South Africa: Iron Ore Exports Pick Up in Q1 CY19 Post Resumption at Transnet

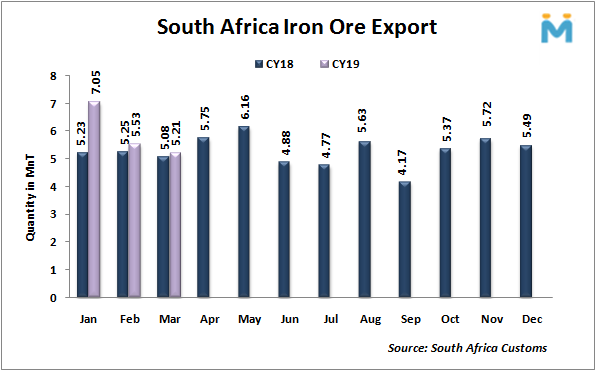

The exports picked up amidst resumption at Transnet (Transport Company), iron ore export channel post closure in Dec'18 due to structural damage to railway line. This led to 10 days operation suspension at Transnet and subsequent force majeure by South African miner Kumba and Assmang.

China stood largest importer of iron ore from South Africa for the quarter at 10.46 MnT, up 6% Q-o-Q as against 9.89 MnT in previous quarter. Netherland stood second largest importer at 1.23 MnT followed by South Korea at 1.13 MnT. Indian imports from South Africa fell for the quarter to 0.55 MnT as compared to 0.57 MnT in Q4 CY18.

South African coal exports fell for the quarter

South Africa coal exports dropped 14% to 18.8 MnT in Q1 CY19 as against 21.77 MnT in Q4 CY19. Data provided by customs indicates that South Africa had exported 7.35 MnT coal in Mar'19, up 4% M-o-M from 7.07 MnT in Feb'19.

Strong Indian demand supported South Africa's coal exports in Mar'19, offsetting lower shipments to Pakistan and South Korea. Exports were down 2% on the year from 7.53 MnT in Mar'18. Eventually, total volume that was shipped in the first three months of 2019 had fallen 5% Y-o-Y to 19.5 MnT compared with 20.45 MnT in the corresponding period of CY18.

Renewed Indian Interest buoys South African Coal Exports: Firm coal demand amid growing industrial activity prior to the general elections had elevated Indian coal sourcing from South Africa.

South African coal shipments to India jumped 63% on the month to 4.7 MnT in Mar'19 compared with 2.89 MnT in Feb'19, which was also 60% higher on the year from 2.94 MnT in Mar'18. Notably, this was the greatest volume sent to India since January 2010, the period from which SteelMint has started compiling data for South African exports.

South Africa ferrous scrap exports fall 6% Q-o-Q in Q1CY19

South African ferrous scrap exports witnessed a fall of 6% Q-o-Q as it exported 95,706 MT in Q1'CY19 as against 101,854 MT in Q4'CY18. On yearly premises, scrap exports fell 6% Y-o-Y as against 101,318 MT ferrous scrap recorded in Q1'CY18.

Country wise - The largest importer of South African scrap remained India with 67% share and observed a rise of 5% Q-o-Q in Q1'CY19, India imported 64,132 MT in Q1'CY19 as against 60,983 MT in the previous quarter. Other prominent scrap importers Bangladesh (17,550 MT, 18% share) and Pakistan (9,358 MT, 11% share) observed a fall of 0.4% and 44% Q-o-Q respectively.

In Mar'19, the scrap exports from the country witnessed a growth of 12% M-o-M amid an increase in collection rates and Indian imports. It exported 34,211 MT against 30,449 MT in Feb'19 out of which India occupied more than 71% share.

South African ferro alloy exports increased by 6% in Q1 CY19:

South African Ferro Alloys exports increased by 6% in first quarter of CY19 as compared to the previous quarter. Manganese Ore and Chrome Ore Exports witnessed an increase of 4% and 6% respectively in Q1 CY19 as compared to Q4 CY18. However, in first quarter of CY19 Silico Manganese exports is down by 10% as compared to previous quarter.

Manganese Ore Exports increased by 19% from 1.44 MnT in Feb'19 to 1.71 MnT in Mar'19. Chrome Ore Exports were significantly high in Mar'19 as compared to previous month, exports in Mar'19 were 1.20 MnT. However, Ferro Chrome and Silico manganese Exports fell by 14% and 31% respectively.

South African exports of pig iron down 25% in Q1 CY19

Pig iron exports from the South Africa recorded at 0.15 MnT in Q1 CY19, down 25% as against 0.2 MnT in Q4 CY18.

The exports for the month of Mar'19 fell to 0.05 MnT as compared to 0.05 MnT a month ago. The exports has narrowed down in line with sharp surge in export prices by USD 15-20/MT during Feb'19. The reason behind the surge in prices cited by suppliers was lower availability of pig iron and higher iron ore costs.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI