Global Billet Market Overview- Week 20, 2019

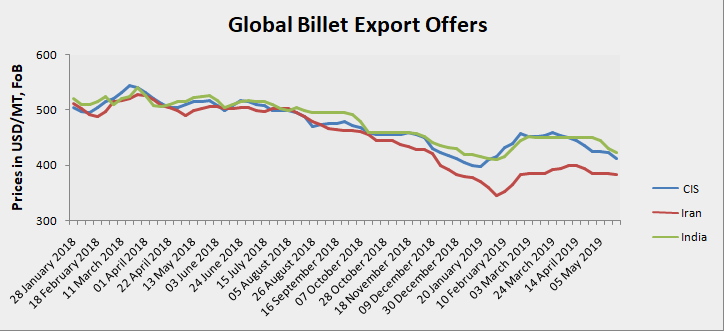

This week offers gain softness and got marginally down by USD 5-10/MT against last week. Market participants await clarity on price impact of US reduction of tariffs on steel imports from Turkey. United States lowered its tariff on steel imports from Turkey to 25%, from the previous 50%, with effect from 17th May. This week SteelMint’s billet export assessment from CIS nations is around USD 410-415/MT, FoB Black Sea.

India’s Vizag Steel concludes 30,000 MT billet export tender – Vizag Steel, a government of India Enterprise, has concluded the billet export tender for 30,000 MT (150*150mm) quantity yesterday, sources reported to SteelMint. The trade value was reported to be around USD 420-425/MT, FoB.

Initially the company had invited the bids for 60,000 MT quantity, but ended by concluding for 30,000 MT only of Size 150*150 mm. As per the delivery schedule, the last date of delivery shall be 15 June ’19 on FoB basis from ‘Gangavaram port (GPL). Limited participation was witnessed, due to which company had to cancel other lots of this tender. Last day for bid submission was 13 May’19.

SAIL cancelled billet export tender amid high domestic realization - Steel Authority of India, a government of India Company, had floated export tender for 16,200 MT billet. The tender was put up for Prime Mild Steel Non-Alloy Concast billets, size 150*150 mm offered from Bhilai Steel Plant and has following specifications - C-0.17 0.23%, Mn-0.50-0.90%, S-0.05% max, P-0.05% max and Si -0.15-0.35%. The cargo was likely to be shipped from Vizag port.

According to market sources report to SteelMint, the tender was cancelled due to comparatively better price realization in the domestic market than in exports. Although, the company received highest bid at around USD 425/MT, FoB. SteelMint tried contacting with company officials but no update was received.

Vietnam billet offers to Phillipines: Billet offers from Vietnam to Phillipines were reported to be USD 460/MT, CFR for 5SP grade 130*130mm billets. Trade sentiments reported stable this week. Formosa Ha Tinh Corporation (FHS), Vietnam’s largest steel manufacturer of the country has revealed the billet export offers yesterday for shipments scheduled by July. The price offered by the company is reported to be USD 465/MT, FoB, up marginally by USD 4/MT against last month.

Thailand books Russain billets: This week, a deal of value 15,000 MT has been concluded for which shipment is scheduled in Jun’19. The trade price of the shipment was reported to be USD 450/MT, CFR.

Iran billet export offers soften in recent deal: The dullness in the Iranian market continued for this week as well, market sentiments have remained marginally down with limited trades being witnessed this week. Imposition of sanctions from US on Iran is dampening the market sentiments.

According to SteelMint’s assessment, Iran billet export offers this week were reported to be USD 380-385/MT, FoB down by USD 5/MT from last week. According to sources, an export deal of 160,000 MT billets has been concluded for which shipment is scheduled in Jul’19 to South East Asia and North Africa. The trade price of the shipment was reported to be USD 380/MT, FoB

Chinese domestic billet prices fall: The ex-factory price of general carbon billet in Tangshan, Changli and Qian’an areas was learned to be around RMB 3,550/MT on 17 May'19, down RMB 30 against last week.

Turkey prices may find support after US tariff cut: Turkish steel billet prices have witnessed a drop of USD 5-10/MT, against last week. This week prices were reported to be USD 410-420/MT, FoB. According to SteelMint’s assessment and sources, the Turkey is trying to compete with CIS nations for billets and hence, is offering billets at par with the CIS offers. Another reason noted was the weakened imported scrap prices in Turkey. In recent, the scrap deal from US witness a drop of USD 10/MT against last week. However recent tariff cut by US might keep sentiments supportive.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook