple of weeks in most of the regions. So, piled stock can clear with the mills.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 34,500-34,800/MT Ex-Raipur & INR 35,400-35,700/MT Ex-Jalna; prices are basic & excluding 18% GST.

On the other hand, few trade participants in Southern region have shared that one of the large mill has withdrawn the price increase of INR 400-500/MT which has been floated in beginning of Jun'19 and it has drop due to limited response amid competitive offers by other large private mills but official confirmation yet to be announce.

-- Current Rebar (12 mm) trade reference prices of large mills registered at around INR 40,400-40,800/MT Ex-Mumbai (Stock Yard).

-- Central region, Raipur based heavy structure manufacturers trade discounts inched up by INR 100-200/MT to INR 600-800/MT against last week and current trade reference prices at INR 38,500-38,800/MT (200 Angle) ex-work.

-- Trade discounts in Raipur Wire rod increased further this week at INR 1,400-1,600/MT, which was last week at INR 1,300-1,500/MT. In line, basic prices also get narrowed down by INR 1,000/MT and current assessment is at INR 35,900/MT ex-Raipur & INR 35,800-36,400/MT ex-Durgapur, for 5.5 mm.

FLAT STEEL

This week domestic HRC prices remained steady on the backdrop of limited trade activities and lacklustre demand prevailing in domestic market. Though in the beginning of this week major Indian steel mills have announced hike in flat steel prices by INR 750-1,000/MT for June deliveries owing to higher raw material cost. However the increased offers are yet to be passed into the traders segment.

Currently HRC (2.5-8 mm, IS2062) prices in traders market is around INR 41,000-41,500/MT ex-Mumbai, INR 41,200/MT ex-Delhi and INR 44,500/MT ex-Chennai. The CRC (0.9 mm,IS 513) prices in traders market is around INR 46,000/MT ex-Mumbai, INR 45,500/MT ex-Delhi and INR 49,000/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

However traders have less clarity on current price hike due to Eid holidays and slowdown of buying activities in traders market. Thus in few trade markets flat steel prices continued to remain steady.

Industry leaders mentioned that, demand in domestic market less likely to improve owing to slowdown in construction and infrastructure activities and weaker growth in auto sector. Also approaching monsoon season along with cheaper imports may keep HRC price under pressure in domestic market.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse