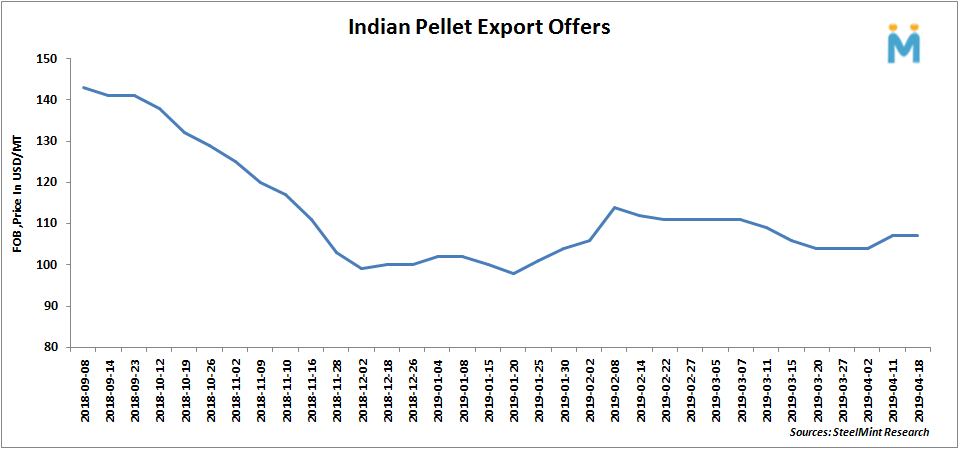

Will Softening Global Iron ore Prices Lower Indian Pellet Export Offers?

Thus a fall of 4% is evident. SteelMint in conversation with major Indian pellet makers learned that they are eyeing for levels of USD 119-120/MT, CFR China and they had offered cargoes for pellet export earlier this week.

However, as per participants, no firm deals were reported so far. If participants are to be believed, traders are actively taking positions as of now, however, Chinese mills are not active in the market at this moment. Few participants reported pellet stock at China's Caofeidian around RMB 950/MT. It seems that Indian pellet makers are in 'wait & watch' mode to receive bids from overseas participants to get the clear picture.

Last week Brahmani River Pellets (BRPL) had concluded pellet export deal to China for 60,000 MT pellets with Fe 64% and 3% Al at around USD 106-107/MT, FoB for April shipment. In other pellet export deal Central India based pellet maker concluded two pellet export deals of 50,000 MT each at USD 106/MT, FoB.

Southern India based pellet maker - KIOCL also concluded pellet export deal last week, the tender was offering 50,000 MT pellet consists of Fe 64% content with 1.4% Al at around USD 114/MT, FoB India.

Indian pellet exports remain stable in FY'19-: According to data maintained with SteelMint, Indian pellet export volumes have remained majorly stable on yearly basis. Pellet export volumes were registered at 9.22 MnT in FY'19 against 8.96 MnT in FY'18.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Goldman told clients to go long copper a day before price plunge

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge