Indian Steel Market Weekly Snapshot

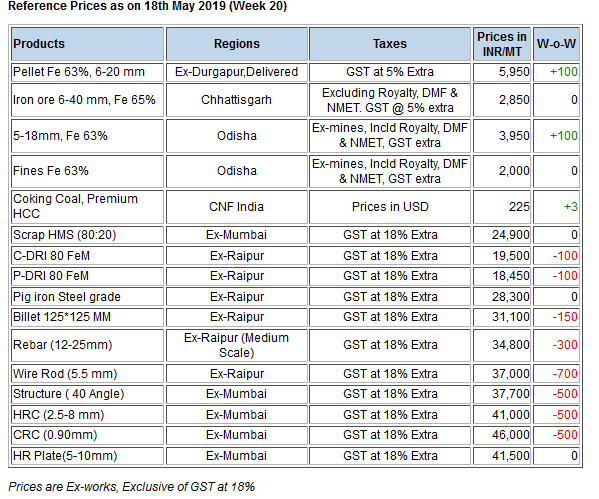

In the same line, Flat steel offers plunged by INR 500-1,000/MT (USD 7-14) in current week.

IRON ORE & PELLET

SteelMint learned that few miners like KJS Ahluwalia, RP Sao, and KN Ram have raised iron ore offers recently. Revised offers for 5-18 mm (Fe 63%) stands at INR 4,200-4,300/MT (ex-mines) and fines (Fe 63%) at around INR 2,200/MT. KJS hiked offers in fines only by INR 200/MT.

-- OMC received a flat response in the recently concluded auction on 14th May’19 in which nearly 71% material got booked. The bid prices for the material remained in line with the set base prices for all the three mines. JSW Steel booked 20,000 MT iron ore fines (Fe 64-62%) from Daitari mines in OMC e-auction at base price of INR 2,450/MT (inclusive of Royalty).

-- India pellet prices seem to be almost stable this week except for Durgapur where prices moved up slightly. Central India (Ex-Raipur) Pellet offers for this week stood at INR 6,600/MT in line with last week offers. Durgapur pellet price assessment stands at INR 5,900-6,000/MT (delivered) against INR 5,800-5,900/MT last week.

-- Jindal SAW (Rajasthan) increased pellet offers by INR 150/MT(USD 2). Offers for Fe 63% grade pellets are assessed around INR 8,450/MT (delivered Kandla) against last weeks’s assessment of INR 8,300/MT.

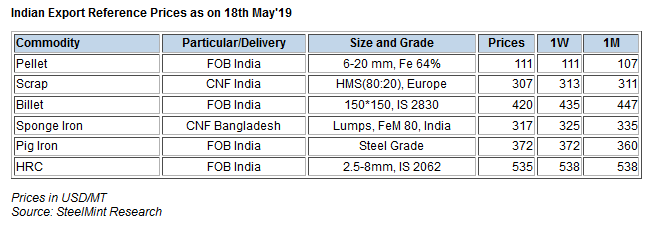

-- Southern India based pellet maker - KIOCL has concluded 50,000 MT pellet (Fe 64% content with less than 2% Al) export deal at around USD 115/MT, FoB India.The tender was due on 14th May'19.

COAL

Seaborne premium hard coking coal prices have held steady so far this week, following their dizzying upward spiral over the last week, while the 64 mid-vol prices have eroded a bit.

In China, trading activity in the seaborne market has slowed down, with most buyers appearing to tread cautiously at current price levels. Moreover, finished steel prices for the July-September quarter are expected to decline. And hence, Chinese mills are not willing to pay above USD 200 per tonne CFR China for premium materials. Furthermore, China’s currency devaluation increases cost of procuring imported coking coal and in turn, the production cost of steel manufacturing.

Meanwhile, Chinese-delivered Premium Low Vol prices may stay firm on persistent demand as China-based steelmakers have become amenable to meet the country’s environmental standards, which require end-users to seek proper-quality coals with high CSR and low ash content.

Latest offers for the Premium HCC grade are assessed at around USD 224.55/MT, while offers for the 64 Mid Vol HCC grade at around USD 194.85/MT CNF India.

SCRAP

Indian imported scrap market observed trades at corrected prices in the beginning of the week. However, towards the closing of the week price hike in Turkish market turned sentiments positive in terms of prices. The outcome of ongoing elections to be revealed on 23rd May, kept importers waiting & seeking more clarity on global levels amid indications of recovery in coming days.

-- SteelMint’s assessment for containerised Shredded from Europe, UK and US stand at USD 320-325/MT, CFR Nhava Sheva, down USD 5-10/MT against last week. Steel mills reported to have booked few trades for Shredded at USD 317-325/MT, CFR depending on payment terms, however offers from leading scrap yards remain in the range of USD 325-330/MT, CFR.

-- Amid limited working hours during ongoing Ramadan, Dubai based offers remained limited with HMS 1&2 trades reported at USD 323-327/MT, CFR Nhava Sheva and HMS 1 at USD 328-330/MT, CFR. Offers for South African HMS 1&2 stand in the range of USD 325-330/MT, CFR that of West African HMS 1&2 in 20-21 MT containers stand in the range of USD 310-315/MT, CFR India.

SEMI FINISHED

On weekly basis Semi finished offers declined in major locations, in which Billet offers fell by INR 200-900/MT and major fall seen in Mumbai, Maharashtra by INR 900/MT. Meanwhile Sponge iron offers drop slightly by INR 100-300/MT.

-- Mid sized mills export offers to Nepal declined and stood at around USD 440/MT for Billet (100*100 mm) & USD 515-525/MT for Wire rod(5.5 mm) ex-mill, Durgapur, eastern India.

-- Rashtriya Ispat Nigam Limited - a government of India Enterprise, has concluded the billet export tender for 30,000 MT (150*150 mm) at around USD 420-425/MT, FoB - Sources.

-- Indian Sponge iron export offers dropped to 21-months low since Jul'17 & stood at around USD 315-318/MT CNF Chittagong (Bangladesh), equivalent to USD 300/MT CPT Benapole (dry port of India & Bangladesh).

-- SAIL's pig iron auction on 15th May’19 for 12,000 MT steel grade pig iron from Rourkela Steel plant (Eastern India) has received weak response despite reduced base price by INR 300/MT to INR 27,200/MT as against last auction.

-- Jindal Steel has reduced prices and offered steel grade pig iron at INR 28,000/MT ex-Raigarh & granulated pig iron at around INR 26,600/MT ex-Angul, Odisha.

-- Rail Wheel Factory (Formerly Wheel and Axle Plant) is situated in Bangalore, India has invited tender for the purchase of 5,190 MT Bloom. Due date for submitting the offer is 06 June’19 till 14:15 hrs.

-- SAIL cancelled 16,200 MT billet export tender amid high domestic realization. Although, the company received highest bid at around USD 425/MT, FoB.

-- SteelMint's Pig iron export price assessment stood at USD 370-375/MT FoB India, USD 320-322/MT FoB Brazil & USD 339-341/MT FoB Black sea.

FINISH LONG STEEL

Indian Finish long marketplace remained dull amid slow trade activities. Since the beginning of this week, trades remained slow but in last couple of days buying inquiries improved slightly and resulted in clearing up of stockpiles to some level.

Industrialist assuming that market should get sustained after election result and existing price range might hover with minor corrections across regions.

On the other hand, few industrialists from majors supplying region i:e; Central India believes that price should get narrowed down slightly with consideration of appropriate supply to surrounding consumption locations such as UP/MP/Gujarat and few nearest location of Maharashtra as existing rebar prices doesn’t allow to reach nearby area.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 34,700-35,000/MT Ex- Raipur & INR 36,200-36,500/MT Ex- Jalna; basic & excluding GST.

-- Further, Large mills price range came up with slight discount level as per region wise & current Rebar (12 mm) trade reference price registered around INR 40,500-41,000/MT, Ex-Mumbai (Stock Yard).

-- Central region, Raipur based heavy structure manufacturers offering trade discount inched up by INR 100-200/MT to INR 500-700/MT against last week and current trade reference prices at INR 38,800-39,100/MT (200 Angle) ex-work.

-- Trade discounts in Raipur Wire rod slightly fall and maintained at INR 700-900/MT which was last week at INR 1,200-1,300/MT. Meanwhile basic prices stood at INR 37,200/MT ex-Raipur & INR 37,000/MT ex-Durgapur.

FLAT STEEL

Ongoing elections, rising inventory among traders, poor sales volumes, low liquidity along with dull demand continued to keep domestic HRC market under pressure.

Currently HRC (2.5-8 mm, IS2062) prices in traders market is around INR 41,000-41,500/MT ex-Mumbai, INR 41,500-41,700/MT ex-Delhi and INR 44,000/MT ex-Chennai. Prices in few markets have come down by INR 500-1,000/MT this week however in other markets offers remained firm.

Although, the current price of CRC (0.9 mm,IS 513) in traders market is around INR 46,000-46,500/MT ex-Mumbai, INR 45,000-46,500/MT ex-Delhi & INR 50,000/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Meanwhile cheaper imports from major exporting nations like Japan and Korea may put pressure on domestic HRC prices further since global HRC offers have started falling.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse