South Korea Import Statistics in Apr 2019

South Korea Finish Long Imports

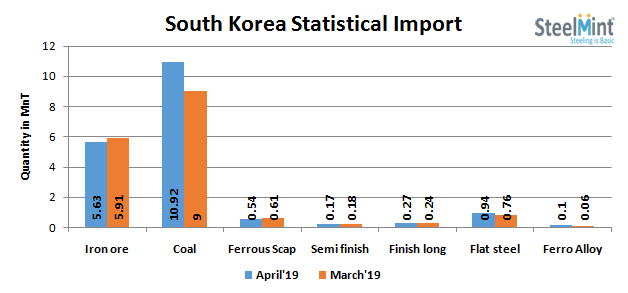

South Korea Finish long imports surged by 12.5% on monthly basis and stood at 0.27 MnT in Apr’19 against 0.24 MnT in Mar’19. In line yearly premises, imports recorded at 0.27 MnT in Apr’19 against 0.19 MnT in April’18 which is enlarged by 42%.

Commodity wise- Rebar imports remain unchanged on monthly basis and observed at 0.14 MnT in Apr’19 against Mar’19 followed by Structure – 0.11 MnT in Apr’19 surge by 22.22% against 0.09 MnT in Mar’19 and Wire rod – 0.02 MnT in Apr’19 against previous month.

Load Country Wise- The major imports of Finish Long Steel in April’19 registered from China at 0.14 MnT in Apr’19 increased by 7.69% against 0.13 MnT in Mar’19 followed by Japan - 0.07 MnT, Vietnam - 0.02 MnT in Apr’19; both unchanged against previous month.

South Korea Flat Steel Imports

South Korea Finish Flat imports surged by 23.68% in Apr’19 to 0.94 MnT against 0.76 MnT in Mar’19. On yearly basis, imports registered a surged by 36.23%, stood at 0.94 MnT as compared to 0.69 MnT in Apr’18.

Load Country wise- China stood as largest exporter of finish flat to South Korea at 0.54 MnT (up by 20% M-o-M) followed by Japan recorded a surged by 17.24% stood at 0.34 MnT in Apr’19 against 0.29 MnT in Mar’19.

Taiwan registered a surge by record high of 300% on m-o-m basis and observed at 0.04 MnT in Apr’19 against 0.01 MnT in Mar’19.

Semi-Finish Imports

Semi-Finish imports in South Korea plunged by 5.56% in Apr’19 to 0.17 MnT against of 0.18 MnT in Mar’19. On yearly basis, imports grew by 41.67%, stood at 0.17 MnT in April’19 as compared to 0.12 MnT in Apr’18.

Load country wise- Japan stood as largest exporter of Semi-finish to South Korea at 0.07 MnT (up by 16.67% M-o-M) followed by Indonesia registered a fall by 66.67% and stood at 0.03 MnT in Apr’19 against 0.09 MnT in Mar’19.

South Korea Iron Ore Imports Down Marginally in Apr’19

South Korea's iron ore imports fell slightly by 4.73% in Apr’19 to 5.63 MnT against 5.91 MnT in Mar’19 amid global material availability crises. In line, on yearly basis imports stood almost same and observed at 5.64 MnT in Apr’18.

Load Country wise - South Korea accounts for more than 65% of imports from Australia. In the month of Mar’19 Australian port were hit by cyclone. Resulted drop in South Korean imports from Australia in Apr’19 at 3.79 MnT (down by around 6% M-o-M).

Brazil stood second largest exporter of iron ore to South Korea at 0.90 MnT in Apr’19 (down 5% M-o-M). Imports from Brazil dropped amid Vale dam disaster in Jan’19. However, imports from South Africa increased by around 4% stood at 0.57 MnT in Apr’19 against 0.55 MnT a month ago.

South Korea Scrap Imports

South Korea ferrous scrap imports fell by 11.47% M-o-M in Apr’19 and registered at 0.54 MnT against 0.61 MnT in Mar’19 amid sharp fall in imports recorded from US.

On contrary, yearly premises imports witnessed a rise of 10% against 0.49 MT in Apr’18.

Country wise- Japan remained the largest scrap supplier to South Korea in Apr’19 as it exported 0.35 MnT ferrous scrap occupying a share of around 65% in total imports, rising 29.62% M-o-M from 0.27 MnT in Mar’19.

US stood at fourth largest supplier position witnessing a sharp fall by 91.67% M-o-M to 0.02 MT in Apr’19 followed by Russia 0.08 MnT, up 100% M-o-M.

Leading steel mills reduced the purchase bids for Japanese scrap throughout April month and supply from Japan increased ahead of Golden week holidays in the last week of Apr’19. Few bulk cargoes arrived from Russia in Apr’19 while bulk scrap bookings from US for May-June shipments picked up after witnessing fall in April shipments.

South Korean Ferro Alloy Imports significantly high in Apr’19

South Korean Ferro Alloys imports enlarged by 67% M-o-M in Apr’19 from 0.06 MnT in Mar’19 to 0.1 MnT in Apr’19. On yearly basis imports were slightly up by 11% and stood at 0.1 MnT in Apr’19 compared to 0.09 MnT in Apr’18.

In line Ferro Chrome Imports were doubled in Apr’19 and registered at 0.06 MnT compared to Mar’19 i.e. at 0.03 MnT.

Country Wise- South Africa, India and China remained the top three Ferro Alloys exporters to South Korea with 30% (0.03 MnT) & 20% each (0.02 MnT) share respectively in its total Ferro Alloy imports in Apr’19.

South Korea Coal Imports

South Korean coal imports have recovered during Apr’19 after continuous fall on monthly basis since the beginning of CY19.

Since the inauguration of the new government in 2017, there have been a range of measures to reduce coal consumption in the power sector, which have lowered the coal imports into the country.

On monthly basis it surged by 21.3% and stood at 9 MnT in Mar’19 compared to 10.92 MnT in Apr’19. On contrary, yearly basis it is plunge by 21.4% and stood at 10.92 MnT in Apr’19 against of 13.9 MnT in Apr’18.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse