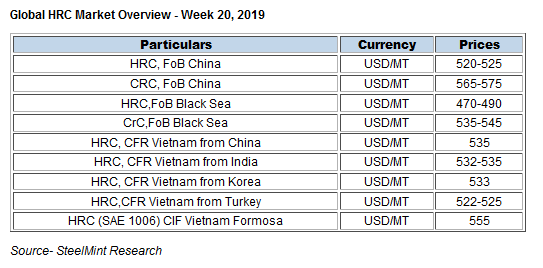

Global HRC Market Overview - Week 20, 2019

The deal price is heard around USD 533/MT, CFR basis. However previously Hyundai Steel was offering HRC to Vietnam at USD 550-560/MT CFR basis.

Imported HRC offers to Vietnam decline - This week imported HRC offers to Vietnam witness decline from major exporting nations like China and India in line with lower offers from Turkey and Russia.

Current HRC offers to Vietnam - Week 20,2019

1.HRC (SAE 1006) 2-3mm/Chinese offer - Magang steel is at USD 535/MT CFR Vietnam for June shipments. Last week the offers was in range of USD 540/MT CFR basis.

2.HRC (SAE 1006) 2-3mm/Turkey offer - Habas Steel is at USD 522/MT CFR Vietnam for June shipments.

3.HRC (SAE 1006,small coils ) 2-3mm/Russian offer - MMK Steel is at USD 515-520/MT CFR Vietnam for June shipments.

4.HRC (SAE 1006) 2-3mm/India offer - India is at USD 532-535/MT CFR Vietnam for June shipments.

5.HRC (SAE 1006) 2-3mm/Germany offer -Thyssenkrup is at USD 525/MT CFR Vietnam for June shipments.

Chinese HRC export offers decline as US-China trade tensions deepens - Chinese HRC export offers reported fall this week amid increased tade tensions between USA and China.USA have increased trade tariffs from 10% to 25% on various products from China which will be implemented from 1st June’19.

This lead to bearish sentiments in nation’s domestic market which in turn reduces export offers in overseas market.

Currently nation’s HRC export offer is assessed at around USD 520-525/MT FoB basis. Last week the offers stood at USD 530-535/MT FoB basis.

Meanwhile prices in domestic market fell by RMB 30/MT D-o-D basis and stood at RMB 3,990-4,000/MT n eastern China (Shanghai)

And prices at Northern China moved up by RMB 10-30/MT D-o-D basis and stood at RMB 3,860-3890/MT in Northern China (Tangshan).

CIS- origin HRC export offers remain moderate over slow trades- This week CIS nation’s HRC export offers remain moderate amid slow trades in CIS nations. Meanwhile Ramadan (Islamic holy month) have also been started last week which resulted to slowdown in trade activities in CIS regions.

Currently offers are in the range USD 470-495/MT FoB Black Sea.

Meanwhile export offers from Russia heard to be around USD 475-480/MT FoB basis.

Thus market sources shared that HRC export offers from CIS nations will decline further by the end of this week.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift