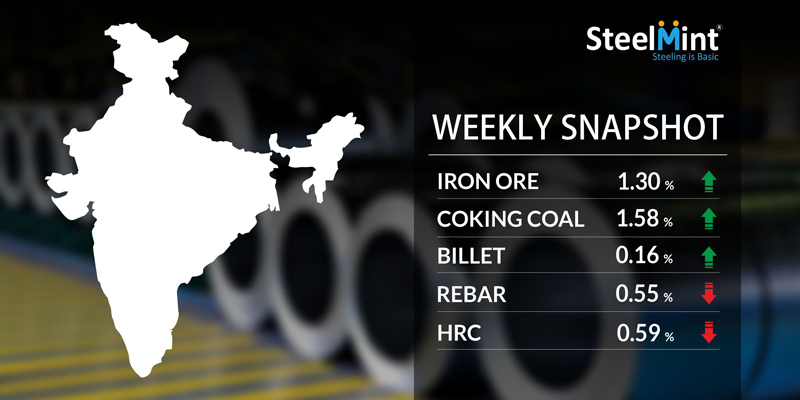

Indian Steel Market Weekly Snapshot

As per industry leaders, presently major buying activities are silent owing to an inert mood of buyers amid ongoing election season. Also, most of the participants adopted 'wait & watch' mode for the next week, they added.

As per SteelMint's assessment, in these days prices of Semis products (Billet & Sponge iron) have fluctuated by INR 200-500/MT (USD 3-7), also limited trades were observed at the current offers.

Meanwhile, the Finished long steel prices plunged by INR 400-600/MT W-o-W. In line Flat steel, the offers fell slightly over limited trade activities.

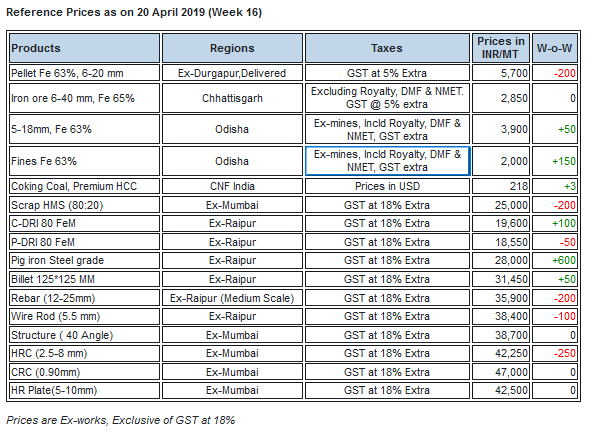

Iron ore and Pellets

Odisha based merchant iron ore miners have increased iron ore prices by INR 200/MT in both lumps and fines today (20th Apr'19). SteelMint learned that miners like Serajuddin Mines, KJS Ahluwalia, Kaypee Enterprises and RP Sao have raised fines prices by INR 200/MT.

-- Raipur (Central India) based pellet makers increased offers to INR 6,400/MT after export deals getting concluded. SteelMint’s assessment for Bellary origin pellets are at INR 7,200-7,400/MT (basic).

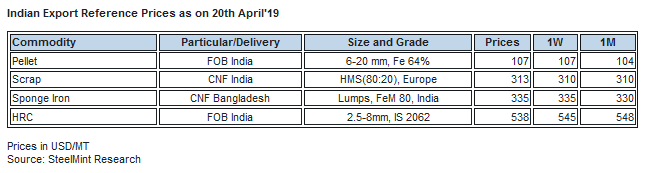

-- No pellet export deal has been concluded this week but SteelMint in conversation with major Indian pellet makers learned that they are eyeing for levels of USD 119-120/MT, CFR China and they had offered cargoes for pellet export earlier this week.

Coal

Australian coking coal prices have held steady after having leaped sharply at the start of this week – following a consistent decline during the past few weeks – on the back of incremental buying interests among end-users in China.

A plethora of recent transactions were heard to have been concluded at prices above the prevailing rates in the Chinese metallurgical coal market. Market sources indicated that the seaborne coking coal market appears to have rebounded now after prices had hit rock bottom by the previous week end. However, as the supply situation of premium coking coal has normalised with improving weather conditions in Australia, seaborne prices might encounter negative pressure against further growth.

Meanwhile, the Indian demand for imported coking coal has stayed healthy, with most end-users looking at forward booking cargoes with laydays cancelling dates for late-May and early-June.

-- Latest offers for the Premium HCC grade are assessed at around USD 218.20/MT & for the 64 Mid Vol HCC grade at around USD 191.45/MT, CNF India.

-- MMTC has issued a tender for purchase of Soft coking coal for a quantity of 19,000 MT coking coal on behalf of NINL, Odisha. The due date for submitting the bids is 22 Apr’19 till 11:00 hrs

Scrap

Indian scrap importers observed limited inquiries for imports amid ongoing elections. Minor trades for low priced scrap picked up in the market amid revival of global scrap prices. Major steelmakers remained away from buying higher priced scrap preferring domestic scrap and sponge iron on easier and cheaper availability. Ramadan restocking may keep global scrap prices supported however, upside seems limited in the near terms.

-- SteelMint’s assessment for containerized Shredded from UK, Europe and US stands stable in the range USD 332-335/MT, CFR Nhava Sheva. HMS 1 from Dubai traded at levels of around USD 325-330/MT, CFR West African HMS 1&2 in 20-21 containers traded at USD 310/MT, CFR Mundra and 313-315/MT, CFR Goa and Chennai.

Semi Finished

Indian Semi finished market observed volatility in prices on fluctuating demand. Sponge offers fluctuated in the range of INR 100-200/MT (upto USD 3) & Billet by INR 300-500/MT(upto USD 7).

-- Indian sponge iron export offers for FeM 78-80 grade lumps, recorded at USD 315/MT CPT Benapole (dry land port of Bangladesh & India) and USD 335/MT CNF Chittagong, Bangladesh.

-- According to vessel-line up data maintained with SteelMint, India imported 21,590 MT HBI (Hot Briquetted Iron) from Iran & as per sources material was booked at USD 224-227/MT, FoB Iran.

-- India's mid sized mills Billet(100*100 mm) export offers to Nepal is hovering at USD 450-455/MT, however buying interest reported at USD 445-448/MT ex-mill, Durgapur. Freight cost to Nepal reported at around USD 30/MT CNF Raxaul border(Nepal).

-- Vizag Steel has concluded Billet export tender to Nepal at around USD 450/MT (ex-mill) for 2,709 MT (equivalent to 1 rake).

-- Punjipatra, Raigarh based steel manufacturers are still facing problems of power cut by JSPL. The plant's are getting power supply of about 12 hrs per day, 50% less than the earlier during Mar'19.

-- SAIL has scheduled a auction to sale of about 10,000 MT basic grade Pig iron on 22nd Apr'19 from its Rourkela Steel Plant (RSP).

-- Private pig iron producers in Central & Eastern India have raised prices by INR 500-1,000/MT, W-o-W. Latest offers for steel grade is hovering at INR 28,000-28,300/MT ex-Raipur & Raigarh - Central India, INR 29,000-29,400/MT ex-Durgapur & INR 27,500-28,000/MT ex-Jharkhand - Eastern regions.

Finish Long

Indian Finish long steel market observed dull sentiments where participants are not getting appropriate buying inquiries and price range fell by around INR 400-600/MT in most of the regions.

Further, stock levels have strengthened to certain level from mid week as previous bookings yet to lift by traders/retailers and participants were expecting to get required price corrections but it couldn’t place in particular regions.

However medium scale manufacturers from major supplying regions are assuming that, stable prices range may observe post to elections along with improve supply movement.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 35,800-36,100/MT Ex-Raipur & INR 37,100-37,400/MT Ex- Jalna; basic & excluding GST.

-- As per sources, large mills likely to maintain existing price range in near term & current Rebar (12 mm) trade reference price registered at around INR 41,000-41,500/MT, Ex-Mumbai & INR 41,000/MT, Ex-Ahmadabad (Stock Yard); excluding GST.

-- Further, central region based heavy structure manufacturers maintaining trade discounts around INR 400-600/MT and current trade reference prices at INR 39,400-39,800/MT (200 Angle) ex-work.

-- Trade discounts in Raipur Wire rod remained healthy and hovering at INR 1,300-1,600/MT. Meanwhile basic prices stood at INR 38,400/MT ex-Raipur & INR 37,000-38,000/MT ex-Durgapur.

Flat Steel

Indian HRC prices reported slight decline this week amid sluggish trades prevailing in domestic market amid ongoing elections.

-- Current trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42-000-42,500/MT ex-Mumbai, INR 41,700- 41,800/MT ex-Delhi & INR 44,000/MT ex-Chennai.

-- The reference prices for CRC (IS513) 0.9 mm is hovering at INR 47,000-47,500/MT ex-Mumbai, INR 45,800-47,500/MT ex-Delhi & INR 51,000/MT ex-Chennai. The prices mentioned above are basic, excluding GST@18% on cash payment basis.

Inquiries are very less and sales volumes reported decline amid weak buying interest and lacklustre demand among end users in domestic market. Also major projects are on hold amid absence of proper funds due to ongoing elections scenario.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook