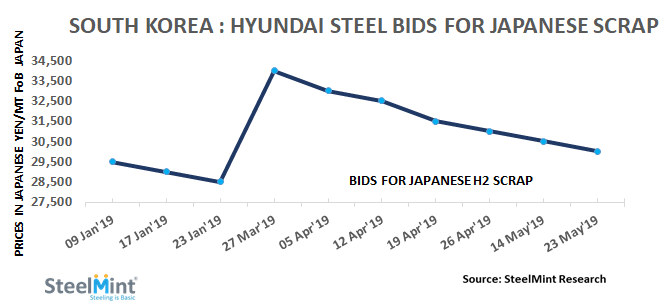

South Korea: Hyundai Steel Cuts Japanese Scrap Purchase Bid by USD 5

In bids presented today for Japanese scrap, the company has reduced H2 scrap bids to JPY 30,000/MT (USD 272), FoB Japan as against JPY 30,500/MT, FoB presented last week. This is the 2nd lowering of the purchase price by Hyundai Steel since market resumed after the Japanese Golden week holidays, while the company has now observed 6 successive price cuts since the closing of Mar’19.

The company has booked another Russian bulk cargo this week of 27,000 MT (A3 grade) ferrous scrap at USD 296/MT CFR South Korea. The deal has concluded at a price of USD 4/MT lower than last week’s contract which was signed at USD 300/MT for 15,000 MT. The said booking takes the total bulk cargo agreement of Russian ferrous scrap by Hyundai Steel to 52,000 MT so far in May’19.

On account of drop in global scrap prices observed last week, Russian scrap prices had declined, leading to bookings being signed at a lower price. Hyundai steel is the largest buyer of Japanese scrap which imports around 2.5 MnT scrap every year comprising around 30% of total Japanese yearly scrap exports. Hyundai’s bidding for Japanese scrap is considered to be the benchmark for East Asian scrap market.

Japanese domestic finished steel demand turns bearish – Amid most of the construction projects for Olympics 2020 nearing completion, domestic rebar demand in Japan has turned limited. Japanese scrap prices remain at around 2 year low with current H2 scrap prices standing in the range of JPY 29,000-30,000/MT (USD 263-272) as any market indications for the prices to move up in the near future has not been received yet. Tokyo steel’s new scrap purchase price revision is expected shortly, after the last price update done around two weeks back on 9th May’19.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook