Tata Steel FY19 Results : Key Takeaways

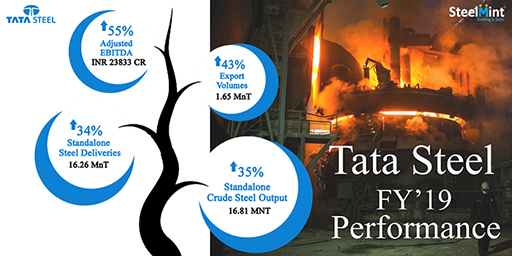

1. Crude steel output surge 35% in FY19- Tata Steel’s crude steel output surge by 35% in FY19 to 16.81 MnT in comparison to 12.48 MnT in FY18 amid ramp-up at both Kalinganagar and Tata Steel BSL. However on quarterly basis the same inched up by 2% to 4.48 MnT in Q4FY19 against 4.38 in previous quarter

2. Steel deliveries up by 34% in FY19- Tata Steel, India deliveries increase significantly by 34% in FY19 to 16.26 MnT in which was 12.15 MnT in FY18. However on quarterly basis deliveries increased by 21% in Q4FY19 to 4.72 MnT against 3.89 MnT in Q3FY19.

3. Export deliveries jumped in FY19- Company’s export deliveries jumped by 43% in FY19 to 1.65 MnT in FY19 which was 1.15 MnT in previous fiscal.However on quarterly basis Tata Steel export sales jumped more than twofold in Q4FY19 to 0.70 MnT which was 0.30 MnT in previous quarter. Tata BSL have increased export deliveries in Q4 amid weaker sentiments in domestic market in order to avoid piling up of inventory levels.

4. Automotive sales crossed 2.25 MnT in FY19- In FY19 automotive products sales up by 22% to 2.36 MnT in FY19 which was 1.94 MnT in previous fiscal. However autos sales decline in Q4 by 20%. However branded products sales up by 30% and industrial products up by 42% in FY19.

5.Tata BSL Steel performance in FY19- In FY19, Tata BSL crude steel output stood at 3.58 MnT ,deliveries at 3.52 MnT and EBITDA at INR 3033 Cr in FY19.

6. Adjusted EBITDA from India operations doubled in FY19- In India,Tata Steel EBITDA doubled in FY19 to INR 23,883 Cr which was INR 15,334 Cr in FY18.

7.Ramp up plans at Bhushan & Usha Martin may increase output by around 1 MnT- Plans to ramp up at Tata steel BSL and Usha Martin (part of Tata sponge). Major portion of increase will come from Tata steel BSL and Usha Martin and its sale guidance will be reviewed in coming six months. Expected increase might be around 1 MnT. Company is targeting special steel through Usha Martin business acquisition.

8.Steel prices to pick up with improved domestic demand - Domestic steel prices will pick up gradually with better domestic demand and improving pricing sentiments in regional markets. Indian steel demand to witness modest recovery with conclusion of general elections and improvement in liquidity. Automotive sector demand remained dull in Q4 FY19 and infrastructure sector witnessed growth in Q4FY19.

9. Coking coal price expected to reduce- Consumption cost of coking coal stood at USD 169/MT in Q4 which may come down by USD 7-8/MT in coming quarter. Prices firmed up in Mar’19 with restocking demand post Chinese new year and various supply disruptive incidents in Australia. The supply has now normalised and China import restrictions are expected to keep prices in check.

10.Tata Steel Kalinganagar Phase II expansion: Company stood by its guidance to ramp up at Kalinganagar plant by 48 months starting from 2017.Company is planning to set Cold rolling mill by early next financial year since Hot rolling maill have already being commissioned of 3 MnT. Second step to set up pellet plant in order to reduce cost and other facilities will be commissioned by FY21-22.Thus company is on track as per schedule to complete in FY22.

11.Tata Steel BSL merger to accelerate synergies and consolidation- Tata Steel and Tata Steel BSL have proposed a merger of both the companies in the interest of maximizing value to all stakeholders.The merger will drive operational synergies and efficiency, reduce the regulatory burden and simplify the group structure and recommend a merger ratio of 15 shares of Tata Steel BSL for every 1 share of Tata Steel

12.UML’s steel business acquisition completed in April 2019 – The acquisition process of Usha Martin's steel business through Tata Sponge Iron Limited, a subsidiary of Tata Steel, has recently been completed which will be expanding attractive long portfolio.It comprises of specialized 1 MTPA alloy based manufacturing capacity in long products segment based in Jamshedpur and captive power plants

13.Co2 emissions reduced in FY19- Tata Steel Jamshedpur has been able to reduce CO2 emission intensity to 2.28 tCO2/tcs in FY19. Solid waste utilization was in excess of 99%.

14.Participating in Sukinda mines auction in 2020- As per MMDR law Sukinda Chrome ore mines auction will come up in FY20 and Tata Steel intends to participate in it.

15. Iron ore supplies to Tata Steel BSL to strengthen- Plans to increase supply of iron ore to Tata steel BSL from Tata Steel’s captive mines. Environmental clearances have been made however logistics and railway transportation still remain constraint. Thus Tata steel BSL externally procured 70-80% of iron ore externally (from merchant market) last year

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

UBS lifts 2026 gold forecasts on US macro risks

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Afghanistan says China seeks its participation in Belt and Road Initiative

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Pan American locks in $2.1B takeover of MAG Silver

Iron ore prices hit one-week high after fatal incident halts Rio Tinto’s Simandou project

US adds copper, potash, silicon in critical minerals list shake-up

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery