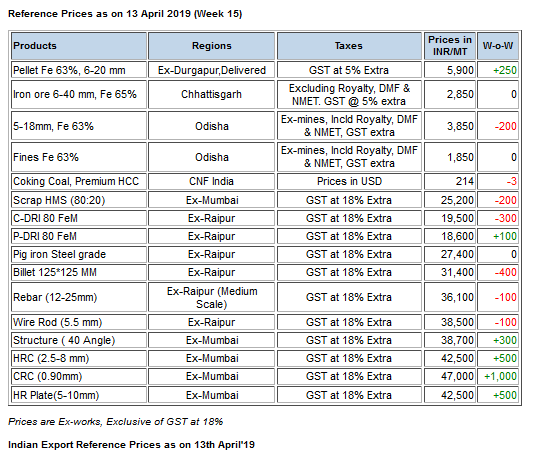

Indian Steel Market Weekly Snapshot

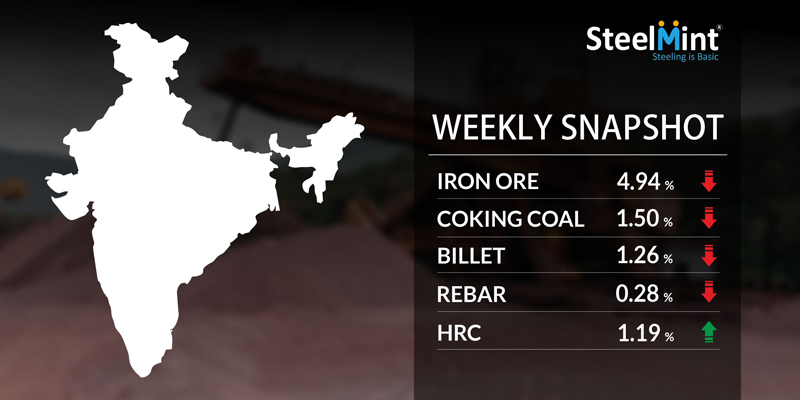

This week, the Semi finished & Finished long steel products registered price fluctuation of INR 400-1,000/MT (USD 6-14) in across major Indian markets. In line Flat steel products, the offers marginally rise by INR 500/MT (USD 7).

In context to raw materials - Iron ore & Coking coal prices have moved down in current week due to weak demand & improved supply.

Iron ore and Pellets

SteelMint in conversation with market participants learned that Odisha's 2nd largest merchant miner - Serajuddin Mines has further widened discounts on iron ore lump prices on bulk bookings.

-- NMDC has reduced its floor prices for both Lumps and fines by INR 150/MT in Apr’19 Karnataka e-auctions.

-- OMC had scheduled an auction for sub-grade iron ore fines on 11th Apr'19 received a good response and 80% material got booked.

-- Raipur based pellet makers raised its offer to INR 6,200-6,400/MT against last assessment at INR 6,100/MT, ex-plant & GST extra.

-- Bellary based pellet manufacturers continue to maintain offers at higher side following logistical constraints. Fe 63% grade pellet offers are learned at around INR 7,200-7,400/MT.

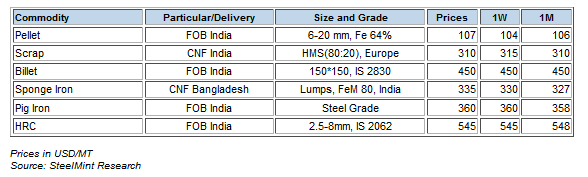

-- Brahmani River Pellets has recently concluded pellet export deal to China, for 60,000 MT pellets with Fe 64% and 3% Al at around USD 117/MT, CFR China for April shipment. In another export deal, KIOCL concluded pellet export deal for 50,000 MT pellet consisting of Fe 64% content with 1.4% Al at around USD 114/MT, FoB India. Central India based pellet maker concluded two pellet export deals of 50,000 MT each at USD 106/MT, FoB.

-- Essar Steel has witnessed the growth of 10% in its crude steel output in FY19 & produced 6.8 MnT of crude steel in FY’19 against 6.18 MnT in previous fiscal- Sources.

Coal

Australia’s premium hard coking coal prices slipped amid sluggish demand from mills in China, as buyers still withhold procurement activity in order to take stock of the overall direction of seaborne coking coal.

Further, as supply of Australian coking coal has increased with cyclone concerns getting over, Chinese traders are raring to liquidate their unsold cargoes on hand. Accordingly, sellers have lowered offers to attract buyers. On the other hand, the 64 mid-volatile coking coal prices have held steady over this month so far.

Demand for imported met coal in India, meanwhile, has stayed healthy, but some sources indicated that there are incremental interests for smaller tonnages. Most end-users are looking at forward bookings of seaborne coking coal cargoes with laydays cancelling (laycan) dates for late-May and early June.

-- Latest offers for the Premium HCC grade are assessed at around USD 213.65/MT & for the 64 Mid Vol HCC grade at around USD 186.35/MT CNF India basis

Scrap

Indian imported scrap market continued observing less trades amid ongoing election activities in the country, cheaper substitutes and an outlook of monsoon to start immediately after elections. Limited trades in containers reported this week at lowered levels against last week.

-- SteelMint’s assessment for containerised Shredded from UK, Europe and US stands at USD 330-335/MT, CFR Nhava Sheva. Trades for HMS 1 from Dubai heard at USD 327-335/MT, CFR depending on quality. West African HMS 1&2 traded in 20-21 MT containers at around USD 313-315/MT, CFR Goa and around USD 310-313/MT, CFR Chennai. Central American HMS 1&2 (80:20) scrap sold at USD 322-325/MT, CFR Mundra and Ludhiana.

Semi Finished

On weekly basis, Billet offers reported down fall of INR 200-700/MT & Sponge iron by INR 100-300/MT in across regions except in southern India, where prices rose upto INR 1,000/MT in both products due to falling inventories amid less availability of raw materials (Iron ore & pellets) on logistic concerns.

-- Indian sponge iron export offers rise by USD 5/MT, price assessment for 80 FeM sponge lumps are at USD 310-315/MT CPT Benapole (dry land port of Bangladesh & India) and USD 330-340/MT CNF Chittagong, Bangladesh.

-- Indian induction grade Billet (100*100 mm size) export offers to Nepal are reported at USD 450-455/MT (ex-mill at West Bengal), equivalent to USD 480-485/MT CFR Nepal (Raxaul border).

-- on 9th Apr, power supply resumed by Jindal for Punjipathra, Raigarh based furnaces, which was cut down by 30-50% since 1st Apr'19, as reported by manufacturers.

-- Private pig iron producers in eastern India have raised prices by INR 900-1,200/MT, W-o-W. Steel grade prices hovering at INR 28,500-29,000/MT ex-Durgapur & INR 28,000-28,500/MT ex-Jharkhand.

-- SAIL’s Rourkela Steel Plant (RSP) tender held on 13th Apr'19 to sell 12,500-15,000 MT steel grade pig iron, had received good response. The base price for the tender was quoted by RSP at INR 26,450/MT (ex-plant) and near about 100% material sold.

-- Jindal Steel has offered Pig iron at around INR 27,300/MT ex-Raigarh & Panther shots (granulated pig iron) at close to INR 26,000/MT ex-Angul, Odisha.

-- SteelMint's Pig iron export price assessment stood at USD 359-361/MT FoB India, USD 339-341/MT FoB Brazil & USD 348-350/MT FoB Black sea.

Finish Long

Indian Finish long steel market remained volatile amid ongoing elections and inappropriate movement notified in specific locations led to price fluctuations in Rebar & Structures by INR 300-500/MT, W-o-W.

Further it’s less expected to get any major amendments in near term through the medium/small scale mills due to completion of back log orders along with slight change in raw material prices.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 36,000-36,200/MT Ex-Raipur & INR 37,500-37,700/MT Ex-Jalna; basic & excluding GST.

-- As per sources, large mills soon to float discounts of around INR 500-700/MT in specific regions & current Rebar (12 mm) trade reference price hovering at around INR 41,000-41,500/MT, ex-Mumbai & INR 41,000/MT, ex-Ahmadabad (Stock Yard).

-- Central region based heavy structure manufacturers maintaining trade discount around by INR 400-600/MT and current trade reference prices at INR 39,100-39,500/MT (200 Angle) ex-work.

-- Trade discount in Raipur Wire rod have raised this week to INR 1,200-1,500/MT as against last week at near to INR 600-800/MT due to lessened movement for outside states.

Flat Steel

This week Indian HRC prices witnessed marginal increase in domestic market post recent hike by major Indian steel mills by INR 500-1,000/MT in the beginning of this month.

Current trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42,500-43,000/MT ex-Mumbai, INR 42,200- 42,500/MT ex-Delhi & INR 44,500 MT ex-Chennai.The prices for CRC (IS513) 0.9 mm is hovering at INR 47,000-47,500/MT ex-Mumbai, INR 47,000-47,500/MT ex-Delhi & INR 51,000/MT ex-Chennai. The prices mentioned above are basic prices excluding GST@18% on cash payment basis.

Recent hike by major steel mills has been partially absorbed amid subdued trades in domestic market ahead of general elections scheduled this month. Thus, lesser trade activities, weak market sentiments and dull demand may put pressure on HRC prices by the end of this month.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse