Global Ferrous Scrap Market Overview - Week 17, 2019

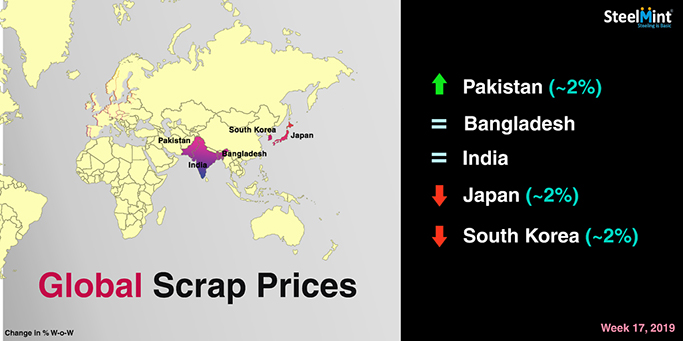

However scrap restocking activities in Pakistan picked up ahead of Ramadan restocking.

Turkey imported scrap prices inched down - A USA based supplier concluded 26,000 MT imported scrap deal to a Turkey based mill which contained a mixed cargo. HMS (80:20) was sold at USD 307; Shredded at USD 312 and Bonus scrap at USD 317/MT, CFR Turkey for May shipments. Prices have softened on weekly basis by USD 2-3/MT.

Japan’s Tokyo Steel makes another scrap purchase price cut this week -Japan’s leading EAF steel mini-mill, Tokyo Steel lowered domestic scrap purchase price again this week, effective from 24th April, observing a price cut of JPY 500/MT (USD 5) at all five works in Japan. The company now pays JPY 29,500/MT (USD 264) for H2 scrap delivered to Utsunomiya plant in Kanto region which is the lowest price observed in 20 months. For high-grade scrap 'New breaking press A' at Tahara Plant, the steelmaker further lowered price by JPY 1000/MT to JPY 34,500/MT (USD 309).

Golden week holidays have started from 26th April ‘19 and will keep the production activities sluggish , maintaining the Japanese scrap prices on the lower side. However market sources estimate that scrap prices may rise after holidays.

South Korean Hyundai Steel cuts bid for Japanese scrap by JPY 500 - South Korean leading steelmaker Hyundai Steel lowered open bids for Japanese scrap by JPY 500/MT (USD 5) against last week. It presented bids for H2 at JPY 31,000/MT (USD 278) FoB Japan. Sharp fall in Japanese scrap prices are likely to result in a fall in domestic Re-bar prices in South Korea in May-Jun'19.

Japanese Yen strengthened against South Korean Won (KRW) this week leading to slight rise in South Korean domestic scrap prices. JPY/KRW exchange rate now at 10.40.

Limited activities reported in Indian imported scrap market -Indian market for imported scrap continued observing limited activities on account of ongoing elections. Competitive domestic scrap and DRI prices have also kept scrap imports on lower side.

SteelMint’s assessment for containerized Shredded from Europe, UK and US stand at USD 335/MT, CFR Nhava Sheva while P&S scrap is majorly being offered at around USD 350/MT, CFR India.

South African HMS 1&2 traded at around USD 334-335/MT, CFR while trades of Dubai HMS 1 ranged between USD 330/MT to USD 334-335/MT CFR as per the quality. Deals for low priced HMS scrap from West Africa and other origins were witnessed. Assessment for HMS 1&2 from West Africa remained at around USD 310-313/MT CFR Chennai & Goa while USD 2-3/MT higher for CFR Nhava Sheva. HMS 1&2 from Brazil & Germany were booked at USD 320/MT and USD 305-310 (as per quality) CFR respectively.

INR has depreciated to 6 weeks’ low against USD and hit 70.2.

Pakistan imported scrap prices move up due to Ramadan restocking -Pakistan imported scrap market picked up in the later half of the week, as active buying was observed due to Ramadan restocking. SteelMint’s assessment for containerized shredded scrap from US & UK stand at USD 337-340 USD, CFR Qasim, rising 5-6 USD since last week’s closing. However few bookings from USA were also heard in the range of USD 335-337/MT.

Bangladesh imported scrap prices rangebound; bookings yet to pick up-Bangladesh mills are expected to turn active for scrap bookings ahead of upcoming Ramadan holidays and begin with scrap restocking activities shortly.

Assessment for shredded scrap from UK remained similar to last week’s report in the range of USD 348-350/MT, CFR Chittagong, However, few offers from USA and Canada scrap yards were a bit higher by USD 5/MT, CFR.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook