Indian Iron Ore Exports Hit-1-Year High in Apr'19

Why did Indian iron ore export volumes increase in April’19?

1. Lucrative iron ore (Fe 62%) offers-: The global iron ore fines prices (Fe 62%) had increased to USD 95.8/MT CFR China the prices have hit 5 years high. Sharp rise in high-grade iron ore prices have led Chinese mills to hunt for low-grade iron ore. The month of April is marked by the highest construction activities in China and also relaxation in production curbs in the country has led to increased preference for lower grade ore in China. Monthly average global iron ore fines (Fe 62%) increased sharply by 8% in Apr’19 to USD 93/MT, CFR China against last month at USD 86/MT, CFR China.

2. Increased Chinese demand of low & medium grade ore -: SteelMint has learned from the sources that export prices for Fe 58/57 grade increased to USD 56/MT, FoB India against USD 50/MT FoB, at the beginning of April’19. Traders in Odisha were also learned to have booked decent quantities in recent past at the same price.

3. Supply disruption indications from Brazil and Australia-: The January collapse of mine dam waste in Brazil operational at Vale followed by the cyclone in Australia led to drop in global availability of iron ore. As a result, global iron ore miners have slashed their 2019 estimates leading to material availability crises.

4. Narrowing discounts of low-grade ore –: Fortescue Metals Group - world's 4th largest iron ore producer has reduced iron ore discount for SSF (super special fines) to 11% in May’19 from 13% in Apr'19. Discount from the miner has dropped sharply from as high as 42% in Oct-Nov'18 to 33% in Feb'19, 16% in Mar'19,13% in Apr'19 and 11% in May'19.

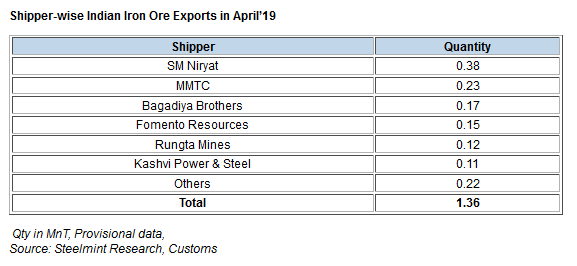

SM Niryat turned out to be India’s largest iron ore exporter -: SM Niryat stood largest iron ore exporter in April’19 at 0.38 MnT, up 52% M-o-M as against 0.25 MnT in Mar’19. MMTC (which exports on behalf of NMDC) stood second largest and its exports increased by 10% to 0.23 MnT for the month.

Other major exporters were Bagadiya Brother at 0.17 MnT, Fomento Resources at 0.15 MnT and Rungta mines at 0.12 MnT

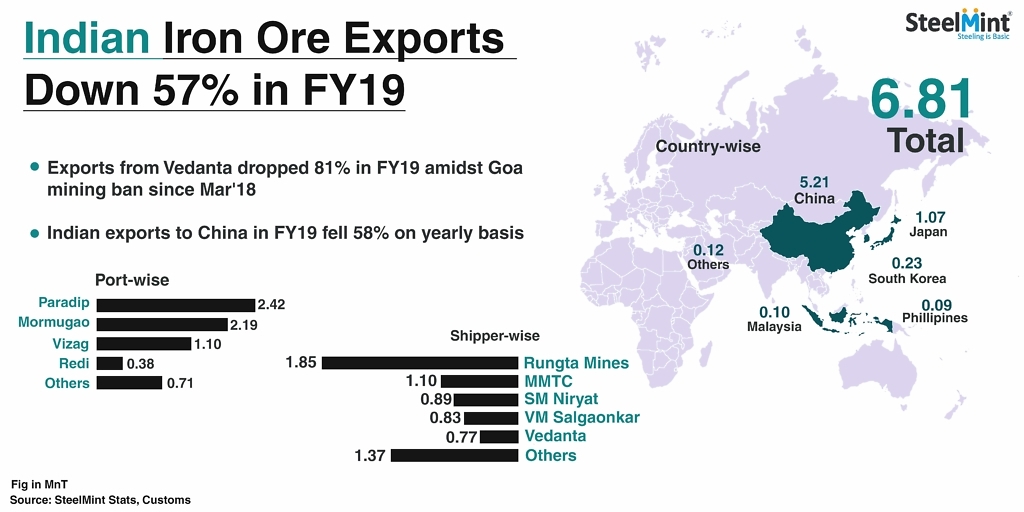

India iron ore exports to China increased 26% in April'19-: China continued to be the largest importer of Indian iron ore in April’19 at 1.8 MnT. However, exports increased by 26% against 0.86 MnT in Mar’19. Exports to Japan and South Korea dropped to 0.15 MnT (down 47%) and 0.08 MnT respectively.

Paradeep port remained India’s largest iron ore exporting port in Apr’19-: In April’19, Paradip port stood the largest exporter of Indian iron ore at 0.42 MnT, down 15% compared to 0.5 MnT in Mar’19. Vizag port stood second largest exporter at 0.28 MnT, up 36%.

Exports from Redi port has almost stable at 0.20 MnT against 0.21MnT in Mar’19.

Gold price eases after Trump downplays clash with Fed chair Powell

Copper price hits new record as tariff deadline looms

Chile’s 2025 vote puts mining sector’s future on the line

Brazil producers look to halt pig iron output as US tariff threat crimps demand

Gold price could hit $4,000 by year-end, says Fidelity

Three workers rescued after 60 hours trapped in Canada mine

US targets mine waste to boost local critical minerals supply

Glencore workers brace for layoffs on looming Mount Isa shutdown

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Column: EU’s pledge for $250 billion of US energy imports is delusional

Trump tariff surprise triggers implosion of massive copper trade

Maxus expands land holdings at Quarry antimony project in British Columbia

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Southern Copper eyes $10.2B Mexico investment pending talks

American Tungsten gets site remediation plan approved for Ima mine in Idaho

Kinross divests entire 12% stake in Yukon-focused White Gold

Gold price could hit $4,000 by year-end, says Fidelity

Southern Copper expects turmoil from US-China trade war to hit copper

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming